In Trading Candidates on

13 May 2010 with no comments

Gamestop, the mall based purveyor of video nonsense for folks half my age, used to be a stock I traded frequently. A look at their chart now shows a company prone to almost random looking gaps:

For those fans of the bromide that “every gap must be filled,” it looks like almost every gap on the chart has already been filled, except for two: the large drop from $28 in mid-October, and the rise back above $20 in March.

Any guess on which of these is the next to go?

In Trades on

13 May 2010 with no comments

I’m fully positioned on the short side now, as I capitulated to my fascination with shorting Minefinders this morning. Sold 1000 shares short at $9.87:

Another trip down to the $9 range would be nice, and it’s possible I might get greedy and see if it will legitimately slip back into the $8’s like it did last summer. A close at $10.50 above the recent highs proves me wrong.

Hope they don’t find no more mines!

In Trades on

13 May 2010 with no comments

After a quick jettison of the go-to trade on QLD, I took a small short-term short position this morning, picking up 300 shares of SDS (double-short the S&P500) for $30.44 at the open.

I was thinking of doing this last night, but wanted a little “peek” at morning market conditions.

My bet is that the 50 day moving average will serve as a resistance point, and that a fill of Monday’s (5/10) upside gap is more probable than not:

A close above 1185 on the S & P will prove me wrong, as I’m not looking to lose a lot on this one.

In Trades on

12 May 2010 with no comments

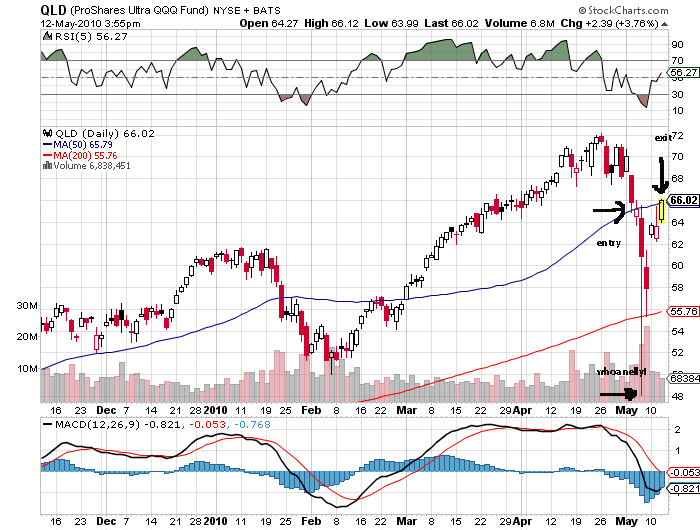

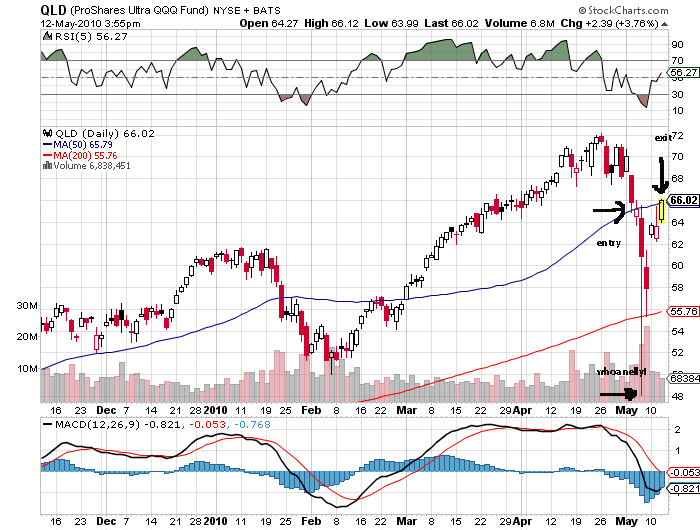

The “go-to” trade on QLD has concluded. And good riddance to it. I sold my 250 shares for $66.02 right before Wednesday’s close, as the sell signal of RSI(5) > 50 was triggered.

Obviously, this was a crappy was to make $215 (before commissions), as this trade was put on right in time for last Thursday’s flash crash:

Just as I pointed out that the main drawback to this trade is that it doesn’t utilize stop orders for exits, I was forced to watch the position drop over $4200 in the course of a few minutes (if the $48 print for QLD can be believed)! Not good money management for a $10,000 account, I can assure you. The go-to trade came through in the end, but not before extracting way more than a pound of flesh for $215!

In Followup on

8 May 2010 with no comments

For those who are newly interested in the short side of trades, a second look at Minefinders (MFN):

I prefer to draw the neckline around $9 even rather than where finviz puts it, but no biggie. This one hasn’t been bombed so bad you can’t get in on the short side if you are so inclined. The goal is to see if it goes down to $8, then cover; a close above the 50-day moving average at $9.75 would be the place for a stop loss.

In Pure speculation! on

7 May 2010 with no comments

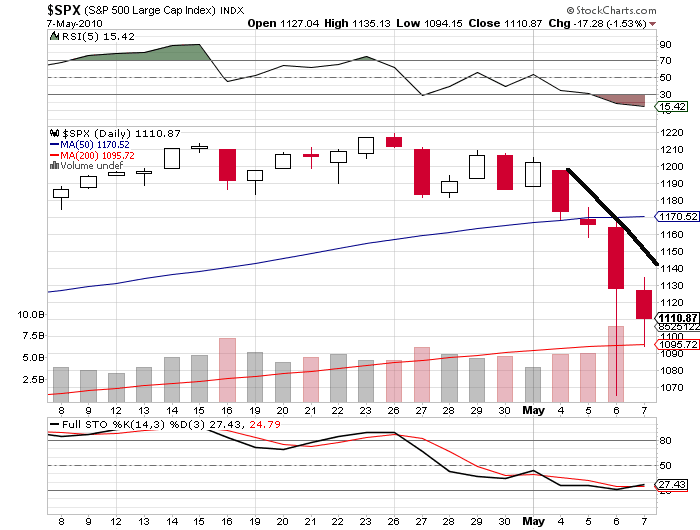

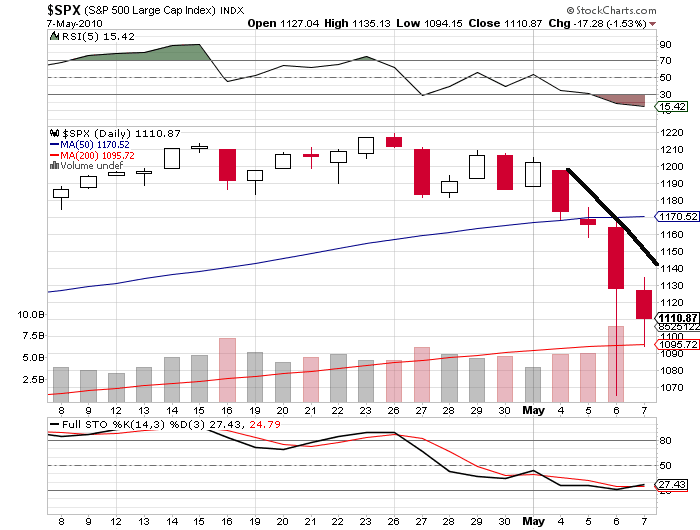

The above is just a rough idea on where a down trend line might be drawn on this week’s data. With so much technical damage out there, and that weird spike from Thursday popping up on almost every chart, I wouldn’t want to reposition to the long side until that downtrend line is taken out on a close.

The above is just a rough idea on where a down trend line might be drawn on this week’s data. With so much technical damage out there, and that weird spike from Thursday popping up on almost every chart, I wouldn’t want to reposition to the long side until that downtrend line is taken out on a close.

Of course I am stuck long with QLD, but that’s another matter . . . .

Have a good weekend, traders!

In Market Recap on

6 May 2010 with 1 comment

Sell in May and go away? The day a fat finger erroneously sold billions? No matter how you look at it, this was a day to remember (or maybe to forget)!

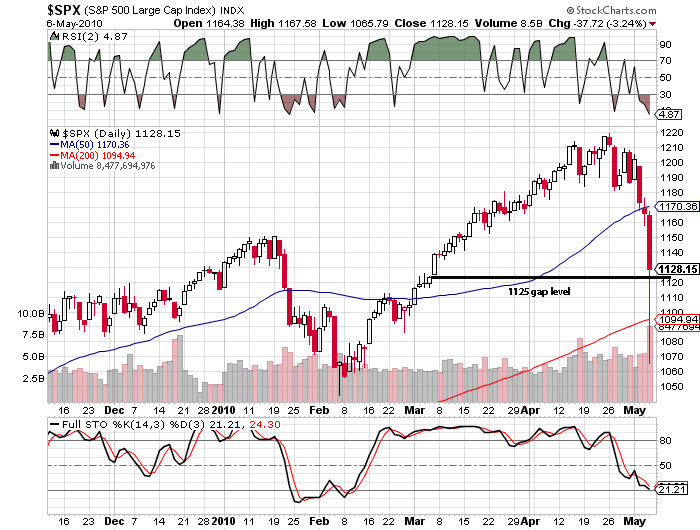

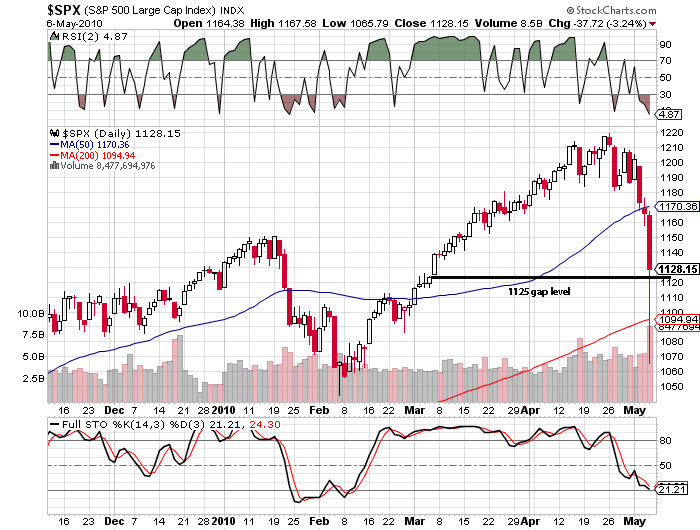

For those of you who believe gaps are always filled, the two on the S&P I have been watching (1125 and 1080) were filled within minutes after the fat finger fell shortly after 2:30 EDT:

Its eerie how the close ended up right at the 1125 level of the March 5th upside gap!

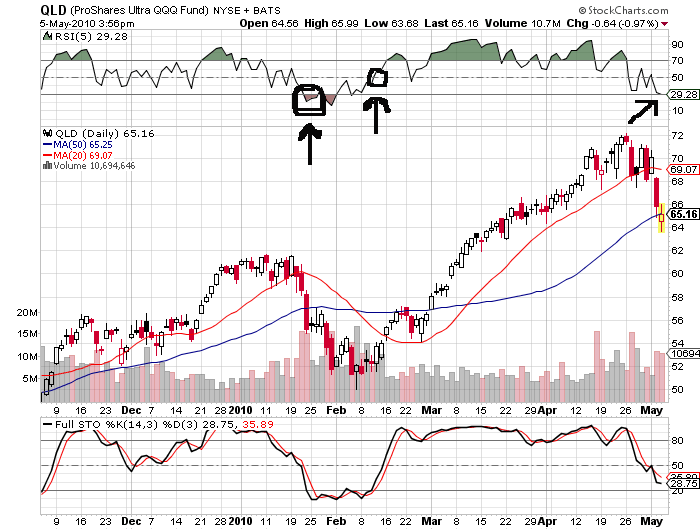

Of course, my own “go-to” trade in the QLD was brutalized:

How I wish it triggered at the close today instead of yesterday! At one point it appears to have been down over $3000 — plenty of destruction for an account that started at $10,000.

That just emphasizes to me the weak point about the QLD trade I mentioned before — the lack of any well defined stop for it, not that a stop order would have been honored in today’s hectic session anyway.

On the other hand, while it didn’t help me personally, days like today certainly vindicate my idea of not having open positions while travelling or on vacation!

Tomorrow should be interesting. Jobs report, anyone?

In Trades on

5 May 2010 with 2 comments

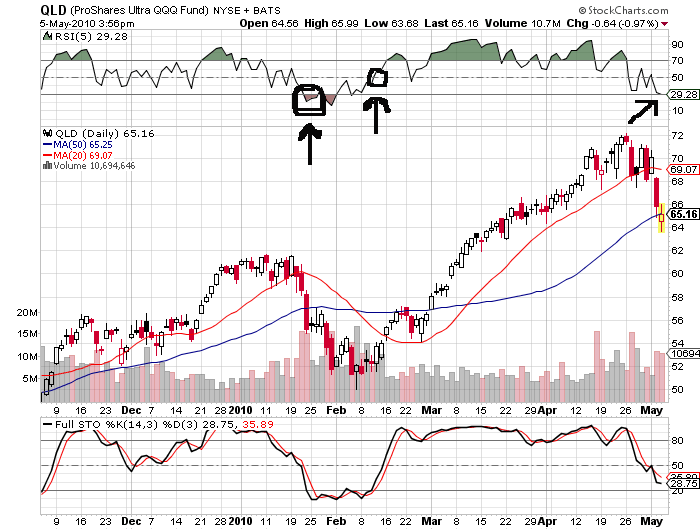

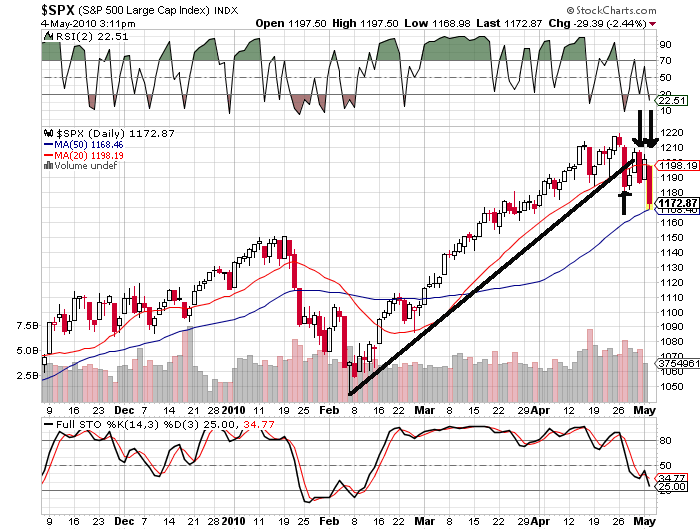

Every speculator has a “go-to” or automatic trade to fall back on, and one of my favorites triggered a buy signal today.

The buy signal is to purchase QLD, the ultra-QQQ 2x ETF, when its RSI (5) reading falls below 30. As it was under that for most of the day, I picked up 250 shares of QLD at $65.16 right before the close.

The sell signal on this trade is to get out when RSI(5) exceeds 50 again.

Last year (2009) this trade produced 8 winners out of ten, and cleared a profit of 41.9% after commissions, handily beating the markets.

So far this year, however, the only signal produced has been a losing one:

The entry point was on January 22 and the exit was on February 11th, with a net loss of about 2.5%.

The main benefit to this trade is its usual consistency; the main drawback is that stops are not incorporated in the exit, allowing for occasional beat-downs of epic proportions. I am studying this problem this year, and hope to find some sort of workable compromise. In the meantime, it looks like I am a dip-buyer on a day when the 50-day SMA failed to hold!

In Pure speculation! on

4 May 2010 with no comments

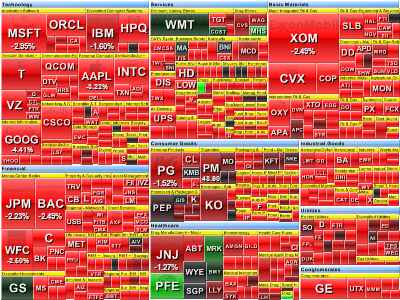

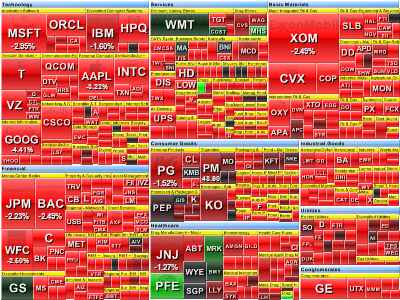

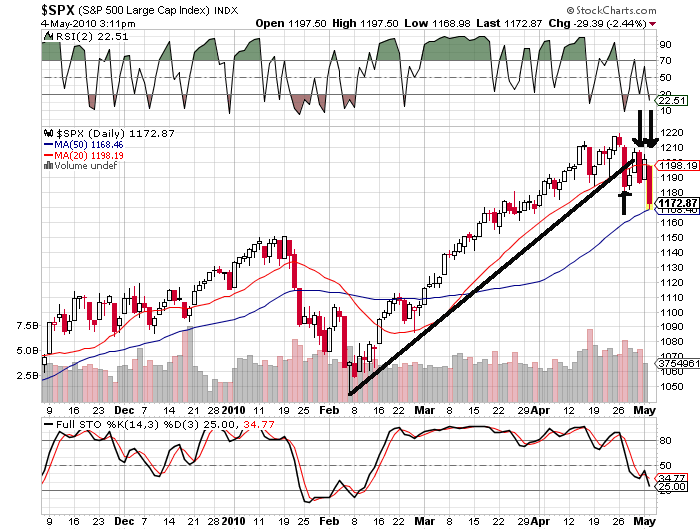

Well, this is a day that is long overdue in the old equity markets! Just a few minutes before the close, it is certainly looking like a big distribution day. Lets take stock of the damage done:

Well, this is a day that is long overdue in the old equity markets! Just a few minutes before the close, it is certainly looking like a big distribution day. Lets take stock of the damage done:

This chart shows the trendline from the February lows (black line) clearly broken, the 20-day SMA (red line) broken as well, although the 50-day SMA (blue line) has held. Noteworthy is that will be the third day in a week that the 20-day hasn’t held (arrows), but the market has rallied to reclaim it the prior two occasions. I would say it is doubtful that it will do this a third time. You will also see above that we are not as oversold on the RSI (2) as we were last week.

Also, peeking at POT isn’t painful today. Looks like the first time since last October it will close below the important 200-day SMA mark:

In Followup on

3 May 2010 with 1 comment

After you close a trade, do you ever catch yourself compulsively checking the stock price to see if you “made the right move?”

Or do you always do this?

Sometimes I just can’t resist, although its asking for mental torture. I dumped my Potash position last week because I didn’t want it open while I was travelling. Today I returned, and true to form, just couldn’t resist taking a little peek:

Peeking in the morning made me mad, because POT obviously had returned to the plus side of the ledger in the meantime while I was away. But by the close, most of those gains had been given back, and there is less than $200 difference from where I sold.

I suppose a case can be made for purposeful peeking; first, to learn to steel yourself to the markets, and not let every “trade that got away” get to you. The second reason would be to keep following interesting companies, and looking for more opportunities, entry points, chances to swing trade and go short, etc.

Still and all, peeking is a good way to drive yourself crazy!