In Pure speculation! on

27 May 2010 with no comments

Lets take a look at Disney stock, on the heels of the news that two persons have been arrested for allegedly trying to sell confidential information on the company to hedge funds.

DIS looks like it followed the long Feb.- Apr. grind up in a typical fashion, fell victim to a rogue trade or two during the May 6th flash crash, then saw those lows tested for real recently.

Looks to me like a stock that sticks pretty close to major market trends, which would not typically give much of a valuable edge to anyone trading on inside information.

In Trades on

26 May 2010 with 1 comment

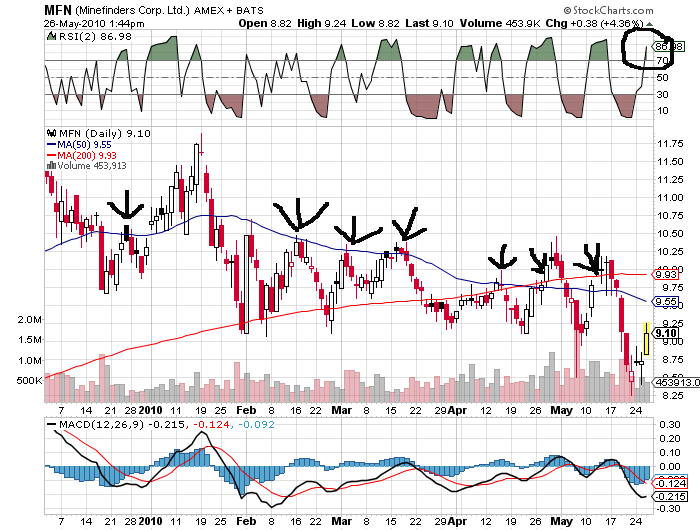

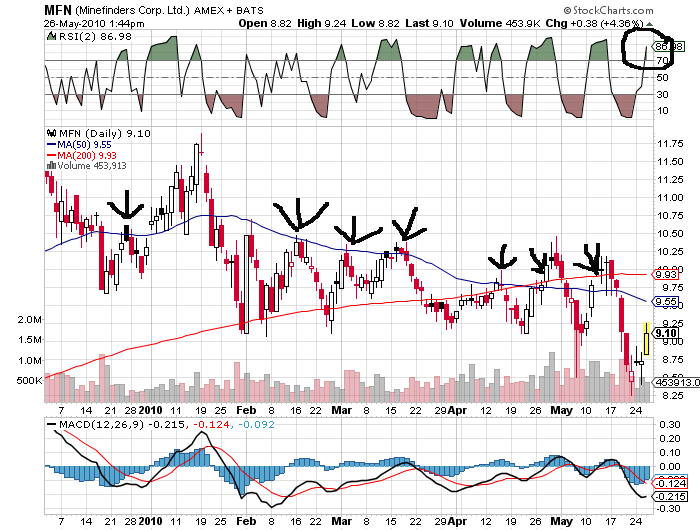

I sold my 1000 share position in Minefinders (MFN) this afternoon for $9.21 per share.

At the time of the sale RSI (2) was over 87; on quick-pop trades like this I take an RSI (2) of over 70 as a sell signal.

Speculators with a little bit longer focus might try to see if they can get MFN to hit the 50-day moving average, currently $9.55.

Recently, on every previous little upswing, MFN has crossed the 50:

In Followup on

26 May 2010 with no comments

The last time I looked at Game Stop, I was led to comment on the gappy, almost random type of trading it was providing. An updated look at the chart shows something not seen every day: all the important moving averages (20-50-200) have converged right at $23:

Also note that GME never quite filled that gap just under $20 when it was under pressure last week.

If you buy into the theory that the MA’s might provide resistance, with the stock trading at $22 right now, you could short it and have about a 2:1 risk/reward setup shooting for that mid-March gap to fill.

In Market preview on

25 May 2010 with no comments

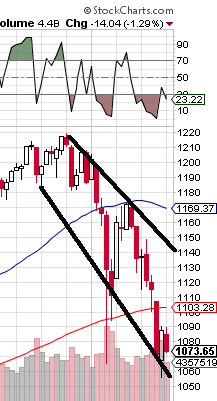

Tuesday’s slump and re-test of the February lows has left us with two big gaps — at 1073 and 1115 — to try to fill on any short-covering upswing:

A tempting trade is to bet on one or both gaps filling soon, then quickly reverse to the short side unless and until the downtrend line is broken.

Good Luck!

Ed. note — didn’t take long to fill the 1073 gap, that was taken care of at Tuesday’s close! – CCD

In Market preview on

25 May 2010 with 1 comment

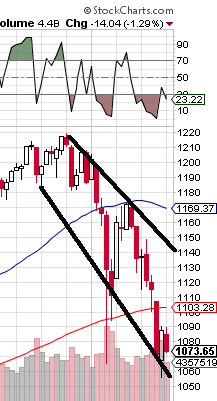

Here is how I am presently drawing the down trend channel:

Although we are right at the bottom of it, it looks like a down-side gapper to start Tuesday morning will stretch the lower line.

There’s a good chance that we will see a ripper sooon going all the way up to fill the gap at 1115, but don’t let that alone trick you in to thinking the market is well.

Caution is the word for bulls until the top line is taken out on a close.

In Followup on

24 May 2010 with no comments

Remember, I started the trading on this blog with a position in SCO, the double-short crude oil ETF. Took a nice little profit to get this project off on the right foot. But look at where oil has gone lately!

What might have been (the eternal trader’s lament, I know)! Around now, with that long run, it might be time for CapeCodDoug to start fooling with SCO’s alter ego, DIG.

In Followup, Stock of the Day on

24 May 2010 with no comments

By my count, today’s CNBC stock of the day Citigroup, was also stock of the day on April 19th; why not just make C the permanent holder of the crown, the stock of the day everyday?

It’s not as if Citi offers a compelling chart for long positioned traders:

I plan on staying far, far away from that huge double top. As I posted back in April, Citi remains a long, long, long term buy for investors convinced on the ultimate soundness of the American economy and banking system. Meet a lot of those folks lately?

In Trading Candidates on

21 May 2010 with no comments

After surviving another wild week in the markets (I will be holding both MFN and QLD long positions over the weekend), it was interesting to find this nugget at Thomas Bulkowski’s chart pattern blog: the sector with the worst relative strength is . . . drum roll please . . . alternative energy. Got my wondering what an ETF in this specialty looks like. Well, take a look at TAN:

If that’s not ugly enough for you, the specific stock noted was American Superconductor:

AMSC popped a bit today after beating earnings estimates, but we gotta root for a rally all the way to $37, and then watch the ultimate head-and-shoulders swoon play out!

Have a great weekend!

In Followup on

21 May 2010 with no comments

If ever there was a day that Doug hoped for Minefinders to find a mine, today would be it. With everything on the line, I’m not really even getting good dead-cat action on MFN. On the other hand, after the morning recovery, I’m not getting stopped out either (yet).

If ever there was a day that Doug hoped for Minefinders to find a mine, today would be it. With everything on the line, I’m not really even getting good dead-cat action on MFN. On the other hand, after the morning recovery, I’m not getting stopped out either (yet).

Holding over the weekend is looking like an increasing reality . . .

In Trades on

20 May 2010 with no comments

Not sure if this is the right thing to do, especially right before option expiration, but I picked up 1000 shares of Minefinders (MFN) before the close for $8.66.

This leaves me fully invested on the long side, even given my bearish bias. Might not be sleeping all that well tonight . . .