In Market Recap on

9 March 2011 with no comments

Looking at just today’s action, the S & P 500 definitely seems to have taken on a different personality from what we saw from December 1st into February:

The increases aren’t coming as easily anymore, as the inability to get through the resistance at 1322 shows. Tomorrow, of course, could be a radically different story, but I’m getting the feeling that the long ride of easy gains is at least temporarily behind us.

In Market Recap on

4 March 2011 with no comments

A week that has the biggest up day since December 1st, plus a jobs report trade, must have ignited Wall Street with fireworks, right? Well, not of you look at the weekly SPY chart:

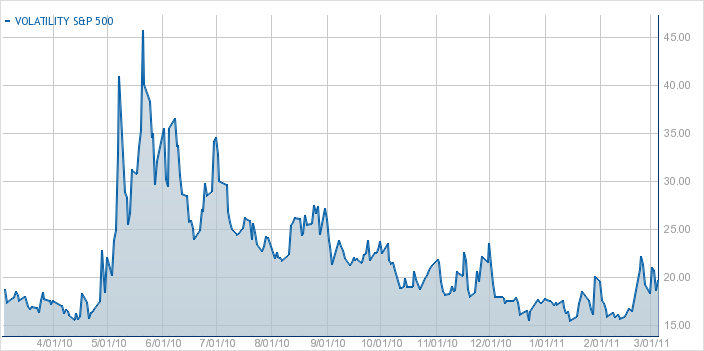

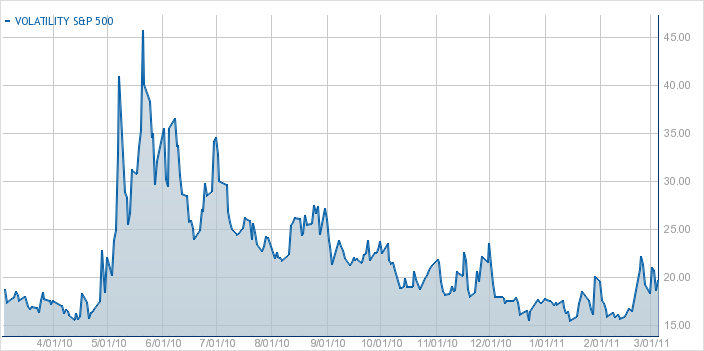

We ended up almost exactly where we began. Maybe a roller coaster ride along the way, but really no net gain for the market as a whole. Oil, however, finished over $104.00 a barrel. I have a hunch that a big spike in volatility looms. We will see next week — in the meantime have a good weekend!

In Trades on

4 March 2011 with no comments

Since returning from Tampa, I’ve decided to buy some more time with my conviction that a rise in the VIX is imminent.

Since returning from Tampa, I’ve decided to buy some more time with my conviction that a rise in the VIX is imminent.

So I dumped my March $22.50 calls for a break-even trade as soon as I got back, and today I cashed in the April $20 calls for a modest $500 profit.

There is only two weeks to go before my self-imposed deadline for achieving a 100% profit in a year, and on closed trades, I am just barely over the mark at $10,049 in profit, and still some commissions to be accounted for.

Sooooooo …… the part about kicking the can: I also bought 7 April $25 VIX calls, and 5 May $25 VIX calls, both out of the money, for a total outlay of $2100. The VIX itself is trading about 20 today.

I think this is the right approach to extending my bet (partially confirmed) that a spike in volatility is in the offing sometime soon!

In Market preview on

22 February 2011 with no comments

It’s vacation time for Cape Cod Doug — once again to the Tampa – St. Petersburg area for a week until March 2nd.

It’s vacation time for Cape Cod Doug — once again to the Tampa – St. Petersburg area for a week until March 2nd.

This is going to be an unplugged vacation, which begs the question, what to do about open market positions?

Well, since my primary wish is to see a rise in the VIX, you can bet your bottom dollar today’s market action will send me off with a grin:

The VIX itself jumped up more than 4 point to 20.80!

What I decided to do was to set the following limit orders in case I continue to get get lucky:

I’ll sell my 1000 shares of BZQ for what I bought them for — $20.21. I’ll also wait for the snowballs to start forming in Tampa.

My 8 March calls on the VIX at 22.50 will go for $3.70, which would be a $2000 profit.

My 5 April calls on the VIX at 22 will sell for $6.00 — also a $2000 dollar profit.

I have a couple of trading ideas for March already, so I’ll be rested and ready to go when March 2nd rolls around. Until then, good trading to everyone!

In Pure speculation! on

21 February 2011 with no comments

Looking for a new trading system? An indicator seldom followed that outperforms the market consistently?

Looking for a new trading system? An indicator seldom followed that outperforms the market consistently?

Try trading the air pollution index.

At least that’s the theory of two academics who looked at returns from a number of markets over a ten year span: The stock market hates dirty air.

The authors of the study from the Journal of Economic Psychology found that stock returns were generally lower on days with poor air quality ratings in the vicinity of the stock exchange. The effect is significant: Trading stocks based on day-to-day air quality ratings might have allowed you to beat the annual return on the S&P 500 by several percentage points.

Looks like its time to short those belching smokestacks!

In Pure speculation! on

18 February 2011 with 1 comment

If I’m successful in my quest to double my stake in a year, a lot of the credit will go to the Cost Plus Word Market trade that eventually panned out in November. Yes, I sold out too early, but remember, woulda, coulda, shoulda doesn’t get it done . . .

Take a look at CPWM now:

Promising, eh? Q4 earnings on the wicker wonder are due out soon, so be careful . . .

In Market preview on

15 February 2011 with 1 comment

Signs are brewing that the market rally, seemingly unstoppable, may actually be in its tired stage.

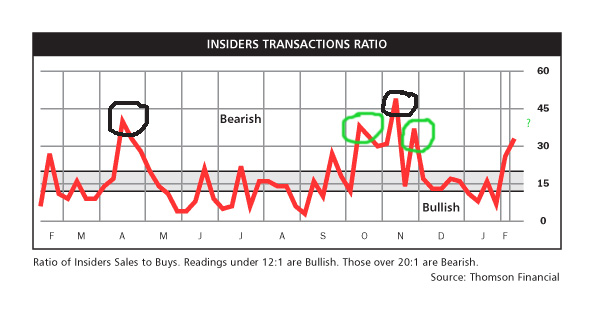

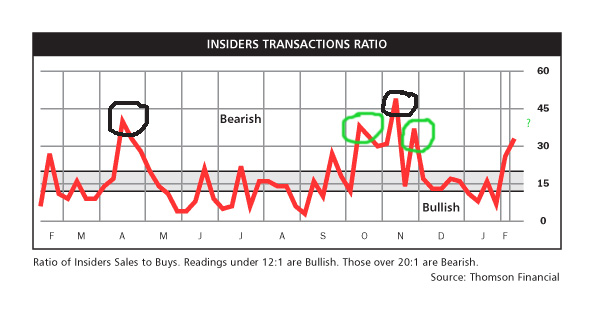

One of my favorite charts is Thompson’s insider buy/sales ratio:

The idea is when insiders aren’t buying anymore (and the red line shoots up) its getting to be a good sign to sell (or short, or panic, or whatever you like to do when the market falls).

Notice that it can throw off some false signals, though. The April and early November peaks circled in black, were good sell points, but the October and Thanksgiving jumps were not. Now that this index is ip above 30 again, will it serve as an oracle to the beginning of the end — or at least a decent dip?

Another clue comes from market sentiment surveys. The Consensus bullish sentiment from Consensus, Inc. is pegged at a whopping 71% this week, as opposed to a “mere” 65% 2 weeks ago. That’s up in the stratosphere, and augers for a turn in fortunes. But the bulls in the AAII “dumb money” survey, have backed off a bit to 49.4% from a previous 51.5% level.

So what does all this auger? On the whole, I’m betting a catalyst appears soon that takes the S & P 500 down at least 5%.

In Pure speculation! on

10 February 2011 with no comments

It sure looks like Cisco is getting a well deserved reputation as a stock to short right before earnings are announced:

That’s three massive gaps down on the last three announcement days. It will be interesting to see how long CSCO keeps this pattern going.

In Trading Candidates on

10 February 2011 with no comments

Just last month I made a nice score betting against AT&T on their earnings announcement. The thinking was that expectations had to be lowered with the exclusivity of their iPhone contracts in its waning days. The trade played out nicely, as T gapped lower, a gap which still hasn’t filled:

Just last month I made a nice score betting against AT&T on their earnings announcement. The thinking was that expectations had to be lowered with the exclusivity of their iPhone contracts in its waning days. The trade played out nicely, as T gapped lower, a gap which still hasn’t filled:

Swing traders alert! It might be time to tack sharply and think about putting on a bullish position in Telephone. I noticed the Boston Globe gave a rave review this morning to Motorola Mobility Inc.’s new Atrix 4G smartphone (pictured above), due out by March 6th, and maybe sooner.

Globe techie Hiawatha Bray raves about this new annoyance device, which will set you back $199.99 ($499 if you also want a sexy docking station that turns it into a laptop)– if you sign up for a 2 year contract. And who holds exclusivity on these contracts, you ask? Well, none other than AT&T.

So Telephone may again have latched on to something hot — if I was going to actually do this trade, which I’m not, I would be thinking about perhaps buying June calls, to give the new phone some time to gain street cred. If you’re trading Telephone, Good Luck!

In Market Recap on

9 February 2011 with no comments

Woulda, coulda, shoulda doesn’t get it done.

Certainly not in the equity markets.

So I won’t kick myself for not getting on board the Disney train yesterday:

Though that was a nice pop for DIS, in the end I just didn’t feel either bullish or bearish on playing their earnings. I’m not mad about missing this trade, because I still like the idea of increased volitility before spring. That’s where I want to commit my trading capital!