In Market preview on

18 April 2011 with no comments

There has been some good articles put up lately concerning trading VIX options and related instruments, which has been my focus for much of 2011.

Take, for instance, the insights of trader Steven Place, who thinks the failure of the VIX to pop last week on a brief down day (Tuesday) is a bullish sign for the near-near term. His chart of the VIX for the past three months:

Steven reasons that “option customers are already loaded to the teeth with long options and they have no need for extra protection. Because of that, there’s low demand for equity options, which leads the VIX to stay low.”

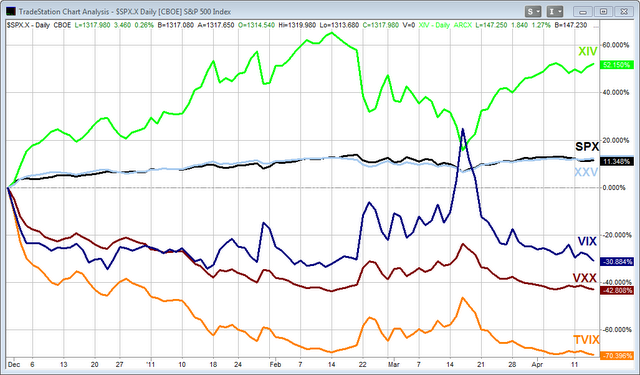

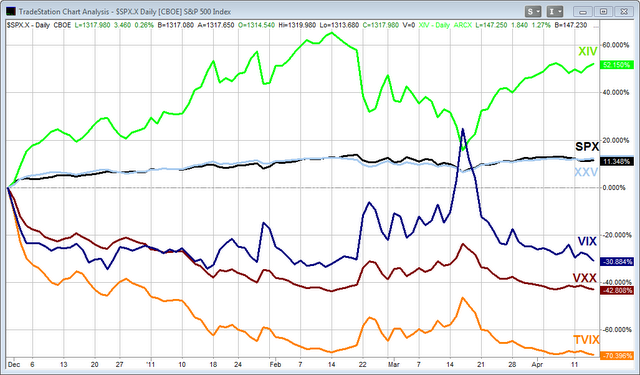

A guy with a much more complicated VIX chart is blogger Rob Hanna, a market historian who is always looking for “quantifiable edges” in past market data:

Rob is studying ETFs that track the VIX; one of his insights is that the inverse-VIX XXV fund is worthless to trade, as it basically mimics the SPX as a whole, which is easily seen on the above chart.

Rob did get me thinking about maybe using one of these funds in the future, possibly as a means of reducing commission expenses.

In Trading Candidates on

15 April 2011 with no comments

Here’s a look at an old friend that I have followed for a long time on this site — grocery giant Supervalu, which was one of Thursday’s big market winners, off a 1Q earnings beat, in an otherwise forgettable session.

Here’s a look at an old friend that I have followed for a long time on this site — grocery giant Supervalu, which was one of Thursday’s big market winners, off a 1Q earnings beat, in an otherwise forgettable session.

I sold this one back at New Year’s but am glad to see it bounce a long way back off the 52-week low list!

In Trades on

15 April 2011 with no comments

When the VIX is down to 15, I like to buy — in many cases, almost impossible to resist. So I put a little more than $2000 down on an increase in volatility sometime before June. It would take a lot for the present market torpor to last that long.

When the VIX is down to 15, I like to buy — in many cases, almost impossible to resist. So I put a little more than $2000 down on an increase in volatility sometime before June. It would take a lot for the present market torpor to last that long.

Specifically, I bought 7 VIX June 15 calls for $6.30, then sold 7 June 20’s for a credit of $3.00 each.

This gives me three open VIX positions: naked April 20’s sold that are expiring next week, plus May 17 calls and now a June call spread. In short, VIX hovering under 20 next week, then spiking, would be just fine with me!

In Uncategorized on

14 April 2011 with no comments

So today the market found yet another way to end up exactly where it started. VIX fell back down to the mid 16 range, which is fine with me. Options expiration (for equities and indices, not VIX) tomorrow — lets see if it brings some fireworks, or more of the same!

In Trades on

12 April 2011 with no comments

I realized today that I had really gone crazy with my sale of 20 naked April VIX options and covered the trade for a small profit of $340. A spike up in the VIX got me appropriately nervous, and I realized it was better to cover it than not sleep tonight!

I realized today that I had really gone crazy with my sale of 20 naked April VIX options and covered the trade for a small profit of $340. A spike up in the VIX got me appropriately nervous, and I realized it was better to cover it than not sleep tonight!

In Food for thought on

11 April 2011 with no comments

If you have 11 minutes to spare, Barry Ritholtz has a good post on his site that includes a video by trader Yan Ohayan on the impact of algorithmic trading.

If you have 11 minutes to spare, Barry Ritholtz has a good post on his site that includes a video by trader Yan Ohayan on the impact of algorithmic trading.

Did you know that 73% of the current trades in the market were done by machine? Or that some of the trading programs out there can do a trade once every 400 microseconds? Or that the programs compete with each other by “co-locating” (attempting to put their servers as close to the exchanges as possible), and by quote stuffing 9sending out thousands of phony quotes that other programs have to process, slowing them down)?

The video is a chilling look at what trading has become. It explains a lot about how humans can’t really compete with that, which is why day-trading scalpers using 1990’s methods are doomed to failure in the present system.

At the other end of the spectrum is “Chicago Sean” McGlaughlin, a reformed daytrader, who now trades from his apartment and blogs and tweets about how to simplify one’s trading. He’s the guy who claims an average of three trades per week — sometimes one.

If you ask me, Sean really is the one who has an idea worth following if you are a newbie to trading or investing anything under $100K. As human beings and not machines, we need to manage out lives as well as our trades. Simplicity is one reason I have been concentrating on VIX options, as it is much easier to master one number than to follow thousands of tickers. I think I will be emphasizing this approach in the months to come.

What is your plan to simplify your trading?

In Trades on

11 April 2011 with 1 comment

I’m trying to take advantage of the relatively lackluster market by selling naked 20 VIX April 22.50 call contracts for $0.42. A risky move if the market pops tomorrow.

I’m trying to take advantage of the relatively lackluster market by selling naked 20 VIX April 22.50 call contracts for $0.42. A risky move if the market pops tomorrow.

By the way, the April 20 calls were still selling around $0.60 this morning.

In Trades on

8 April 2011 with no comments

This may come back to bite me, but I sold 10 VIX April 20 calls at $0.65 this morning, intending to cover my April call spread, which is heading for a loss of $640 if the markets stay in their torpid state

This may come back to bite me, but I sold 10 VIX April 20 calls at $0.65 this morning, intending to cover my April call spread, which is heading for a loss of $640 if the markets stay in their torpid state

My reasoning is that I already have a much larger May position on which will increase nicely if the VIX does spike Monday or Tuesday.

The market was still in its week long funk, and VIX was 17.04 when I put on the trade.

Note: before heading out for what looks like the first glorious weekend of spring, I closed out my original April VIX call spread for what it could get (which was a $265 loss). I am now positioned to profit if the VIX closes under 20 on Tuesday.

Note: VIX finished the week at 17.87.

In Market Recap on

7 April 2011 with no comments

You know what I think about this market! Let’s put it this way, hope you have nice weather, its been a good week for outdoor activities.

But I may have some close to expiration trades to do soon. Stay tuned.

In Market Recap on

6 April 2011 with no comments

. . . and the beat goes on. I know, I know, the market is being “coiled like a spring,” to jump higher and make us all rich . . .