Informative commentaries on VIX trading

There has been some good articles put up lately concerning trading VIX options and related instruments, which has been my focus for much of 2011.

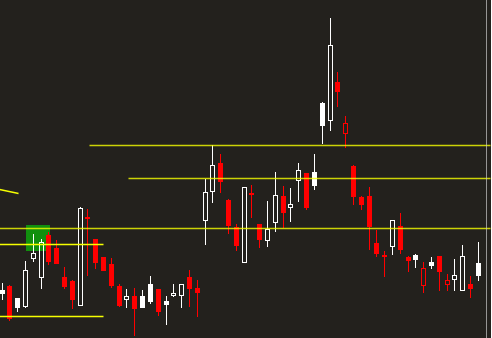

Take, for instance, the insights of trader Steven Place, who thinks the failure of the VIX to pop last week on a brief down day (Tuesday) is a bullish sign for the near-near term. His chart of the VIX for the past three months:

Steven reasons that “option customers are already loaded to the teeth with long options and they have no need for extra protection. Because of that, there’s low demand for equity options, which leads the VIX to stay low.”

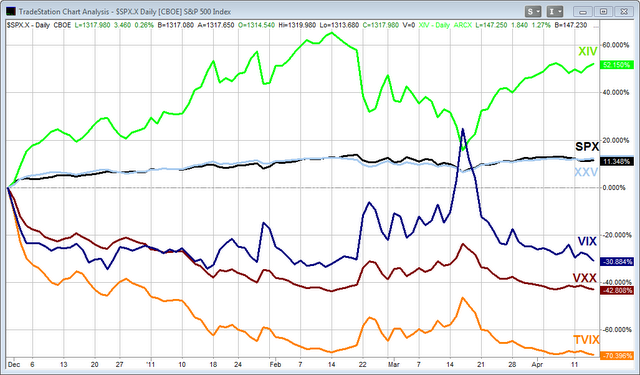

A guy with a much more complicated VIX chart is blogger Rob Hanna, a market historian who is always looking for “quantifiable edges” in past market data:

Rob is studying ETFs that track the VIX; one of his insights is that the inverse-VIX XXV fund is worthless to trade, as it basically mimics the SPX as a whole, which is easily seen on the above chart.

Rob did get me thinking about maybe using one of these funds in the future, possibly as a means of reducing commission expenses.

No Comments Yet