In Food for thought on

25 May 2011 with 2 comments

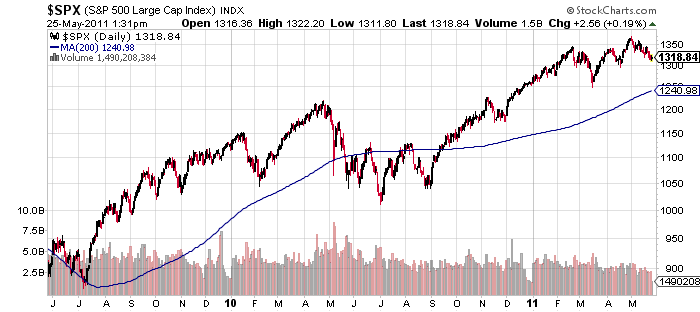

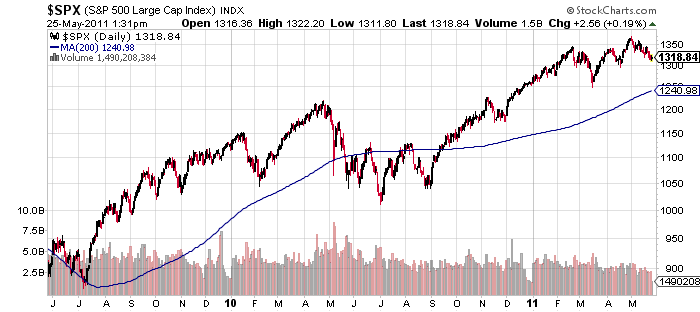

It’s been a long time since the S & P 500 tested the 200 day moving average, hasn’t it?

Last year we spent much of the middle portion of the year (roughly March – September) underneath the 200. Since then it’s now been eight plus months without a whiff of that level. And the market stayed above the 200 from July 2009 to March 2010 as well — another ten months. A trip down to 1240 this sometime this summer to keep everyone honest is certainly a good possibility; but what happens after that is any one’s guess!

In Uncategorized on

25 May 2011 with no comments

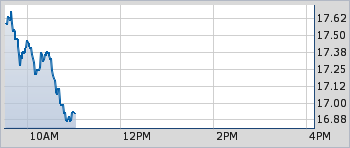

Will this be a scorching summer for grains and agricultural commodities? Corn has been on a nice rise:

The chart shows corn right in the middle of it’s trend channel, but sitting above support points represented by the 20 and 50-day moving averages. I’m passing for now, as I would prefer the bottom of the channel as an entry point.

In Food for thought on

25 May 2011 with 1 comment

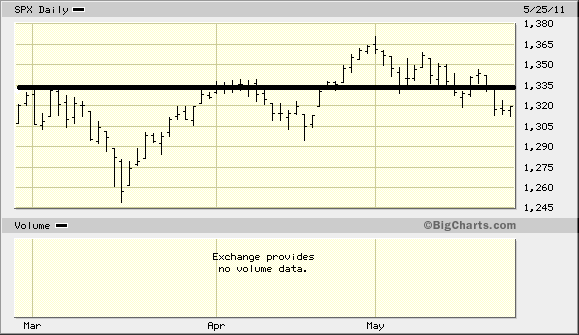

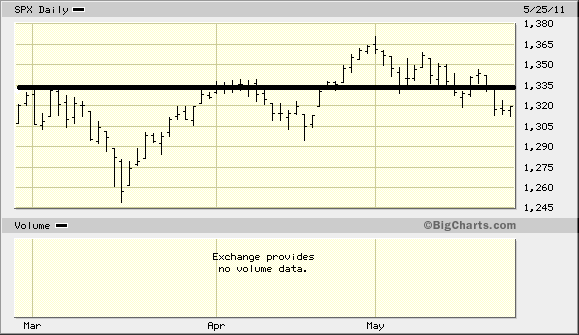

If you’ve been confused by the stock markets lately, don’t feel alone — there haven’t been a lot of good tells, but there are plenty of contrary opinions and a lot of lackluster trading days. But for what it’s worth, here is the line I will be watching above all else:

If we see more resistance around that 1335 level on the S & P 500, we will know we are on to something. And unless and until that line is reclaimed and it holds, the “sell in May” slogan will be the song of the day.

In Market Recap on

23 May 2011 with no comments

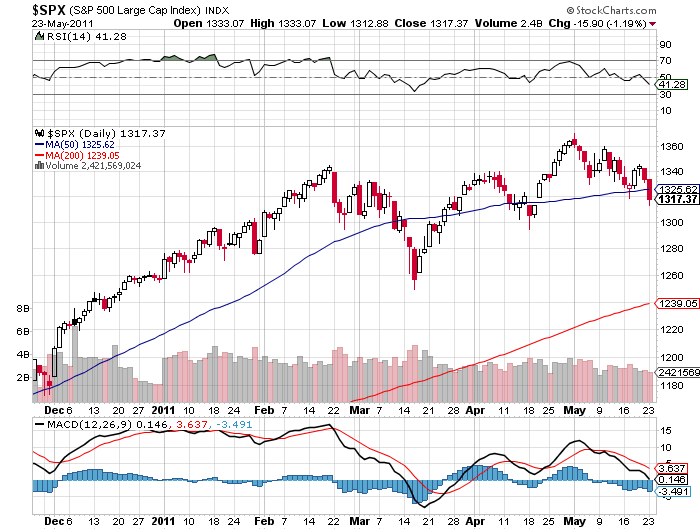

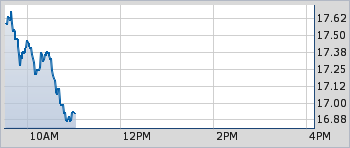

With the big opening gap down today, VIX started the morning at almost –but not quite — 20, which I what I need to maximize my bullish-on-VIX option position. But from the open, VIX steadily eroded:

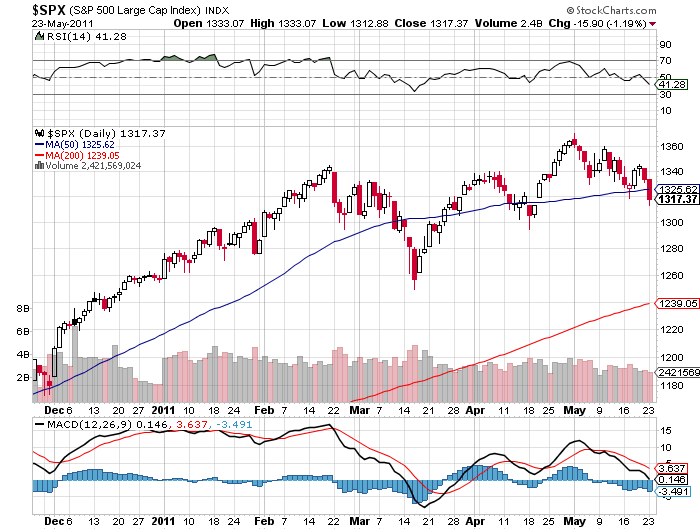

while the market as a whole never recovered:

I think we need to see a swift reclamation of that 50 day moving average, or the big dip will be coming soon!

In Pure speculation! on

19 May 2011 with no comments

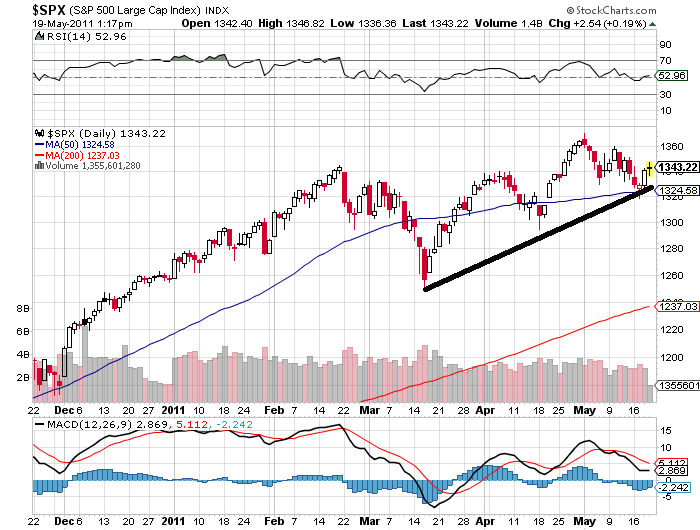

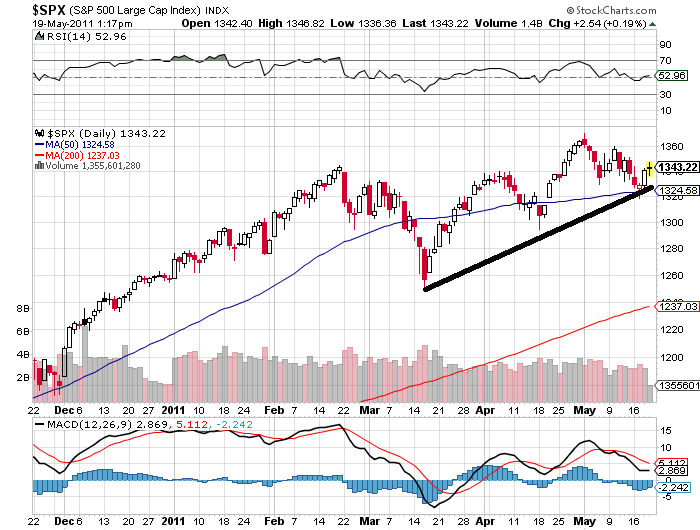

If you have bullish instincts, why not trade this support line (drawn on a chart of the S & P 500)?

If you have bullish instincts, why not trade this support line (drawn on a chart of the S & P 500)?

Notice that both the March and April lows sliced right through the 50-day moving average with no problem, but that sweet recoveries ensued anyway. Re- tracing to the support line now would just about hit the 50-day at 1324. Good trading opportunity for the bulls, with tight stops below the 50.

On the other hand, if you’re a bear, you are probalbly fulminating on whether a giant head-and-shoulders is forming, with Armageddon to follow! . . .

In Trades on

18 May 2011 with Comments Off on Escaping unscathed on VIX settlement day

With the markets opening mixed this morning, I escaped unscathed with my remaining May VIX options position, which was a now-naked sale of VIX 20 calls. The May settlement figure for VIX came in at 18.02, and though it is not material for my trade, VIX has since deteriorated further to the mid-16 range.

With the markets opening mixed this morning, I escaped unscathed with my remaining May VIX options position, which was a now-naked sale of VIX 20 calls. The May settlement figure for VIX came in at 18.02, and though it is not material for my trade, VIX has since deteriorated further to the mid-16 range.

Maybe time to buy more ???

In Trades on

16 May 2011 with no comments

Well I’ve been battling a sore foot for most of the past month, which has kept me from posting here, which might be just as well as I’ll be quick to admit to being baffled by the present market situation.

Well I’ve been battling a sore foot for most of the past month, which has kept me from posting here, which might be just as well as I’ll be quick to admit to being baffled by the present market situation.

While I’ve been tending to my foot, my VIX option positions haven’t been doing nothing, of course; they’ve been decaying. With May expiration (for VIX) on Wednesday, it’s time to bail!

So here goes; I sold my May 17 VIX calls for a measly $0.85, and my May 16 VIX calls for a somewhat better $1.55 this afternoon. I plan on (hopefully) letting the May 20 VIX calls I sold expire by Wednesday morning.

For the record, the VIX itself was trading around 17.57 this afternoon.

Lets hope things are looking up from here!

In Trades on

20 April 2011 with no comments

The irresistibly low VIX has got me in buying mood again, this time picking up 5 May 16 calls with the VIX at $15.18. The idea here is to have some almost immediate upside, and not to cap it by making it a spread, in case the market really reverses in some now-unseen frenzy.

The irresistibly low VIX has got me in buying mood again, this time picking up 5 May 16 calls with the VIX at $15.18. The idea here is to have some almost immediate upside, and not to cap it by making it a spread, in case the market really reverses in some now-unseen frenzy.

The May expiration month is a little short — trading stops on May 17th, and we have Good Friday off this week, but remember VIX was flirting with 19 as recently as Monday morning.

In Trading Candidates on

20 April 2011 with no comments

All must be peace and light in the financial world; despite oil trading over $109.00 per barrell, the SPX surged back to 1330 this morning and the April VIX contracts were settled at 14.86, which means the $650 put in my account for options I sold on April 8th will stay there.

All must be peace and light in the financial world; despite oil trading over $109.00 per barrell, the SPX surged back to 1330 this morning and the April VIX contracts were settled at 14.86, which means the $650 put in my account for options I sold on April 8th will stay there.

But I’m already itching to “reinvest” it. When VIX levels dip to the 14’s or low 15’s I love to be a buyer of calls, which may happen later this afternoon if things stay so peachy keen . ..

In Food for thought on

19 April 2011 with no comments

The stat junkies at Bespoke Investment Group have reviewed the best and worst of earnings season so far, and look who is the “best of the best” — our old friend Supervalu!

Back when I was touting this one off the 52-week low list, who would have thunk it?