In Trades on

28 April 2010 with 1 comment

I sold my 100 share Potash (POT) position for a $104 loss this morning, fetching a price of $107.67.

I sold my 100 share Potash (POT) position for a $104 loss this morning, fetching a price of $107.67.

This had nothing to do with chart formations, Euro finances, or the looming Fed day announcement. I’m leaving for a short trip to San Diego, and didn’t want an open position while I travel.

While I realize that you can trade from anywhere nowadays, and that this represents the first losing trade posted on this site, the peace-of-mind factor is the most important point with me,

Have a great weekend (I’m planning to), and I will be back trading on Monday May 3rd!

In Market Recap on

27 April 2010 with no comments

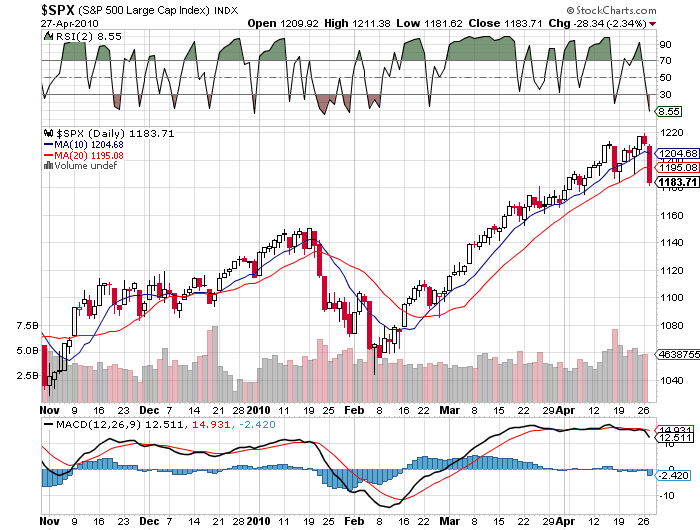

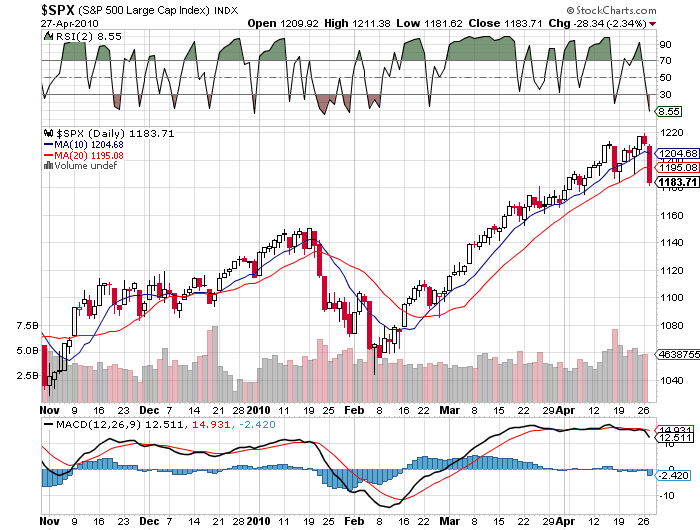

Needless to say, today’s slamdown was loooooong overdue; the question now is whether the failure to hold either the ten or twenty day moving average portends the end of the Feb.-March-April part of the rally, or just gives the buy-the-dippers a better dip to buy into.

Needless to say, today’s slamdown was loooooong overdue; the question now is whether the failure to hold either the ten or twenty day moving average portends the end of the Feb.-March-April part of the rally, or just gives the buy-the-dippers a better dip to buy into.

Looks like February 13th was the last day we closed under the 20-day SMA until today; that was quite a run!

In Stock of the Day on

26 April 2010 with no comments

Everything’s looking up this morning for heavy equipment maker Caterpillar Corp., — topline, bottom line and outlook — so a big pop on the earnings announcement is to be expected.

This company seens to track the major averages almost exactly, so what you see in the market as a whole is what to expect at CAT. Probably too late to get in now, but if you’ve owned this one and have been riding it up, the 20-day moving average (thin purple line) would make a sensible point to set a trailing-stop.

In Market Recap on

23 April 2010 with no comments

How long ago was it that everyone was terrified of holding stocks over the weekend?

How long ago was it that everyone was terrified of holding stocks over the weekend?

Now the prevailing attitude seems to be “This is so much fun, do I really have to take two whole days off?”

Yes, you do. Enjoy!

In Trading Candidates on

23 April 2010 with no comments

While waiting for my listless Potash trade to play out, I’ve been rather half-heartedly prowling around for some different set ups, and stumbled on Ryan Mallory’s list of sixteen short setups ripe for agonizing us dispirited bears . . . . Just kidding!

Here’s one from Ryan’s list, called Minefinders, which has apparently found a gold and silver mine in Mexico:

I guess this one would be short-worthy based on a sloppy head-and-shoulders pattern, but based on its price action for the last two sessions (and indeed, for the entire calendar year so far), it stands ready to punish those who enter early.

I think its better to wait for a definitive break of the apparent neckline right at $9.00 even, then get ready to bail with a tight stop if it rallies much above that point. Good Luck to those who dare!

In Market preview on

23 April 2010 with no comments

Yesterday, the bulls staged an impressive comeback as the moving averages not only held, but a small gain at the close was sustained. And so the rally that cannot be killed off rolls on!

For the next little while, lets watch for breakouts from the current range — S & P 1213 as the recent high on the upside, and S & P 1185 (Monday’s intraday low) as a target for whatever bears are left out there.

In Market preview on

22 April 2010 with no comments

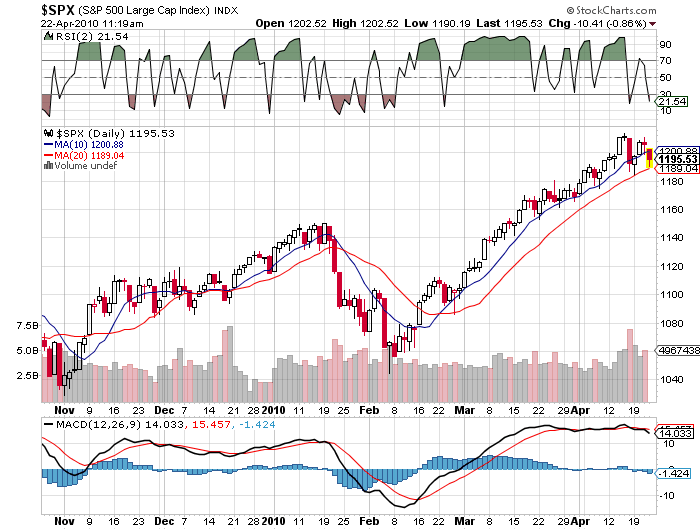

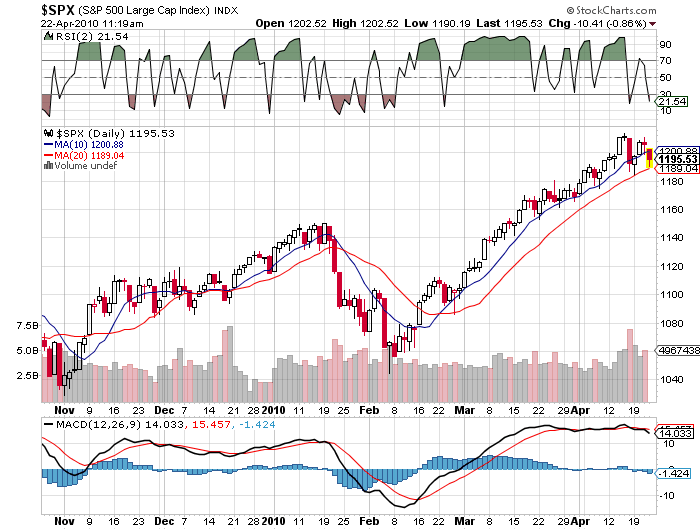

Will this be the second successful test of the 20-day moving average in a week? Watch it at the close . . .

Will this be the second successful test of the 20-day moving average in a week? Watch it at the close . . .

In Followup on

22 April 2010 with no comments

There’s nothing worse than some news to screw up good a bit of technical analysis! Green Mountain Coffee Roasters got spooked and entered plunge mode when a potential acquisition’s “K-Pod” product sales slowed. Personally I would rather boil my coffee in an old pot over a fire like the Marlboro Man, but obviously the disappointing K-Pod news was meaningful to someone.

There’s nothing worse than some news to screw up good a bit of technical analysis! Green Mountain Coffee Roasters got spooked and entered plunge mode when a potential acquisition’s “K-Pod” product sales slowed. Personally I would rather boil my coffee in an old pot over a fire like the Marlboro Man, but obviously the disappointing K-Pod news was meaningful to someone.

Last time I looked at GMCR it was as a potential buy; that setup is now completely broken down, and the only question on the long side is are you brave enough to buy and hope support at around $80 holds?

GMCR announces earnings next Wednesday, April 28th.

In Market preview on

22 April 2010 with no comments

If the bears are going to warrant any respect, they need to take out, in order, these S & P 500 moving averages on a closing basis:

10-day: 1200

20-day: 1189

50-day: 1151

Watch how the S & P does at the close, and you’ll get a clue as to whether the bears have any teeth.

And by the way, I was just thinking we are getting pretty close to “sell in May . . . .” aren’t we?

In Stock of the Day on

20 April 2010 with no comments

Well I missed hearing the CNBC stock of the day this morning as I was busy pouring anti-freeze in to my car radiator, so why not just go ahead and nominate Apple Corp. (which announces earnings tonight after the bell), as the stock of the day:

That’s a fairly simple pattern to analyze; a long grinding recovery upwards to all-time highs. With IPad’s out there in the real, touchable world, my instinct is to “sell the news” on this one. Short-term bearish.

I sold my 100 share Potash (POT) position for a $104 loss this morning, fetching a price of $107.67.

I sold my 100 share Potash (POT) position for a $104 loss this morning, fetching a price of $107.67.