In Trading Candidates on

20 May 2010 with no comments

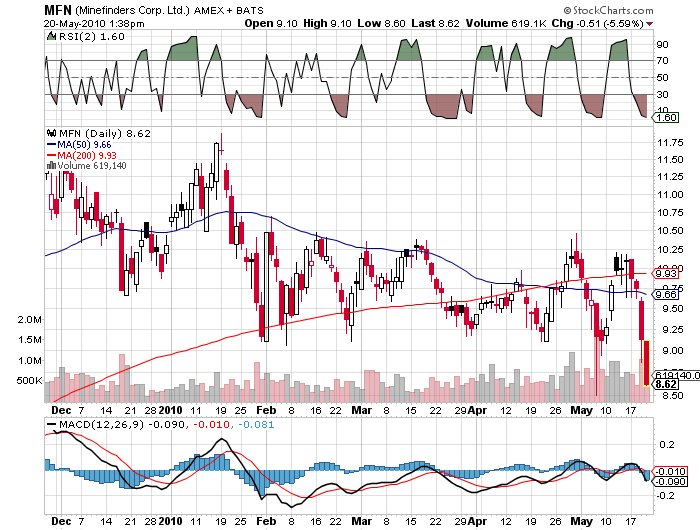

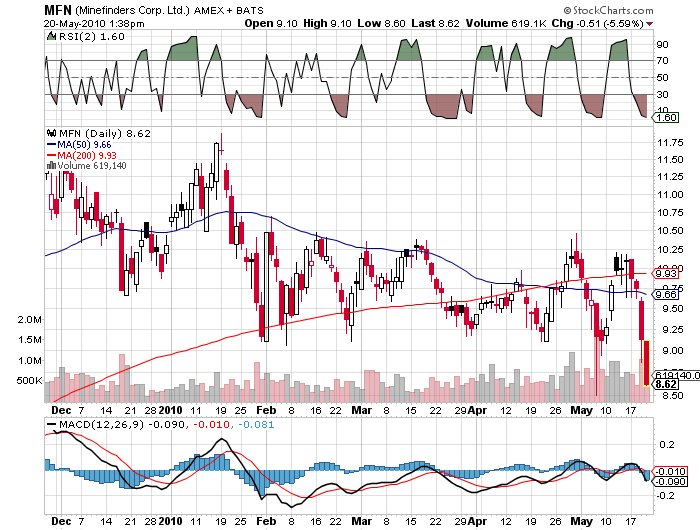

Talk about a swing trade, but I am halfway considering BUYING into MFN, which I just covered as a short (one day too soon, I know, I know).

Talk about a swing trade, but I am halfway considering BUYING into MFN, which I just covered as a short (one day too soon, I know, I know).

The play would be a real quickie, to see if it will bounce on a test of the $8.50 flash-crash low.

Note the RSI (2) at 1.60; this move has paid off consistently, except in late March. The stop would have to be a little below $8.50, and the bounce would have to happen fast.

In Followup on

20 May 2010 with no comments

Plenty of traders have been catching knives lately with credit card processor Visa (V), but who would have thought it would be one of the very few stocks to rise on a day when the S & P 500 is down over 36 points before 1 PM?

Plenty of traders have been catching knives lately with credit card processor Visa (V), but who would have thought it would be one of the very few stocks to rise on a day when the S & P 500 is down over 36 points before 1 PM?

I wouldn’t bet on that gap down from $86 filling any time soon, though . . .

In Trades on

19 May 2010 with no comments

It was a crazy day here as I completely flipped my positions at the close.

First, I covered my 1,000 share MFN short at $9.15. Not as much as I would have liked, but I was away from my office for work and missed some of the best prices. I know, I should have had a limit order in, but those work both ways too. Anyway, this added $720 in profit to the till.

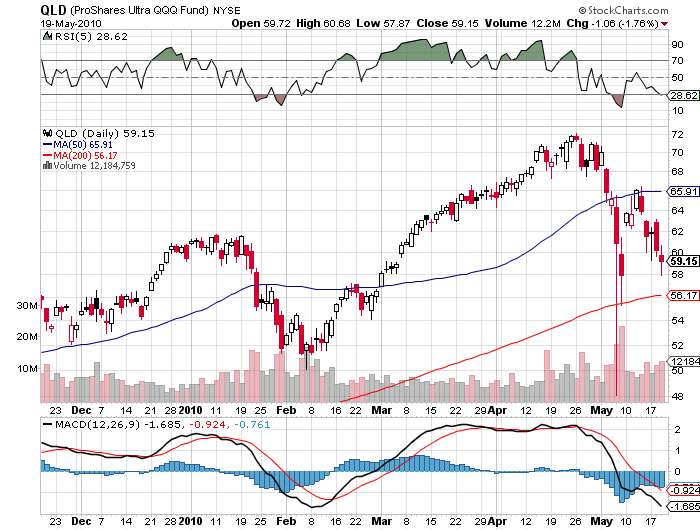

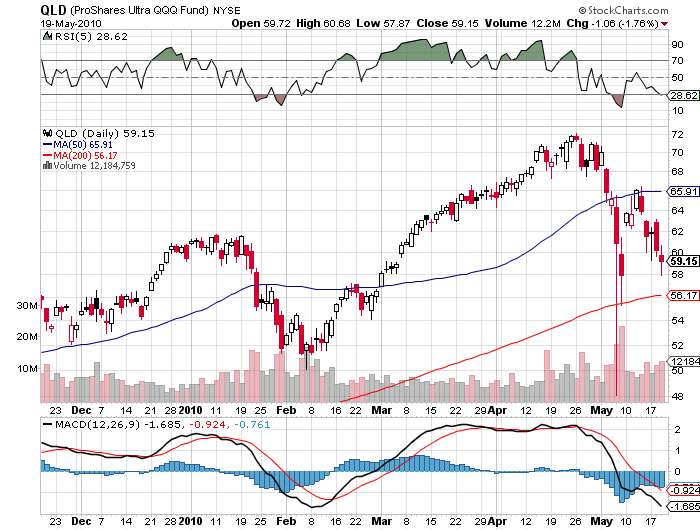

Then, the “go-to” trade in QLD fired again with a RSI (5) under 30, hence the swing! Here we go again . . . .

. . . . buying in to an unwell market without defined stops. With cash freed, I picked up 300 shares this time at $59.15. Notice that QLD (unlike the SPX) hasn’t yet made a new lower low, or explicitly tested the 200-day moving average. I suspect I am in for a wild ride with this trade, stay tuned!

In Followup on

18 May 2010 with no comments

The last time I took a look at Super Value back on April 8th, it was a potential buy with a nice cup and handle formation forming. That obviously didn’t play out! A good reminder to wait for upside confirmation if and when playing cup and handle formations — being early on the trigger can be brutalizing!

The last time I took a look at Super Value back on April 8th, it was a potential buy with a nice cup and handle formation forming. That obviously didn’t play out! A good reminder to wait for upside confirmation if and when playing cup and handle formations — being early on the trigger can be brutalizing!

Now this stock is broken down technically and I have to wonder if there is a decent trade on the short side, trying to get that mid-January gap up from the $12.90 level to fill.

A tight stop just above last Thursday’s intraday high (about $14.35) would make this an acceptable play for a minor gamble on the short side.

In Market preview on

18 May 2010 with 1 comment

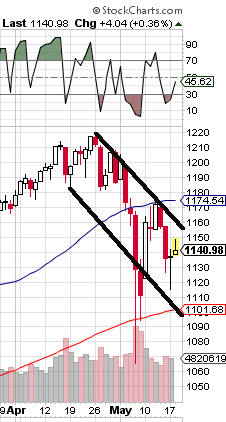

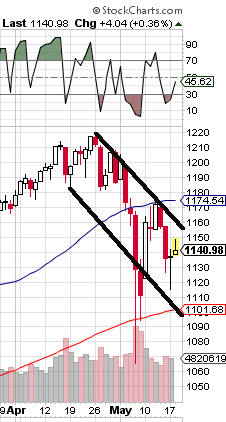

Here is a little bit clearly drawn view of the S & P 500 downtrend channel I mentioned yesterday that I will be trading for the near future. I won’t be bullish until the top trendline is taken out on a close.

Here is a little bit clearly drawn view of the S & P 500 downtrend channel I mentioned yesterday that I will be trading for the near future. I won’t be bullish until the top trendline is taken out on a close.

Also, be aware that 1150 is a long term resistance level to watch. A test of 1150 to the upside and then another rollover is one likely scenario I’ll be watching for!

In Performance Review on

18 May 2010 with no comments

Today brings to a close two months of active trading on this site, where the goal is to double a $10,000 margin account in the space of a year.

Today brings to a close two months of active trading on this site, where the goal is to double a $10,000 margin account in the space of a year.

The second month of trading was a wild ride, to say the least, principally due to my decision to go “all-in” on the long side the day before the May 6th “flash crash,” and not having any stops set in place to protect against capital erosion. For a brief moment, my account was off over $4,200 for the day!

Obviously, this is not good trading practice, but this time I was bailed out by luck and a good hefty bounce. The actual statistics for the month belie the insane wild ride of May 6th!

Two of three trades were profitable, adding $879 in capital to the account, for a 7.2% positive gain on the month.

So far then, over two months, I’ve had five profitable trades out of the six completed (a short position on MFN is still outstanding), for a gain of 30.1%.

Double money in a year? I’m still ahead of schedule, now lets try to keep the positive momentum going!

In Market preview on

17 May 2010 with no comments

While many will argue that the market’s uptrend is intact (blue and purple lines on the chart drawn above), I think shorter term traders should be paying attention to the downtrend channel drawn in black instead.

While many will argue that the market’s uptrend is intact (blue and purple lines on the chart drawn above), I think shorter term traders should be paying attention to the downtrend channel drawn in black instead.

A very viable trading strategy would be to stay away from initiating long positions until that channel is taken out. Of course, the longer term uptrend may yet win out in the end, but by following the black lines, you may profit from a short-term dive, while still knowing when to close out shorts and swing to the upside.

And remember, we still haven’t EXACTLY filled last Monday’s opening gap yet — close, but no cigar!

In Trade deconstruction on

17 May 2010 with no comments

On my just concluded SDS trade, it looks like I just about caught the bottom of today’s downside move, marked by the arrow above.

On my just concluded SDS trade, it looks like I just about caught the bottom of today’s downside move, marked by the arrow above.

This is not to brag, it was pure luck, as a pre-set limit order was filled when program sell orders came in about noon. That just happened to be almost the exact low for the day.

All-in-all, a little luck never hurts; maybe it was a give back from the market gods for being caught with my pants down in the flash crash on May 6th!

In Trades on

17 May 2010 with no comments

A limit order I placed Friday triggered at noontime when SDS hit the $33 mark. Due to the dynamics of leveraged ETF’s, I was out of this trade at about S&P 500 1120, rather than the 1110 level that I would consider a true fill of last Monday morning’s gap.

Still, a profitable trade doesn’t leave much to complain about.

In Stock of the Day on

14 May 2010 with 1 comment

Take a look at Visa dropping like a stone on general market weakness, and more particularly, news that the Senate has approved Richard Durbin’s proposal to cut debit card fees:

The measure would force credit card companies like Visa (V) to charge less for debit transactions.

Talk about a swing trade, but I am halfway considering BUYING into MFN, which I just covered as a short (one day too soon, I know, I know).

Talk about a swing trade, but I am halfway considering BUYING into MFN, which I just covered as a short (one day too soon, I know, I know).