In Trades on

4 June 2010 with 2 comments

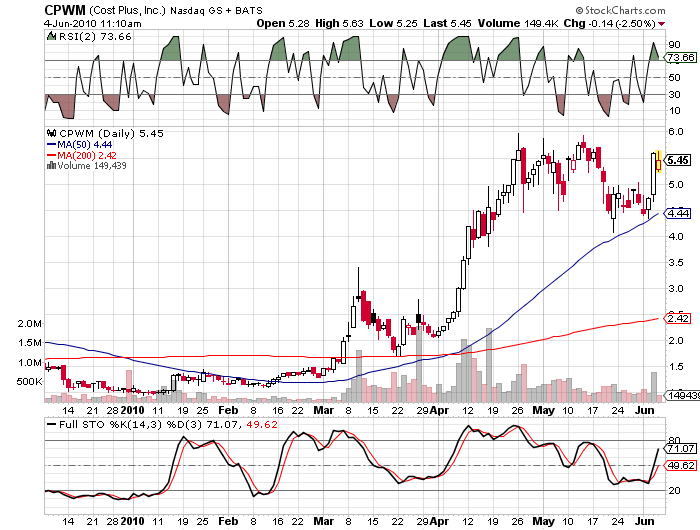

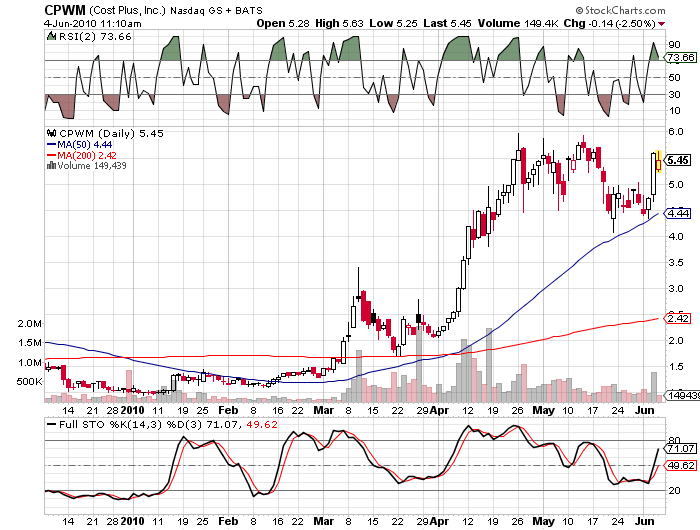

It took over an hour to get my limit order filled in this thinly traded issue (a West Coast discount store), but I wanted some more upside potential if there is a jobs report counter-bounce ….. maybe around 3:PM today, perchance?

It took over an hour to get my limit order filled in this thinly traded issue (a West Coast discount store), but I wanted some more upside potential if there is a jobs report counter-bounce ….. maybe around 3:PM today, perchance?

CPWM was an idea purloined from Charles Kirk’s subscription site the Kirk Report, where he shares several proprietary screens with his “members.” A screen called “cream of the crop,” for instance fingered this one. We will see if that proves prophetic, or if Cape Cod Doug gets skimmed instead!

This may take a bit longer than my usual trade to play out, as the goal is to break out over $6 up to say, $7, without violating the 50 day moving average, currently in the mid $4 range.

In Trades on

4 June 2010 with no comments

Jobs report trading will surely be the death of me . . . . But back to the well we go, looking to reprise the most successful trade to date on this site with 500 shares of Grand Canyon Education (LOPE) purchased at $24.60 once things calmed down a smidgen.

The idea here is to fade the negative jobs news and hopefully pick up a bargain near support. The black line ($24) represents about where I throw in the towel; but with some better news this could provide a 3:1 trade ($1.80 upside: $0.60 down). Will keep you posted . . .

In Trading Candidates on

3 June 2010 with no comments

I’m not super interested in putting on positions just prior to the jobs report (which always seems to kill me), but I’ve been wondering today if MFN makes a good short again:

I draw the resistance line (black) just a little bit lower than FINVIZ, which if it holds this morning might be a nice short set-up. Just an idea while idling away the day . . .

In Trading Candidates on

2 June 2010 with no comments

Another woulda-coulda-shoulda story, if only I had followed my own March 12th advice and kept an eye on BZQ, some nice profits were to be had buying a breakout over $25. As for the current situation:

There are two ways I look at this chart, leading, of course, to opposite conclusions. The double top speaks of an upcoming slide, which may in fact be in progress now. On the other hand, maybe there is a potential (bullish) cup with handle setting up here.

So two ways to play BZQ: buy now, with a stop at the 200 day moving average ($25), and a goal of hitting $34 again; or wait for the cup with handle to complete, and buy new highs over $34. That would be a longer term trade; maybe you can get it to go all the way back near $50,like last September.

In Followup on

1 June 2010 with 1 comment

I like to take a look at this one every once in a while — supermarket chain and former takeover target Supervalu — and right now its looking interesting on the long side again.

I like to take a look at this one every once in a while — supermarket chain and former takeover target Supervalu — and right now its looking interesting on the long side again.

We might see an inverted head and shoulders form to go with the double bottom — bullish stuff indeed, although the market as a whole isn’t feeling well, and SVU is well under its 200 day moving average — usually cautionary signs.

I’ll probably be sitting on my hands for a while with SVU (I’ve never actually traded it on this blog), but a break over $14 could yield a decent play with $15 as a target, and $13.70 as a stop. That way you get your 3:1 reward:risk ratio all lined up.

In Pure speculation! on

1 June 2010 with no comments

Fascinating chart of beleaguered BP, which raises the eternal question of whether fundamental or technical factors are primary in stock price swings. Obviously, BP has been dominating the news lately, with the latest failure to cap the Deepwater Horizon well causing another 10% haircut this morning.

Fascinating chart of beleaguered BP, which raises the eternal question of whether fundamental or technical factors are primary in stock price swings. Obviously, BP has been dominating the news lately, with the latest failure to cap the Deepwater Horizon well causing another 10% haircut this morning.

But was a drop fated anyway by that massive double top? It was April 14th when BP tickled $60 on that chart — the rig blowout and subsequent oil slick hit the news on April 20th.

Technicians will love to claim they would have had you out on the 15th or so with BP’s failure to make new highs.

After that the drop has been accelerated, shall we say, by corporate news of the very worst kind.

In Market preview on

1 June 2010 with no comments

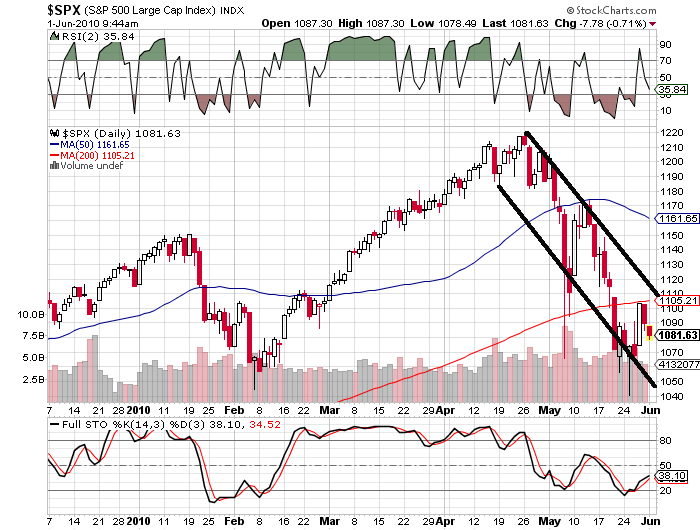

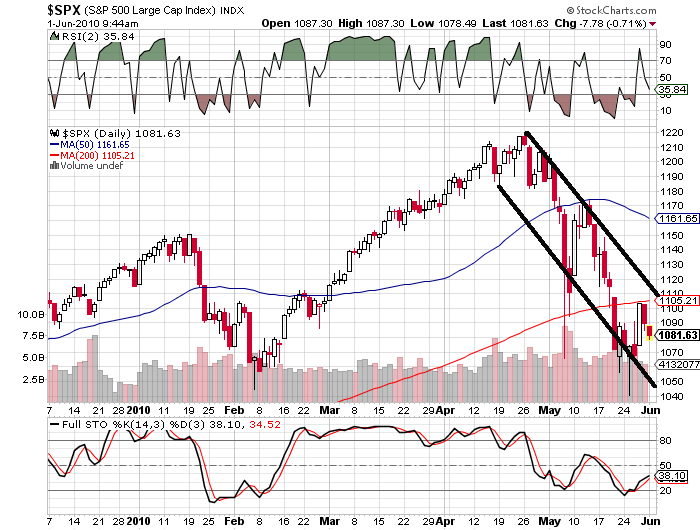

Back to the markets after the holiday weekend, and it’s not too pretty out there already! Assuming you are the glass-half-full type that is. As I am relentlessly neutral, here is how I see the downtrend:

We are more than a month into the downside now, so this is not really a short, short term trend any more, but here is my basic take-away point: be very, very careful on the long side until you see the top black line taken out at the close.

Co-incidentally or not, this would currently mean a close on the S&P 500 of around 1115, or in other words a fill of the big gap down at the open on May 20th.

Good luck in the markets this week and be careful; Friday is another jobs-report day.

In Uncategorized on

28 May 2010 with no comments

Wherever Memorial Day weekend finds you or takes you (it is the traditional time for opening up Cape Cod summer cottages), I hope you will be happy and healthy.

Wherever Memorial Day weekend finds you or takes you (it is the traditional time for opening up Cape Cod summer cottages), I hope you will be happy and healthy.

It is, of course, a time to reminisce on the lives of the persons who have died in service to the United States, and I hope you will get the time to remember some of these brave souls.

Back on Tuesday for the start of June!

In Followup, Trading Candidates on

28 May 2010 with 1 comment

I been kind of listless since moving to cash yesterday, and the upcoming Memorial Day weekend probably hasn’t helped. So I decided to re-visit the company that has produced my biggest trade since starting this site, Grand Canyon Education (LOPE).

Do you ever find yourself drawn back to past winners? Actually, sometimes you can make a good deal of money by becoming sort of a specialist in the trading of select stocks, and it helps if they are perhaps a little off-beat. So lets take a current look at LOPE:

I might consider trading the black line, going long for as close to $24 as you dare, with a tight stop under that solid support at $23.75 or so. If there is a mini-bounce coming, LOPE might even get up to $28 or so, providing a very good risk-to-reward ratio.

I’m not getting in now, as I prefer to wait out the long weekend without LOPE on my mind. And don’t forget, we are still in the short-term downtrend channel, so be careful trading on the long side!

In Trades on

27 May 2010 with no comments

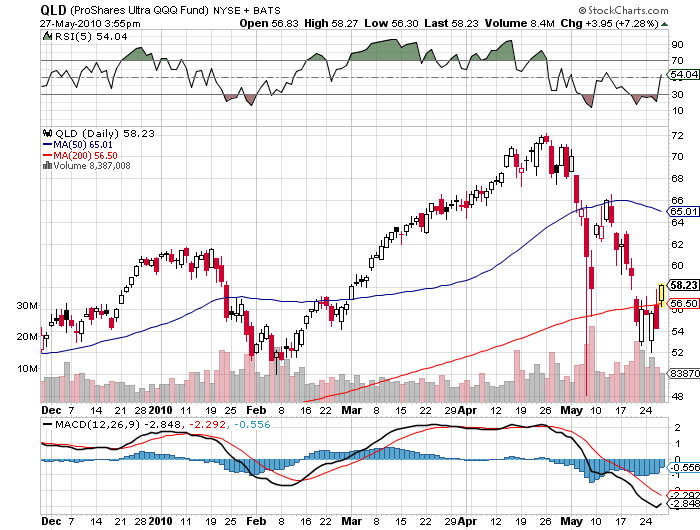

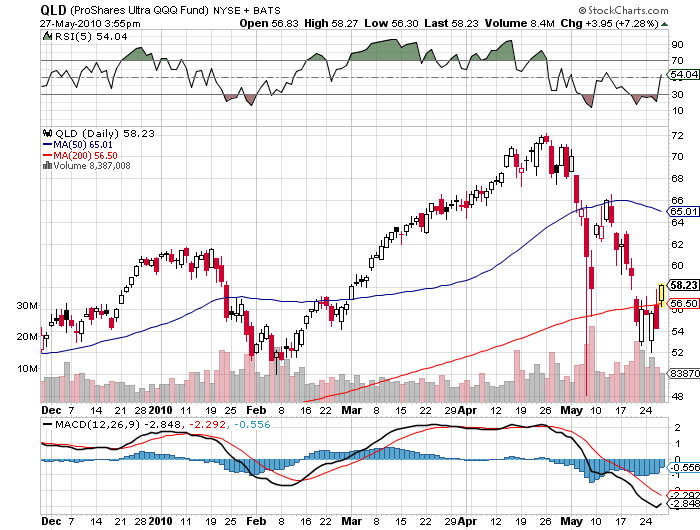

The exit signal (an RSI (5) over 50), on my “go-to” trade of QLD triggered this afternoon, so I sold out 300 shares at the close for $58.23.

The exit signal (an RSI (5) over 50), on my “go-to” trade of QLD triggered this afternoon, so I sold out 300 shares at the close for $58.23.

The QLD trade has been a big disappointment so far. It is now 1-for-2 on this blog and a minor money loser, and 1-for-3 for the calendar year of 2010 to-date.

The buy signal is to purchase QLD at the close when its RSI (5) drops below 30.

Last year, this trade was 8-for-10 and up 42.7% without taking commissions into account.

So far this calendar year, the trade is off -2.1%, with the broad market S&P 500 average down only 1.0% for the calendar year.

But I still have a posted a 40% gain since starting this site, so the battle continues!

It took over an hour to get my limit order filled in this thinly traded issue (a West Coast discount store), but I wanted some more upside potential if there is a jobs report counter-bounce ….. maybe around 3:PM today, perchance?

It took over an hour to get my limit order filled in this thinly traded issue (a West Coast discount store), but I wanted some more upside potential if there is a jobs report counter-bounce ….. maybe around 3:PM today, perchance?