In Trading Candidates on

24 August 2010 with no comments

Hi– back again after sort of a summer hiatus, with time at Cape Cod and bringing my daughter to college in Florida. Hopefully I wil be fresh for the challenge, and can reverse some of damage from losing positions in BZQ and CPWM.

One thing I noticed right away is that Gamestop now has a nice gap to shoot for again — if you’re in the market for a bullish trade, that is:

Right now, you can buy near the summer lows, and see if that gap near $20 fills quickly!

In Followup on

26 July 2010 with Comments Off on Gamestop not throwing out as many gaps

As the above chart shows, Gamestop has turned from a dangerously gappy issue to one that rarely shows opening gaps.

As the above chart shows, Gamestop has turned from a dangerously gappy issue to one that rarely shows opening gaps.

As a matter of fact, the only unfilled gap on the chart is the very first one from back in mid-October, when it plunged from $28.

You would have to be a very strong bull to shoot for that one filling any time soon, though, even with GME’s good, grinding performance lately!

In Performance Review on

19 July 2010 with no comments

With today being July 19th, it marks four full months of trading on this site. How do we stand?

As with most things involving trading, there is both good and bad to report.

As far as booked profits go, that is to the good. Starting with $10, 000 in March, I’ve made $4,282.60 on top of that, so I count myself as being still on track to hit my goal of doubling the original stake within a year.

On the downside, well the biggest one without a doubt has been the family health issues that hit hard in June. In addition to everything else, it has curtailed my ability to follow the markets, and no doubt the results as well. Don’t kid yourself: when someone tells you your health is everything, believe them!

As for the trades, the Cape Cod Doug blog (i.e., me) has hit its first real stinker, with shares of Cost Plus (CPWM) swooning to lows as we speak. It’s never fun being “stuck” with a loser, and its a good reminder I’m not really stuck, all I gotta do is hit the sell button, but there is sense sugarcoating that this is the first serious setback since putting up this blog.

I also have an open position in BZQ that is profitable as we speak, offsetting the CPWM disaster to a point.

So that’s the four month report. The next eight promise to be just as interesting!

In Pure speculation!, Trading Candidates on

13 July 2010 with no comments

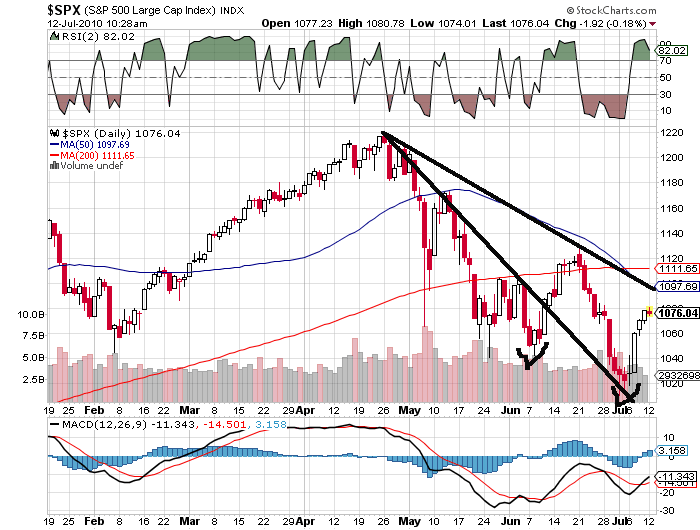

Today’s earnings season-fueled optimism has created a nice gap in the SPY to shoot for — down to 1078 or so. With RSI (2) currently at 99.07 as I write this, looks like a good bet for a bear to take . . .

Today’s earnings season-fueled optimism has created a nice gap in the SPY to shoot for — down to 1078 or so. With RSI (2) currently at 99.07 as I write this, looks like a good bet for a bear to take . . .

In Market preview on

12 July 2010 with no comments

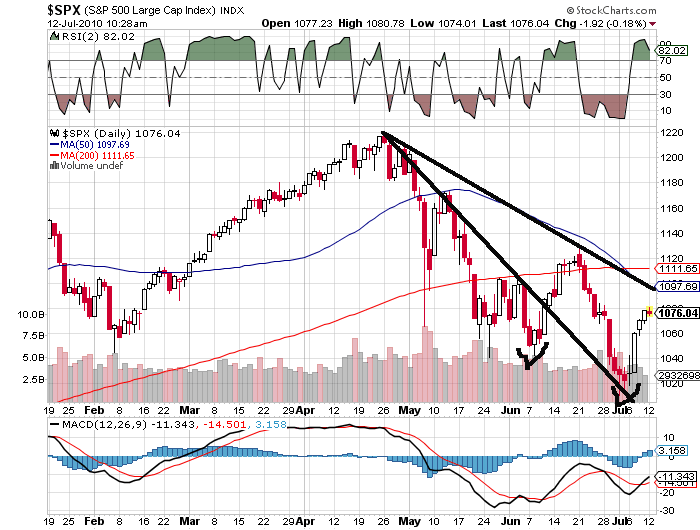

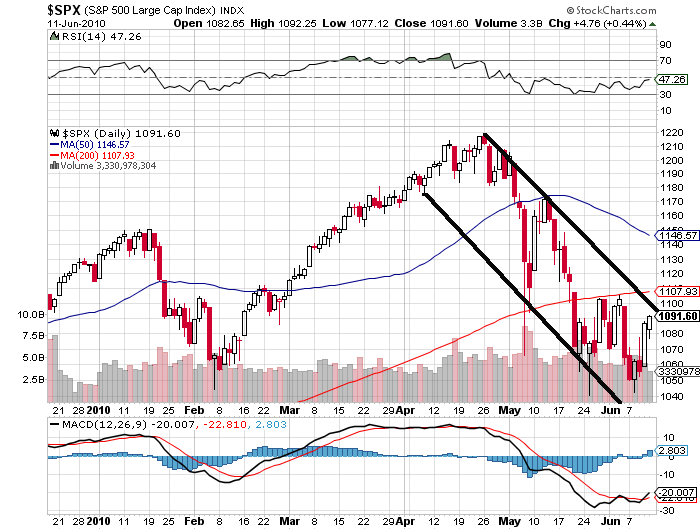

It’s been a while since I’ve posted my all-clear signal for the April downtrend; as of today we would need to clear 1100, and perhaps make a run for the 200 day moving average at 1111 to throw the bearishness aside. After that, we would need to see “higher highs” go in — in other words, a climb above 1125 posted on June 21st.

It’s been a while since I’ve posted my all-clear signal for the April downtrend; as of today we would need to clear 1100, and perhaps make a run for the 200 day moving average at 1111 to throw the bearishness aside. After that, we would need to see “higher highs” go in — in other words, a climb above 1125 posted on June 21st.

Note the previous trend-line I’ve left on the chart, which was broken on June 10-11 in a move that proved to be a fakeout. Although we have never really re-entered that steep channel, we have put in lower-lows on July 1. If you’re a bull, be careful out there!

In Trades on

9 July 2010 with no comments

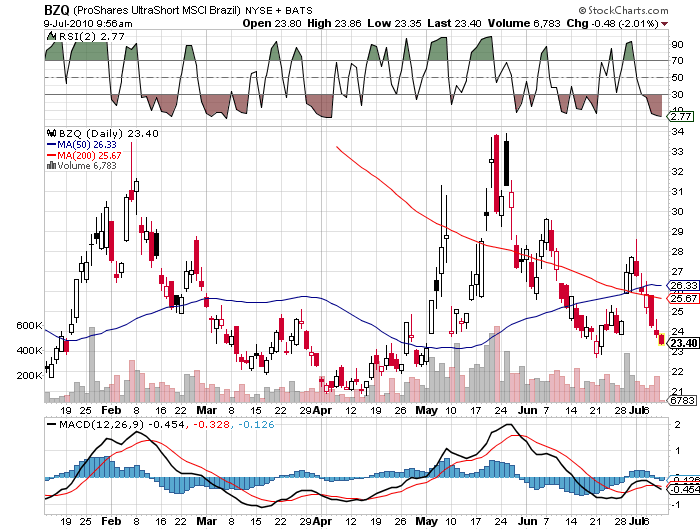

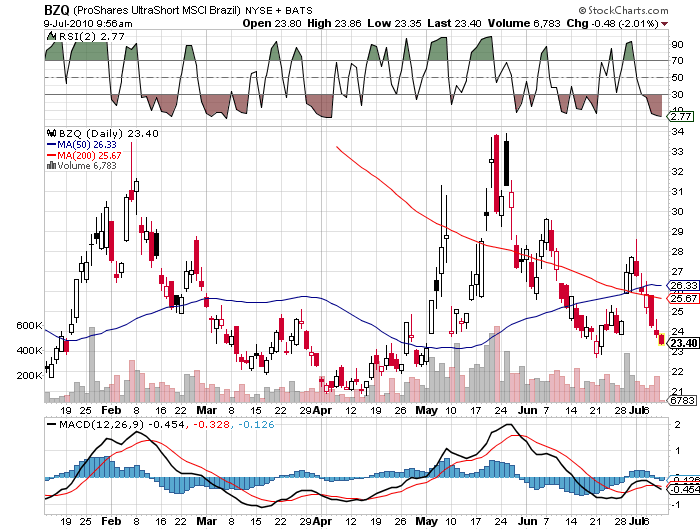

Why short Brazil now?

Why short Brazil now?

Well, there’s that Golden Cross out there, an RSI (2) of about 2, and three gaps to the upside in just the last week begging to be filled. There’s a clearly marked downside call-off point right under $23, too.

And, all those unemployed soccer coaches, too.

I picked up 600 shares at $23.22 this morning.

In Trades on

8 July 2010 with no comments

Trading is never an easy vocation, and when family crises intervene, things can get bad fast. Looks like that’s whats happened here, as I let one trade get away from me, and the “go-to” QLD trade has once again been found wanting (it’s negative for the year at this writing).

Trading is never an easy vocation, and when family crises intervene, things can get bad fast. Looks like that’s whats happened here, as I let one trade get away from me, and the “go-to” QLD trade has once again been found wanting (it’s negative for the year at this writing).

At any rate, I sold my 200 shares of QLD for $54.34 this morning; as the sell signal (RSI(5) over 50) actually triggered at yesterday’s close.

A loss of $432, but I will keep plugging, (and posting as time allows).

In Trades on

25 June 2010 with no comments

Family emergencies have kept me from posting much, or trading much, or studying much, but this morning with oversold readings flashing, i changed my positions:

I sold my 400 shares of BZQ (short-Brazil) for $25.05. This made a profit of $500 before commissions on this trade.

I then immediately bought 200 shares of QLD, as the “go to” trade’s buy signal of RSI (5) was under 30. These were purchased for $56.50.

I will keep you posted as time allows.

In Trades on

16 June 2010 with no comments

I’m finally going to give the BZQ trade (double short Brazil a try), hopefully getting it right at support. I bought 400 shares for $23.80. Wish me luck!

I’m finally going to give the BZQ trade (double short Brazil a try), hopefully getting it right at support. I bought 400 shares for $23.80. Wish me luck!

In Market preview on

14 June 2010 with no comments

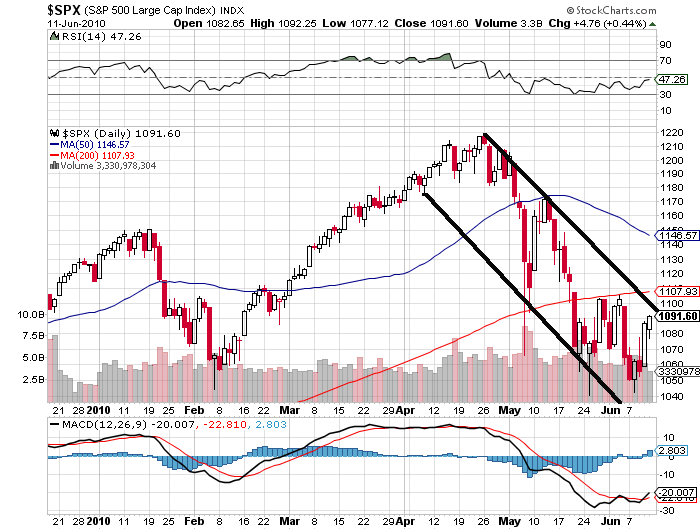

The seven week long downtrend in the S&P 500 remains intact even after the Thursday-Friday rallies last week.

The seven week long downtrend in the S&P 500 remains intact even after the Thursday-Friday rallies last week.

Futures are higher prior to the open and there is a possibility that we could take out the trend at the close.

Front and center targets are the 200 day moving average at 1107 and that mid-May gap at 1115.

Hope you have a great week trading!