In Followup on

19 January 2011 with no comments

I guess it doesn’t take too many blizzards to get folks interested in Florida real estate again.

I guess it doesn’t take too many blizzards to get folks interested in Florida real estate again.

When we last looked at St. Joe, it had just filled a giant gap before Christmas, said gap being brought on in October by David Einhorn’s strategic blasting of the firm’s prospects.

But JOE hasn’t stopped with just filling the gap:

It’s a good reminder not to engage in knee-jerk selling when a gap fills (as I am wont to do). JOE has so far blown right through the $25 level without pausing to form a “handle.” Florida always looks might good when its mighty cold out there!

In Trades on

18 January 2011 with 1 comment

Well, my foray into options trading took an unexpected turn when Steve Jobs announced he was taking another medical leave and AAPL shares plunged at the open this morning:

Well, my foray into options trading took an unexpected turn when Steve Jobs announced he was taking another medical leave and AAPL shares plunged at the open this morning:

I took my Feb 350-330 put spread off the table a little after 10 Eastern, when Apple was trading around $333.30. The end result was an over-the-long-weekend profit of $1,366.

I have to admit like a lousy way to make money. Obviously I was bearish on Apple’s earnings report set for this evening, but now it turns out that I have effectively made a quick buck of Mr. Jobs health misfortunes. While rumors concerning Jobs’ health seem to fly through the Ethernet every day of the year, it doesn’t give me any real pleasure in profiting or even commenting on them.

On the other hand, with the stock trading just above the lower strike price on the spread, there was little point in hanging around for the actual business news tonight, and caching out was the right strategic thing to do. (Also, due to a New England snowstorm, I was unexpectedly at my desk for the open this morning. I had planned a long car trip to another part of Massachusetts for this morning).

I wish Mr. Jobs all the health in the world; he is certainly one of the characters on the American business scene we would like to have around and active for a long time to come.

In Uncategorized on

17 January 2011 with no comments

I decided to come out of my winter hibernation Friday, and put on my first trade of 2011.

To say we are going against the flow on this one is an understatement; I decided to short AAPL right before their Tuesday evening earnings announcement. Anyone with anything negative to say about America’s most beloved consumer sexy stuff provider is rare as hen’s teeth, and probably un-American to boot, so leave it to Cape Cod Doug! Here’s the chart, which looks like an unrelenting ascent to the heights of corporate Nirvana:

Just to mix things up a little more (and to protect my sorry ass when I’m proven wrong) I decided to use options to limit the carnage. This is the first options trade I have made since starting this site.

Specifically, I am going one month out to February expiration, and purchased the FEB 350-330 put spread, 2 contracts each for a total maximum bust-out of $940. My hope is that if Apple does pop down on earnings, to get out quickly, and if there is a down-gap, maybe even turn around and pull a bullish gap-fill trade on the rebound.

But for now, just keeping fingers crossed ’til Tuesday night.

In Performance Review on

17 January 2011 with no comments

Two weeks in to the new year I have finally gotten around to having the trading log reflect the commissions paid out in the 2010 calendar year.

Not that it is a stunning amount: using TD Ameritrade’s $9.99 equity trade commission structure makes for simple math. My thirty five executed trades thus cost me about $350 for the year.

The trading log and all performance statistics on this site have been appropriately updated. From March to December, I’m up about 69% — not bad at all, but still short of my goal of doubling the account in a year. Stay tuned for that!

In Stock of the Day on

14 January 2011 with no comments

Well this is certainly a spectacular way to fill a gap!:

Well this is certainly a spectacular way to fill a gap!:

Coinstar’s big Halloween gap up turned into horrors when it filled this morning on news of problems with its Redbox unit not getting the best films on time. The big question now is does anyone have faith that today’s plunge itself will fill any time soon?

A few superheroes might be needed to pull that one off!

In Trading Candidates on

13 January 2011 with 1 comment

One of my most favorite places to go to pick up long term trading ideas is the 52 week low list. Its a short list lately, which means that those stocks on it are not only just popping new lows, but displaying extraordinary relative weakness as well.

This type of screening needs to produce a lot of discards, or you’ll find yourself at the cleaners pretty quick, but there are sometimes gems in there as well.

Here are three of the present cellar dwellers:

First up is women’s retailer Talbots:

This chart is an eye-opener for gap traders as well as bottom fishers! A 50% slice-in-two since Black Friday is not exactly what retailers hope for. Obviously this one won’t come around until there is some fundamental good news, but if that happens doubling your dough is in the realm of possibility.

Next up is Borders. A lot of what they sell is called books, which come in a convenient paper form in case you are interested.

Some think that books are an old fashioned idea, and a doomed product. This stock is for those who take the contrarian view.

Finally, Martha Stewart. Spending time in a federal prison will surely change your view of adversity, but this is really one ugly chart:

Price-to-book is only 1.66, but I would want Martha to reclaim at least one of her moving averages before being tempted to type in a buy order.

In Trading Candidates on

12 January 2011 with no comments

Some investors are beginning to think that 2011 will be the year of the big cap stocks, when they finally start to outperform the tech laden averages.

Some investors are beginning to think that 2011 will be the year of the big cap stocks, when they finally start to outperform the tech laden averages.

If you are in that camp, are bullish, and like to bet on gaps filling, take a look at Target:

The massive retailer was hit last week with lower than expected December sales. Getting that gap to fill at around $59 will be worth about 7% for a patient bullish speculator.

In Stock of the Day on

11 January 2011 with no comments

Well, here’s an issue that’s been on quite a roll since Labor Day:

Hughes Communications, a broadband purveyor, announces earnings again in February. Until then, this one looks too hot to touch at the moment. If it broke through the 50 day moving average, then stabilized around the $35 level like it did in Mid-November, I would consider it a nice buy at that point.

In Uncategorized on

21 December 2010 with Comments Off on Merry Christmas and Happy New Year

Barring a market meltdown (fat chance of that lately!), I will be officially on vacation (in New Hampshire, not Cape Cod) until January 3rd,at which time we shall resume the hunt for good gap trades and see if I can push this account up over 100% by March 19th, which would be a full year of trading.

In the meantime I hope you enjoy the Christmas and New Year season!

In Pure speculation! on

21 December 2010 with no comments

While the focus of this site has been to try to earn a 100% yearly return through short (and as it turns out, medium) term trading, let us not neglect the long term investor.

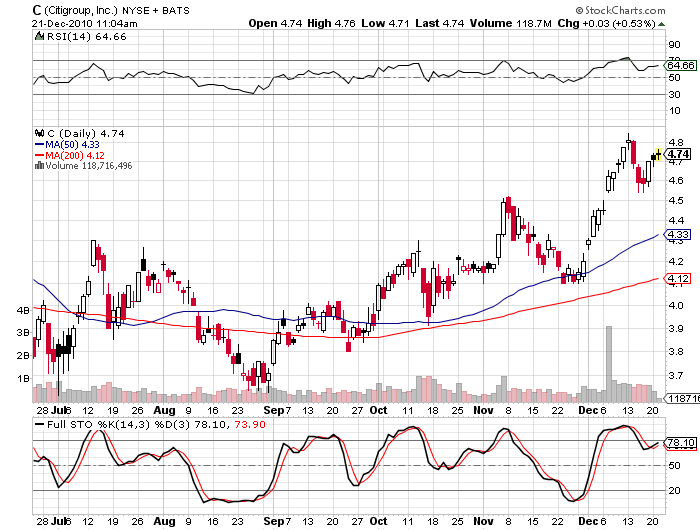

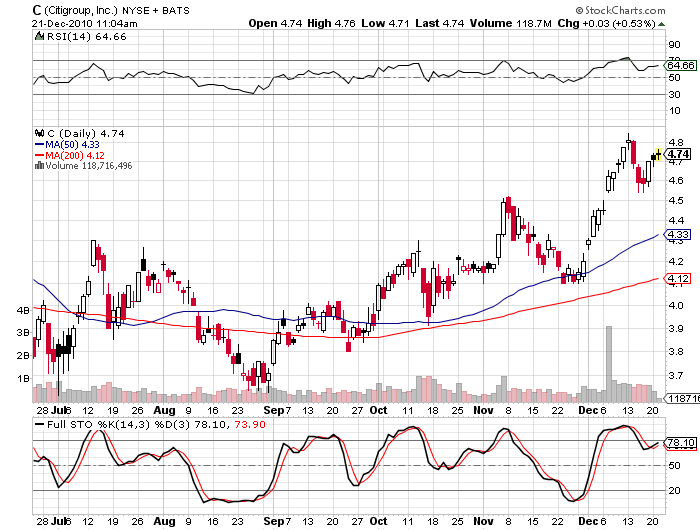

If your time frame is anywhere from 5 to 10 years to longer, let me recommend the battered Citigroup, and suggest a good long-term bet would be to see if it can crawl back to its old highs:

This is nothing less than a flat bet on a great American recovery, something most Main Streeters certainly aren’t feeling at the moment. But such a recovery is likely to happen amid the proverbial wall of worry.

Timing remains an issue, as C has run up sharply all fall, and especially in December. I would wait for that 78 stochastic reading to dip down again, like it did around Thanksgiving, and start accumulating then.

And if it doesn’t work out that way, we know there is a good floor in this stock, as it doesn’t seem that Uncle Sam wants to let it fail.

Ten times your money in five years or less? A real possibility, says your old friend CCD. Have a great Christmas!

I guess it doesn’t take too many blizzards to get folks interested in Florida real estate again.

I guess it doesn’t take too many blizzards to get folks interested in Florida real estate again.