In Trades on

8 February 2011 with no comments

Well, I didn’t exactly double a short position, technically put another $1000 into VIX calls.

Well, I didn’t exactly double a short position, technically put another $1000 into VIX calls.

This time I bought 5 of the April 20 calls for $2.00 each. The VIX closed at a low 16.07 today. Previously I picked up some VIX calls expiring in March, so that’s why I consider it doubling up.

I really think that this is the best risk-reward setup I can find and truly believe in out there. Rather than playing a guessing game on whether a particular company (like Disney) will beat its earnings forecast or not, a simple bet on a return to volatility makes more sense to me.

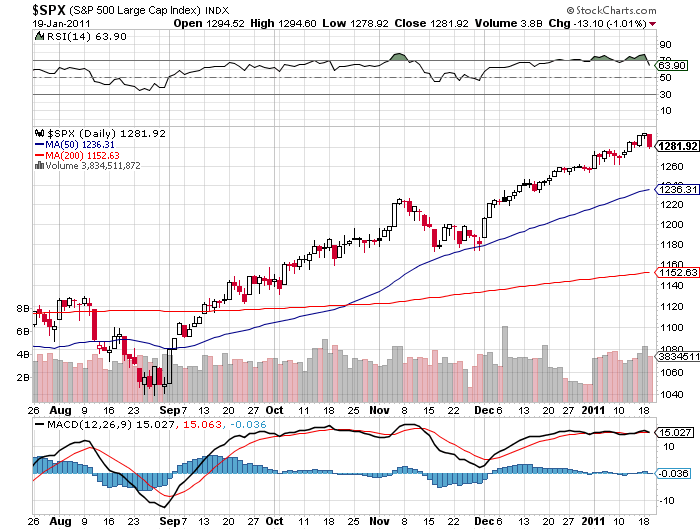

Not that this position isn’t contrarian, as the market just keeps melting up day after day:

But my bet is that it will crack, although I do not profess to know whenit will crack. That’s why I spent a little extra and bought the April expiration today, which falls about a month after my self-imposed deadline for doubling my stake in a year.

If the market cracks and fear returns (or even just a wee bit more worry), I should make my goal. If it doesn’t, I will just have to accept that I tried and failed.

In Trading Candidates on

8 February 2011 with 1 comment

With the stock market seemingly in a permanent melt-up phase, surely it couldn’t hurt to make a bullish options play on Walt Disney, which reports fourth quarter earning after the bell tonight, right?

With the stock market seemingly in a permanent melt-up phase, surely it couldn’t hurt to make a bullish options play on Walt Disney, which reports fourth quarter earning after the bell tonight, right?

Well, I for one just don’t see any edge in it, so I have decided to sit on the sidelines and just watch what happens with this one.

Look at the fantastic run-up DIS shares have had in the last week:

I’m always very leery of jumping on board a stock that is pushing the upper end of its trend channel. And on the other hand, I’m not really a bear when it comes to this stock, and I’m not in the mood to stand in front of more runaway trains like I did with Baidu last week.

So for the time being, I’ll be on the sidelines until I find something where I really think I might have an edge. And when I do, you’ll be the first to find out!

In Trades on

1 February 2011 with no comments

So there is rioting in the streets in Northern Africa, and the US market is soaring back to its post-crash highs,

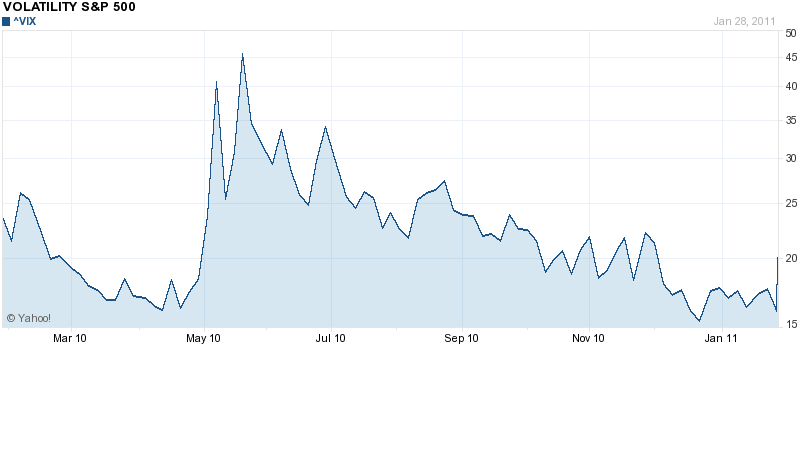

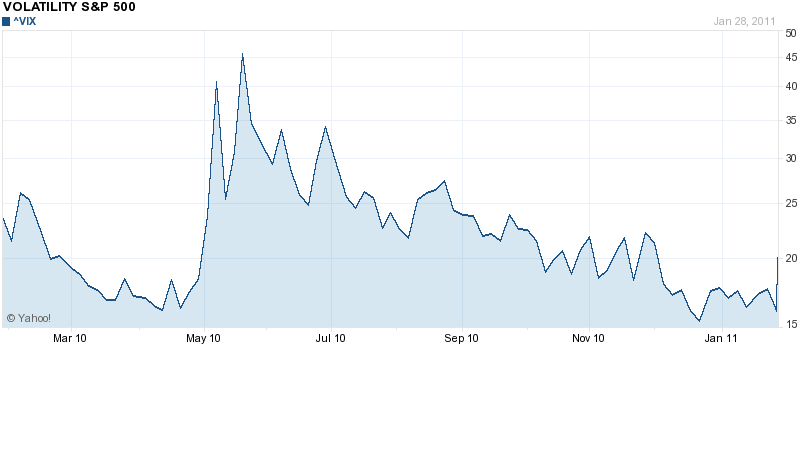

and volatility is again shrinking, with the VIX back down to 17.50 today:

This is a good opportunity to bet that something — don’t ask me what — will be brewing to spike that VIX number before March 18th, the one year anniversary of this site, and the time I am supposed to have made a free and clear 100% profit.

So with that in mind, I bought 8 March 22.50 VIX calls today, for $1.20 each. That’s a total bet of less than a grand, which is part of my plan for bailing myself out of the BZQ trade.

My goal is to get BZQ back up to 18, at which point it is only about a $2,000 loss, with a concomitant spike in volatility making these calls profitable. As always, we shall see if this actually happens!

In Trade deconstruction on

1 February 2011 with 1 comment

I should know better by this time than to try and short emerging markets.

First exhibit: my ongoing debacle of a trade in BZQ (double short Brazil), bought last September for over $20, and currently sitting at about $16 on a good day. Many, many headaches has this trade given me.

And now on to the second exhibit: last night’s bearish gamble on the Baidu earnings report, whereby after they beat impressively, turns into this morning’s upside riot:

There is, however, a crucial difference between the two trades. BIDU was done through options, specifically a put spread which absolutely limits my losses to no more than $725 of precious capital.

This year I am getting more and more enamored with the potential uses of options. For one thing, it tempers my natural distructive tendency to hang on to losers, a la BZQ.

Options aren’t without their own second-guessing, though. I sure am glad I didn’t go with the weeklies for the BIDU trade, giving myself at least a little time to recover. However, I’d really like to try to peg upcoming option trades to the March expiration date, which exactly co-incides with the one-year anniversary of this site, and my self imposed deadline for doubling my capital in that year.

In Trades on

31 January 2011 with no comments

Following up on yesterday’s post, I just put on a modest $725 put spread on Baidu, which announces Q4 earnings after the bell today.

Following up on yesterday’s post, I just put on a modest $725 put spread on Baidu, which announces Q4 earnings after the bell today.

I am envisioning this as a quicky up or down trade on the Chinese internet search company.

I elected to go with the $105-$100 spread, which was executed as follows:

Purchased 5 BIDU Feb $105 puts for $3.55 each.

Sold 5 BIDU Feb $100 puts for $1.90 each.

The underlying stock was trading at about $108.36 at the time I pulled the trigger.

In Market preview on

30 January 2011 with no comments

I have been on a bit of a roll here trading options in January (go ahead and say it– I’ve been lucky), and late last week I had a horrible, wonderful, awful idea — I was going to short the VIX by buying puts on it.

I certainly didn’t go to bed Thursday thinking about Egypt, and I doubt very many other traders did either. I just felt that in order to get and keep my account above a 100% profit level by my one-year anniversary on March 19th, it might be a profitable play.

But real life — in the form of my full time job as a bankruptcy attorney interfered, and I wasn’t able to put a trade on. Then, voila! we woke up Friday to Egypt news, and it made for a missed opportunity. Look how much the VIX spiked Friday:

Catching that obviously would have been a nice addition to the till, but with over $3200 in booked profits already this month, I won’t complaint too much.

Instead its on to the next opportunity — a chance to play the BIDU earnings announcement on Monday. I’m planning on a bearish move:

and given my recent luck, will probably be using options to again to either capture a down move or limnit losses. Stay tuned on Monday!

In Trades on

27 January 2011 with no comments

The news that A T & T issued disappointing guidance sent it gapping lower at the open this morning.

I didn’t waste any time closing out my put spread for a quick $900 profit. Woulda, coulda, shoulda: I might have done better with a Febraury $29-$28 put spread on Telephone. But I’m not complaining.

In Followup on

27 January 2011 with no comments

Picking stocks off the bottom of the 52-week low list can be fraught with dangers. Like your hidden jewel declaring bankruptcy and its common stock becoming worthless.

Book and record store Borders (check that, e-book and music store), mentioned here a couple of weeks ago, is one of those where the B-word has been swirling around the rumor mill lately. So, lest you take it as a blog “pick,” which it is not, instead of just an interesting idea, in my best lawyerly language, you are hereby warned!

In Trades on

26 January 2011 with no comments

Fresh from last week’s options score with AAPL, I decided to put a little bet in the AT&T earnings announcement, before the bell tomorrow morning.

With the endless drift-up of the market as a whole, it might be a little crazy, but this is a bearish bet, the T February 28-27 put spread. T closed at $28.73 today, after the Fed-meeting madness was over. I am paying $130 for each spread, and I’m in for 5 contracts each way, so I’m risking $630 of last weeks gains if Telephone keeps heading North.

BOttom line is I don’t think AT&T is going to be a big winner in a world where I-Phone users have freedom of choice, and this trade is a bet that many will be disappointed in tomorrow’s guidance.

But beware the ever persistent drift-up!

In Market Recap on

19 January 2011 with no comments

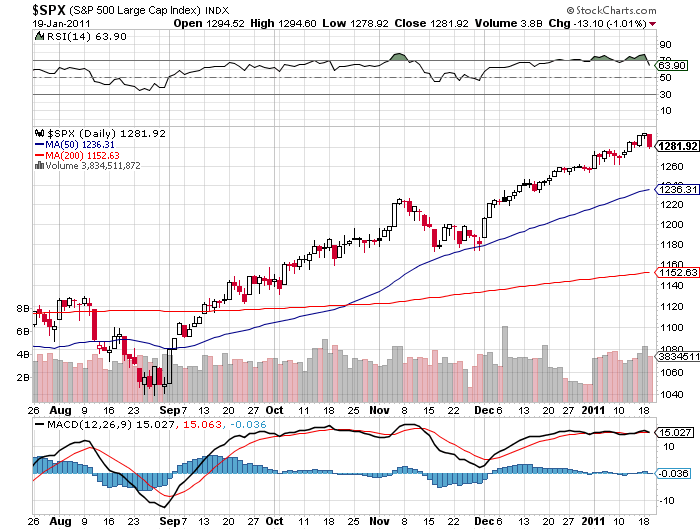

Believe it or not, today was the first day

since November 30th

where the market has dropped 1.0% or more. Quite an impressive run.

Well, I didn’t exactly double a short position, technically put another $1000 into VIX calls.

Well, I didn’t exactly double a short position, technically put another $1000 into VIX calls.