Poorly executed VIX trade stills pays off

I put some more money in the bank this morning at June VIX expiration, but I can’t say it was a very good trade.

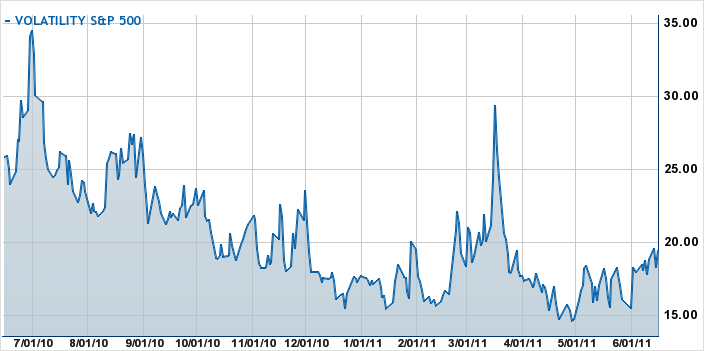

To recap, waaaaay back in mid-April I put on a call spread on VIX options that cost me about $2,300. This was a 15-20 spread, meaning the best payoff was if the VIX touched 20 or went higher. Amazing (to me, anyway), but that never happened in the last two months:

Any way, I took the spread off in stages, allowing the short portion to expire this morning. Even that wasn’t without a bit of a scare, as the overnight plunge in the markets pushed the VIX settlement figure to 19.73 — and I was now short VIX at 20 and 21!

But I survived, and managed to put a little more than $500 in profits into my account from the main trade — not, however, what I consider a success for a trade that took two months to pan out.

So its back to the drawing board, and time to reevaluate the markets for summer trading. If I come up with any ideas, I’ll let you know!

1 Comment