In Market Recap, Trades on

5 April 2011 with no comments

If you thought trading yesterday was a snore, hope you really got jacked up by the market action today:

If you thought trading yesterday was a snore, hope you really got jacked up by the market action today:

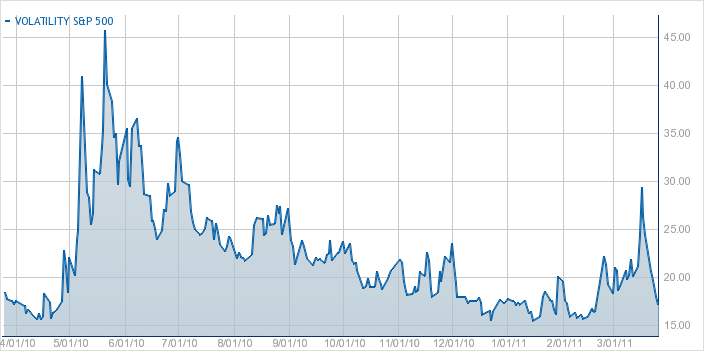

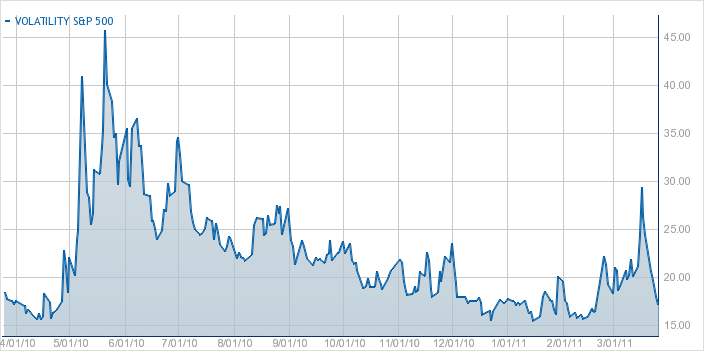

Well, this has to be the ultimate definition of lack of volatility, so the VIX did fall to about 16.69 at noontime, so I took advantage and “tightened up” my May VIX call spread, selling the 22.5 calls and replacing them with the 20.0 version.

Now that you’ve got the market news, back to bed!

In Market Recap on

4 April 2011 with no comments

Today was my candidate for the most boring day for the stock market I can remember.

Boring days are best put to use making plans for the future.

About the worst thing you could do is to start day-trading out of boredom.

In Pure speculation! on

4 April 2011 with no comments

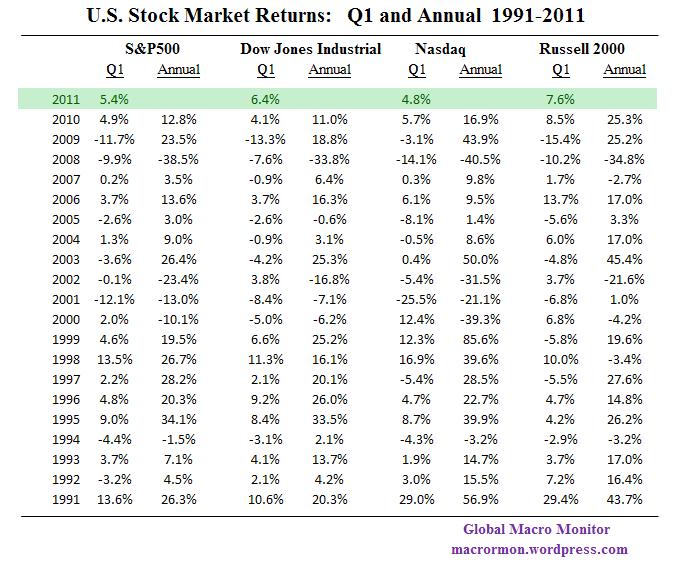

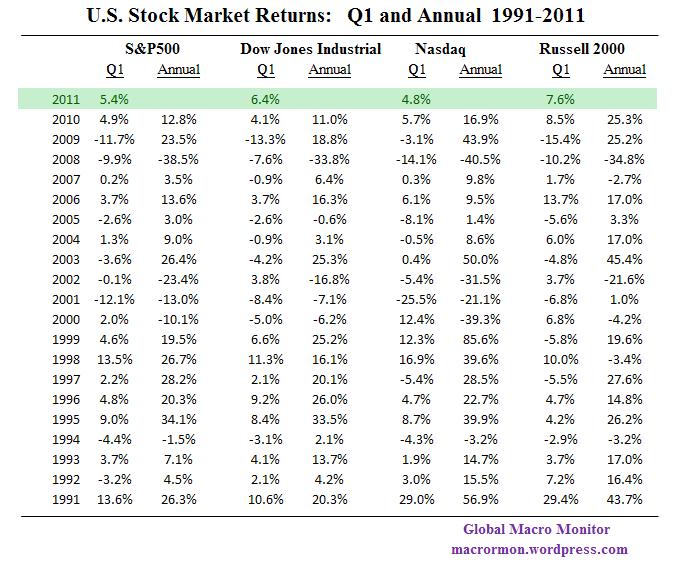

The Standard and Poor’s 500 index rose about 5.4% in the first quarter, a good sign for the whole year if you are a follower of recent trends.

As the Global Macro Monitor site astutely points out, only once in the past twenty years has the market declined for the year after the S&P rose in Q1.

The offender was the year 2000, starting the millenium off with an optimistic 2% pop, only to finish out the year with a 10% setback.

Full stats from GMM:

In Market preview on

3 April 2011 with no comments

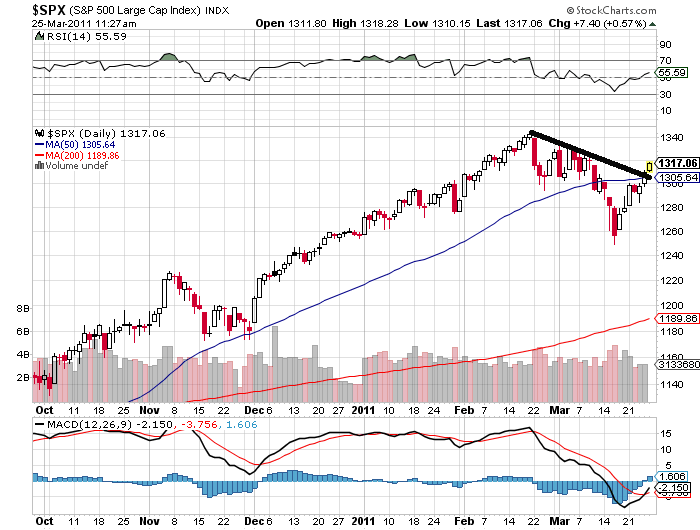

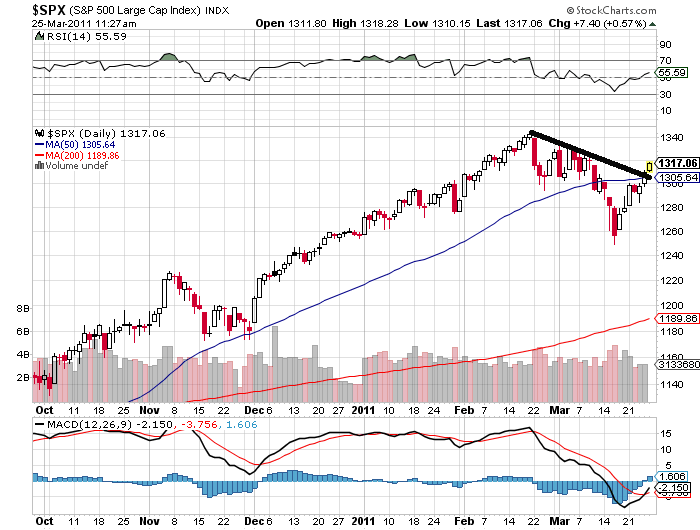

In the upcoming stock market week, all eyes will be on whether the bulls can power prices through the year’s previous top at S&P 500 1343:

Failure to do this might result in the dreaded double top, one of technical analysis’ most ominous signs. Of course reading charts to predict the course of the entire North American stock market, rather than individual issues, is a notoriously rocky undertaking.

But, as we enter the final countdown to the April earnings season, which gets underway in earnest next week, the battle between a new top and a double top will be on center stage.

My positioning is for a burst of chaos (via a call spread on VIX options), so I’ll be rooting for anything except a slow grind higher!

In Trades on

1 April 2011 with no comments

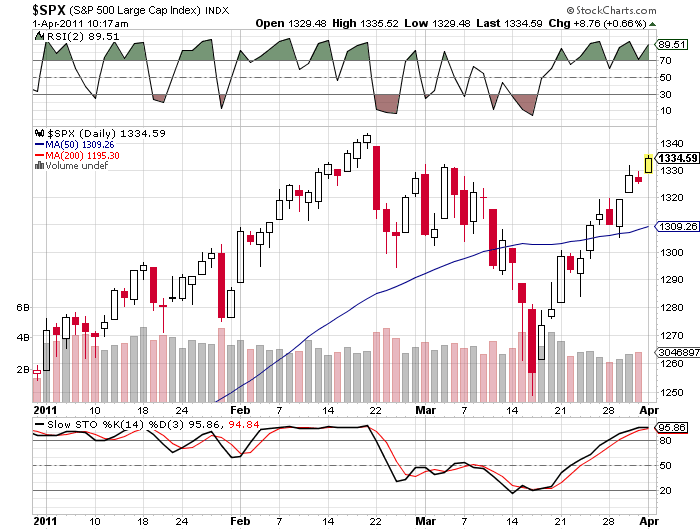

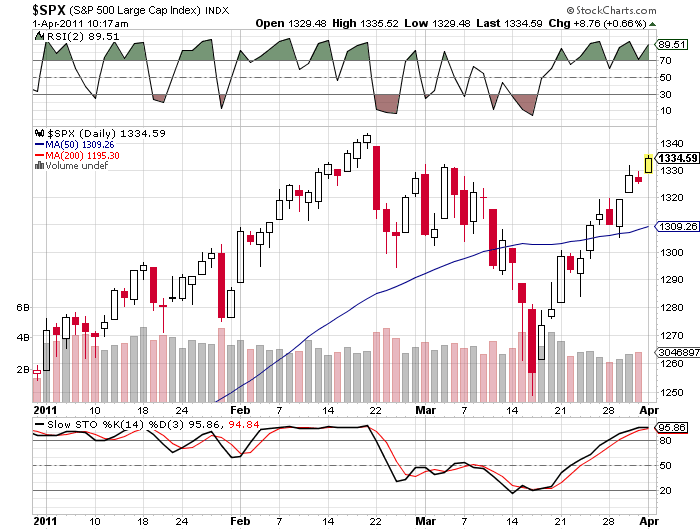

Everything is going so well in the stock market, that new highs for the year are even in sight:

When the calm peaceful feeling sets in, I like to bet that it wont last forever. And so I did, stepping out with a larger VIX options trade this time. This morning, with the VIX at 16.74:

I fired up another VIX options call spread, this time with a May expiration. Bought 10 VIX 17 calls for $3.70 each, and to defray the cost, sold 10 May VIX 22.50 calls against them for $1.55 each. The net outlay is $2,150.00, and I have until May 17th to see the VIX rise to 22 1/2 or more.

In Market Recap on

1 April 2011 with no comments

The first quarter of 2011 is now history, and it was one of the best three month periods in recent history for the stock market, with the S & P 500 posting a 5.4% gain:

It was an even better quarter for my trading account. Right after the start of the year, I started moving into option trades, eventually gravitating towards trading VIX options, where I am essentially betting on volatility (or the lack thereof) directly.

The tweak in strategy has proven useful, as my account gained 25.3% for the Q1 (but not accounting for commissions).

There is, of course, no guarantee that this torrid pace can continue, but I’m looking forward to the next few months. With the April earnings season cranking up in a couple of weeks, I’ll probably be able to smoke out some non-VIX, straight equity plays as well.

Remember, all my trades are shared with you here, nearly in real time, and you are never inundated with advertising when you visit this site.

In Food for thought on

28 March 2011 with no comments

Stock blogger Ivan Hoff has an interesting idea — that the task of chart readers in the stock market is analogous to chicken sexers on a farm. For those not up to speed, the art (or science?) of chicken sexing is to identify female chicks at birth, improving egg yields by not wasting time and effort raising males.

Stock blogger Ivan Hoff has an interesting idea — that the task of chart readers in the stock market is analogous to chicken sexers on a farm. For those not up to speed, the art (or science?) of chicken sexing is to identify female chicks at birth, improving egg yields by not wasting time and effort raising males.

Hoff thinks that “the best technical analysis experts are the modern chicks sexers. By looking at millions of charts at different time frames, they have attained the skill to recognize great technical setups from not so great ones. Their eyes see what most don’t and often they can’t even explain why they like certain chart. They just do, based on experience.”

Implicit in this idea is that success a chart reading requires exposure to thousands of charts over a long period of time — not something that can be learned in its entirety through a weekend day-trading correspondence course.

And just how long is that, a beginner might ask? The answer, of course, is “it depends,” but count on it being longer than the typical small account holder can stay solvent for. Tuition is high indeed, in the stock trading game!

In Trades on

25 March 2011 with no comments

The S&P 500 broke through the recent down trend line this morning, surprising many, including moi, who thought it had reached an overbought resistance point:

So is this a breakout or a fakeout? While only time, and the price action, will tell for sure, I took the opportunity to put on a small VIX option trade. The VIX fell to 17.26:

My trade is a call spread, meaning bullish on the VIX, which is generally bearish on the markets. We are rooting for chaos, in other words. Or, in this case, just a modest amount of confusion.

I purchased 5 VIX April 18 calls for $2.28 each. Against that I sold 5 VIX April 22.50 calls for $1.00 each. My total outlay is $640.00, as this is really just a modest lean.

After doing a few of these trades, I have come to discover I’m probably better off sticking to close-to-the-money strike prices, rather than shoot for the moon (and a massive spike on the VIX). Part of the consideration, too, is that April expiration comes up fast, and the VIX options expire even earlier, with April 12th being the last day to trade.

In Just for fun on

23 March 2011 with no comments

I haven’t yet read the book “Future Babble” by Canadian journalist Dan Gardner, but the review by Jesse Singal in the Boston Globe is intriguing, and it looks like it might shoot to the top of my reading list.

I haven’t yet read the book “Future Babble” by Canadian journalist Dan Gardner, but the review by Jesse Singal in the Boston Globe is intriguing, and it looks like it might shoot to the top of my reading list.

Gardner’s thesis is that humans make lousy prediction machines, at least when matched up with the complexity of the cosmos, although our collective vanity repeatedly leads us to seek out, or to become, sooth-sayers.

Stock market followers have heard this for years, mostly from the random-walk academic crowd. And pretty much it hasn’t stopped them (or me) from trying to peek around the corner of time and have a look-see.

Or, as Singal puts it:”Evolution has given us brains that desperately seek control over our surroundings. Therefore, they abhor a foggy future and yearn for a predictable one. This need for a sense of control is so profound that it can be the difference between life and death — in one “unsettling’’ experiment cited by Gardner, nursing-home residents were twice as likely to die over a given period if they were not given any decisions to make — that is, control over — regarding basic aspects of their environment such as furniture and plant placement.”

The remedy, according to Gardner, is the human emotion most difficult to scarf up when you need it: humility. He says if we can accept that the future is unknown and precise prediction impossible, we can work to make plans that are adaptable to a wide range of potential outcomes (nobody knows for sure how severe climate change will be, but weaning ourselves off of oil is a good idea regardless of what the future holds).

“This may not be as thrilling as believing we possess a map to the future and setting out boldly for some distant El Dorado,’’ writes Gardner, “but it is considerably less likely to end in a collision between one’s nose and reality.’’

Sure sounds like a though provoking read for any speculator. I just might try to pick up a copy, after, of course, putting on a couple of trades where I “know” I have the edge!

In Trading Candidates on

21 March 2011 with no comments

Back around New Year’s, I put up the suggestion that if I was going to pick one stock for long – term capital appreciation it would be the much beleagured Citigroup:

Now by long-term, I’m talking ten years or more: daytraders beware! But over a decade, C might be a true “ten-bagger,” going up 1000%.

Of course, if you want a cheap price rise, you’ll get it much quicker: Citi announced plans for a reverse 1 for 10 stock split, which will float the nominal value up in to the mid $40’s. And to boot, they will soon pay a one-cent dividend — on the inflated shares! Kind of like getting 1/10th of a cent today.

Nevertheless, if you look at the beat-down they have suffered this year, the present level represents a good buying point for the long term investor.

If you thought trading yesterday was a snore, hope you really got jacked up by the market action today:

If you thought trading yesterday was a snore, hope you really got jacked up by the market action today: