In Market Recap on

16 June 2011 with no comments

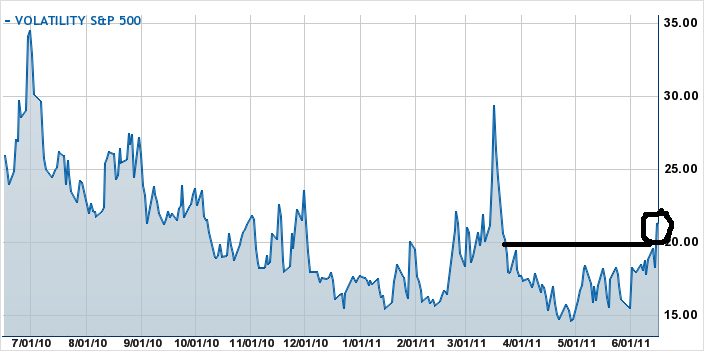

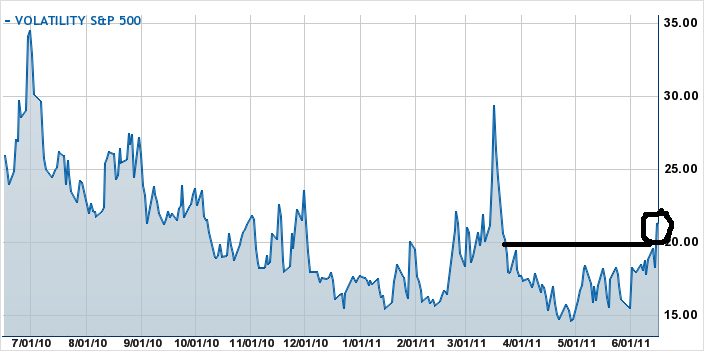

It certainly did not go unnoticed here that just a few hours after the June VIX expiration, VIX finally popped above 20:

Now, the call spread I put on back in April just needed VIX to hit 20 once before June 15th to really pay off. Of course, the index only hit that level right after it was any use to me. On all other days for the past two months, VIX camped out below 20 — sometimes well below it.

Trading is like that — it often seems that markets are on a devilish mission to squish you in the most outlandish way conceivable. Luckily, I’ve been at it long enough to be relatively immune to the psychological torture aspect. Maybe not completely immune, but immune enough to get by in head-shaking mode rather than wall-punching mode!

In Trade deconstruction on

15 June 2011 with 1 comment

I put some more money in the bank this morning at June VIX expiration, but I can’t say it was a very good trade.

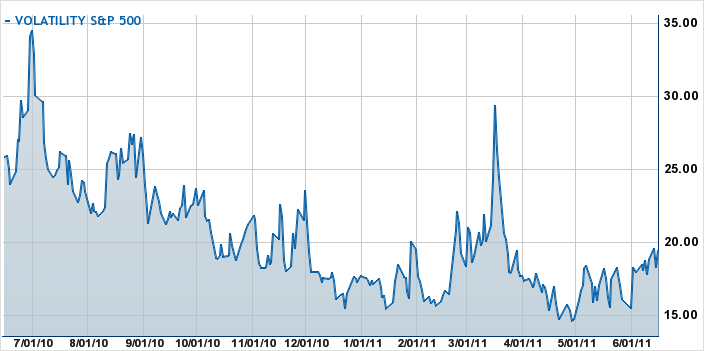

To recap, waaaaay back in mid-April I put on a call spread on VIX options that cost me about $2,300. This was a 15-20 spread, meaning the best payoff was if the VIX touched 20 or went higher. Amazing (to me, anyway), but that never happened in the last two months:

Any way, I took the spread off in stages, allowing the short portion to expire this morning. Even that wasn’t without a bit of a scare, as the overnight plunge in the markets pushed the VIX settlement figure to 19.73 — and I was now short VIX at 20 and 21!

But I survived, and managed to put a little more than $500 in profits into my account from the main trade — not, however, what I consider a success for a trade that took two months to pan out.

So its back to the drawing board, and time to reevaluate the markets for summer trading. If I come up with any ideas, I’ll let you know!

In Uncategorized on

13 June 2011 with no comments

I sold off half — the long half — of my VIX options position a little after noon today (and then watched VIX run briefly to 20, of course). While this will go down a loss for now in the trading log, I’m expecting VIX to moderate, and the expiration of the short side of this trade should produce a small profit.

I sold off half — the long half — of my VIX options position a little after noon today (and then watched VIX run briefly to 20, of course). While this will go down a loss for now in the trading log, I’m expecting VIX to moderate, and the expiration of the short side of this trade should produce a small profit.

This position was purchased way back on April 15th! — guess I’m not much of a short-term trader anymore, eh?

To try to goose the profits a bit, I also sold 10 VIX June 21 call contracts today — with expiration set for Wednesday, so I am really betting on the VIX to settle down by Wednesday morning!

In Trading Candidates on

13 June 2011 with no comments

What’s one burger joint to another? Technically, beleaguered Arby’s is a roast beef place, but that apparently wasn’t enough to keep it off the block.

What’s one burger joint to another? Technically, beleaguered Arby’s is a roast beef place, but that apparently wasn’t enough to keep it off the block.

Just a few years ago investor nelson Peltz controlled Arby’s, and used that chain as a platform to acquire the larger Wendy’s. The deal was finalized in October, 2008 — poor timing for the combined firm’s stock price. Over the last three years it has rarely traded above $6, and usually under $5.

So now Wendy’s has succeeded in shedding Arby’s — selling the beef chain to another private investor, the Roark Capital Group.

The stock got a nice pop on the news this morning, but I don’t see much upside in Wendy’s as a long term investment — with or without Arby’s.

In Market Recap on

7 June 2011 with no comments

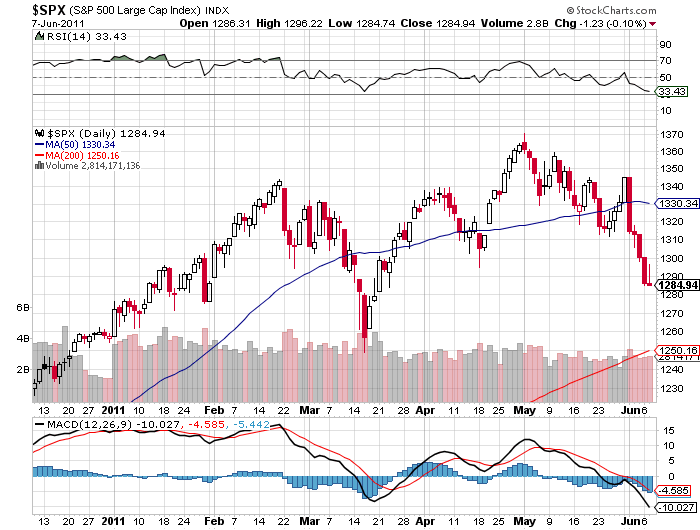

The markets held on to moderate gains for most of the day today, until it was clear that Big Ben had no fairy dust to distribute this time, and that the American economy really is in the crapper. Then it was right back to yesterday’s lows:

The markets held on to moderate gains for most of the day today, until it was clear that Big Ben had no fairy dust to distribute this time, and that the American economy really is in the crapper. Then it was right back to yesterday’s lows:

VIX fell to 18.07, though, and was trading in the 17’s for most of the day.

Are we set to resume plunging tomorrow? Only time will tell, but remember my prophecy that the 200 day moving average will be touched this summer — it’s now only just 34 points away:

In Market Recap, Uncategorized on

6 June 2011 with no comments

Don’t look now, but after today’s session, most of the 2011 gains have been wiped out:

The S & P 500 is now up only about 2.2%.

The VIX closed today at 18.46. I still would dearly love to see it pop above 20, if only for a few minutes!

In Market Recap on

1 June 2011 with no comments

If you were looking for the typical first day of the new month bump up in the markets, you sure didn’t find it today! Summer trading started off with a winter-like wipe-out that extended straight from bell to bell.

If you were looking for the typical first day of the new month bump up in the markets, you sure didn’t find it today! Summer trading started off with a winter-like wipe-out that extended straight from bell to bell.

Today is a good example of why confirmation is important, as yesterday’s close above the important 1340 level turned out to be a big fake-out.

The head-scratching is likely to continue — Friday morning brings the jobs report. Could be a long summer this year!

In Uncategorized on

31 May 2011 with no comments

I had previously marked 1340 on the S & P 500 as an important level, and although the market gapped higher in the first half hour, it quickly retreated to below that level for most of the day:

The last half-hour into the close, however proved very strong, and we did have a close above the critical 1340 level.

It will be very interesting to see if the bulls follow through tomorrow!

Since it is the end of May trading, everyone is focused on year-to-date results. So here is my comparison, for what it’s worth, 151 days and 5/12ths of the way through 2011:

Standard and Poors 500: + 6.9%

Cape Cod Doug: + 22.5%

Let’s hope summer trading is merciful to me!

In Market Recap on

27 May 2011 with no comments

You may have the urge to “sell in May, and go away,” and so may I, but the market is doing surprisingly well regardless:

Of course, I won’t be convinced until we see a close and hold above 1340, but that now looks like a project for next week.

In the meantime, I hope you have a good Memorial Day weekend. Here, this weekend is the start of an intense gardening season, and I’ll be spending it getting my hands dirty!

In Food for thought on

26 May 2011 with 3 comments

Yesterday, I suggested that traders would be better off waiting to see if the market clears S & P 1335, before loading up on bullish positions. Here’s a slightly different chart, where the line in the sand looks like it should be drawn at 1340:

I’m not sure there is all that much difference between the two, and I’m not going to obsess about it. But if we don’t see this level reached, or at least approached, with the end of the month / start of June jumper expected, then its a good sign the market won’t be feeling well this summer.