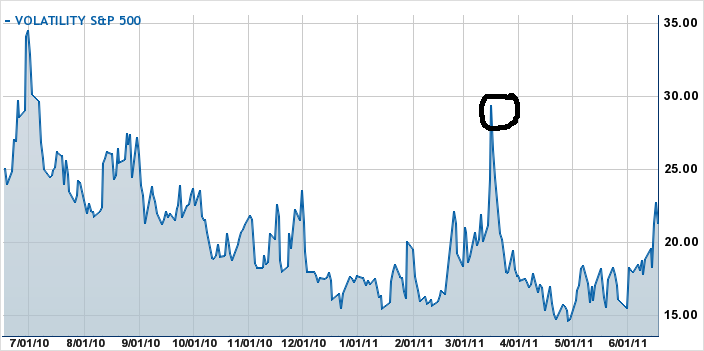

VIX is once again under 20

With the markets popping today:

the VIX is right where I like it — back under 20 again!

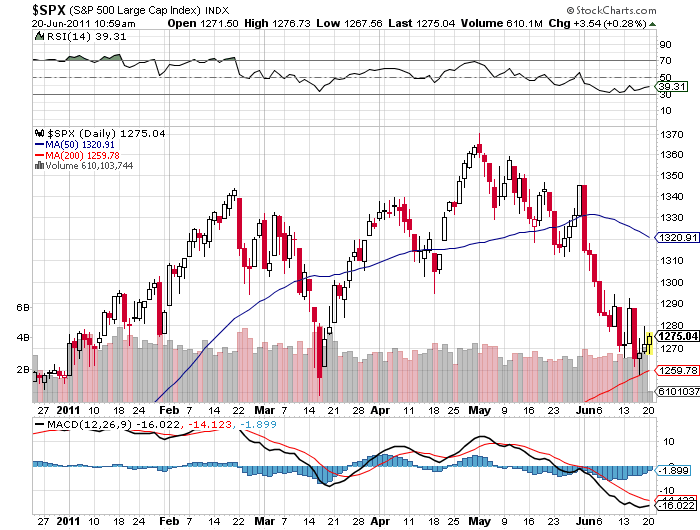

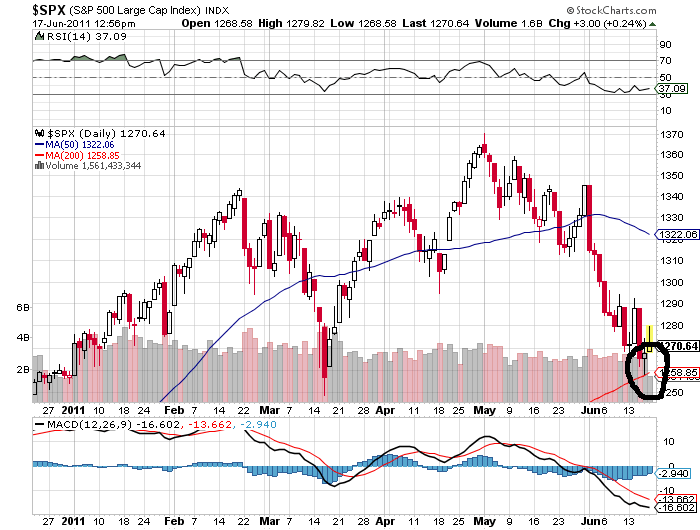

It will be interesting to see if the S&P can crack through the overhead resistance at 1300, and if so, how easy it is to do it.

With the markets popping today:

the VIX is right where I like it — back under 20 again!

It will be interesting to see if the S&P can crack through the overhead resistance at 1300, and if so, how easy it is to do it.

If the market is going to climb the wall of worry, I figure lots of people will need stuff to worry about. Therefore, as a public service, I offer to you Brett Jensen’s “10 reasons to Worry about the second half of 2011” from the Seeking Alpha site.

If the market is going to climb the wall of worry, I figure lots of people will need stuff to worry about. Therefore, as a public service, I offer to you Brett Jensen’s “10 reasons to Worry about the second half of 2011” from the Seeking Alpha site.

My favorite: the chance for an accelerated sell-off if the market cracks its 200 day moving average (currently around 1263 on the S&P 500).

Worry on!

It’s nice to take some longer-term perspective every once in a while (or maybe all the time)!:

With that in mind, there is one level I will be watching this week — 1258, where the S&P 500 closed on New Year’s Eve. I want to see if we “go red” by the half-way point or not.

As for the odds, I would peg it at about 65%-35% that we are still in the green at the end of June.

The last bar on this weekly chart just about sums it up:

Or does it? While the markets barely moved on a weekly basis once again, there sure was a lot of action for the action junkies this week. A nice big fake-out to the upside on Tuesday, and then more or less a continual slide (except for Thursday afternoon) after the fed meeting-cum-news conference.

I find paying attention week-by-week instead of incessantly and obsessively tracking every tick to be beneficial. It helps you get right to the heart of the market; we haven’t really moved much at all for three straight weeks.

The market’s getting a little more worried though; VIX drifted up over 21 again today and closed the week at 21.10.

Enjoy the weekend!

Is stock market blogging slowing to a crawl? Or am I just imagining things (again)?

Is stock market blogging slowing to a crawl? Or am I just imagining things (again)?

Seems like some of my favorite bloggers are awful tardy lately. The once high-flying Market Speculator hasn’t posted since March.

And the trader that I probably would most like to emulate (if we weren’t supposed to “find our own style” and all that), Chicago Sean, has not only slowed his output, but in true blogger style, has written a blog post on slowing his output.

I wonder what, if anything, this means?

This trade is taking an eternity to pan out, but can’t help noticing the developing inverse head-and-shoulders in BZQ, the ultra-short Brazil fund:

But again, it seems like an eternity, and you never know for sure if these patterns will in fact be confirmed.

The 200 day moving average for the S&P 500 index is now perched at 1259 — just a point higher than where we closed out 2010, at 1258.

The 200 day moving average for the S&P 500 index is now perched at 1259 — just a point higher than where we closed out 2010, at 1258.

Look for convergence in this area before we move dramatically higher or lower — and it might be quite a battle, especially with the March lows for 2011 being set at 1250.

At this writing, the VIX is still over 21, so option premiums are relatively high.

Quadruple witching day for June 2011 brought the S & P 500 right to 1271, which was exactly where it closed last Friday too. In between, a big Tuesday, a super slamdown Wednesday, a touch of the 200 day moving averages Thursday (and a temporary erasure of the year’s gains), but the fact remains that it was a nothing week on Wall Street — you could have slept through it and it would have been just like it never happened . . .

Quadruple witching day for June 2011 brought the S & P 500 right to 1271, which was exactly where it closed last Friday too. In between, a big Tuesday, a super slamdown Wednesday, a touch of the 200 day moving averages Thursday (and a temporary erasure of the year’s gains), but the fact remains that it was a nothing week on Wall Street — you could have slept through it and it would have been just like it never happened . . .

VIX closed the week at a somewhat elevated 21.85.

I take my lumps in public here, so its not red-boarding to point out the sucessful predictions (guesses?) when they actually do occur!

Thursday we briefly touched to 200 day moving average on the S & P 500, fulfilling my prophecy of May 25th that it would in fact be hit this summer.

In May the 200 MA was at about 1240; yesterday’s kiss was at 1258. If the market lurches sideways this summer, we could have many such crossings in the months to come!

The term summer trading can mean almost anything to anybody — including the “sell in May and go away” notion that you shouldn’t be doing it. (Head to the Hamptons, instead!).

The term summer trading can mean almost anything to anybody — including the “sell in May and go away” notion that you shouldn’t be doing it. (Head to the Hamptons, instead!).

What I’m looking for is essentially a minimalist approach to summer trading — something that will let me and my kids do our things, without tying the trader to a screen all day unless you want to be there, something that can be followed on the road with a minimum amount of checking up, but still something with a shot at increasing profitability and boosting my performance numbers. Hey, wouldn’t everyone like that?!

What I hit on was a single trade that I entered Thursday morning. I sold 10 VIX July 25 calls for $1.55 each. These expire on July 20th. The trade is essentially a bet that the VIX will be relatively calm, and settle under 25 on 7/20. If so, I bank $1,550 (less commissions). If not, I potentially lose money.

Simple, eh? And buy the way, if it works out I would re-evaluate on expiration with an eye towards putting on the same trade in August. And there you have my summer trading; at most two trades.

VIX has been creeping up lately, but I think (and therefore have bet) that Armageddon is not due in July, and the VIX will gradually settle down. The only VIX option settlement figure so far this year was in March, at the time of the big, but temporary spike:

The March settlement figure was 25.14. Wouldn’t like to see a repeat of that, but that is essentially the risk I’m willing to live with as we play poolside.

Since the July VIX options trade won’t be completed until next month, you can essentially calculate my return for the first half of 2011 now: so far I’ve made 27.3%. For comparison, as I write this, the S & P 500 is up only 1.4%.

© 2010; Counting with Doug:. Powered by WordPress using the DePo Skinny Theme.