In Pure speculation! on

15 March 2010 with no comments

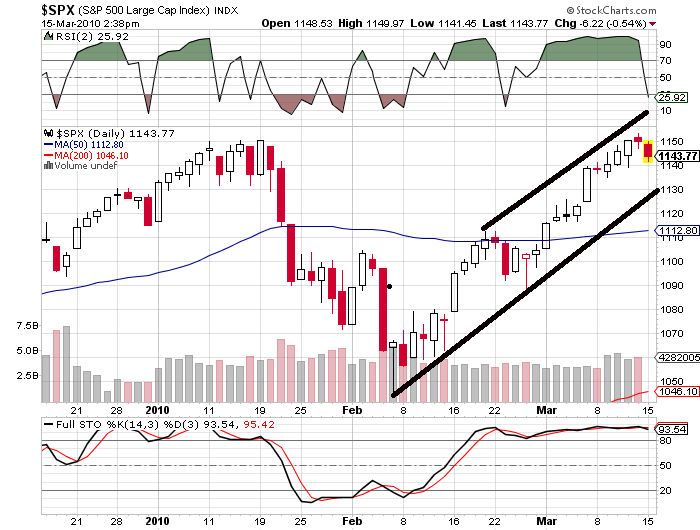

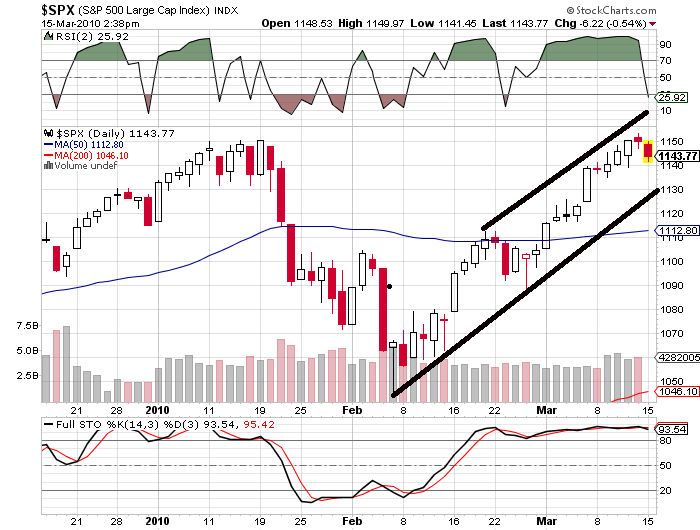

Since February 5th the market has obviously enjoyed a ripping rally, tempered only today by a small pre-Fed retreat. What would it take to declare this rally done for?

I’ll offer my best guess, based on the lower trend line drawn above: Somewhere under 1130 on the S&P 500, or another 13 points or so as of this writing.

In Trading Candidates on

15 March 2010 with 1 comment

Super Value (SVU) jumped up to match and briefly exceed its October highs Friday on rumor and speculation that of a possible leveraged buyout (remember those) in the works. I wouldn’t buy this one now at such heights, and I sure don’t wan’t to be around when the rumor goes POOF! A retreat to the low 16’s however, might get me intersted, with a tight stop not too far below that.

In Trading Candidates on

14 March 2010 with no comments

Not a current long, as the RSI(2) is overbought at 91.59, but on the watchlist, especially looking for a dip near the 50 day moving average, about $11.74.

In Market Recap on

13 March 2010 with no comments

Well, at least the S & P 500 is. With everyone watching the 1150 level, the market closes for the week at, ahem, 1149.99:

The overbought RSI(2) has me generally bearish, but it has stayed that way for what feels like weeks now. As a matter of fact it has been two full weeks, plus a trading day. A key tell to watch for next week is bullishness among the pundit class (which I guess I have joined). I can smell a reversal, but have no idea when. Have a good weekend!

In Links on

13 March 2010 with no comments

Five links for your weekend reading:

*Surprise! Retail sales surge in February (Boston Globe)

*A squeezed short ruminates on what he has learned from the market lately (Slope of Hope)

*Good idea? Trading with a buddy (Don Miller)

* Polly wants a lawyer? (BT)

*Book review: Scott Patterson gets inside the Quants heads. (Reading the Markets)

In Trading Candidates on

12 March 2010 with 4 comments

As the turmoil in the fertilizer business plays itself out concerning over who is going to buy who, traders placed big bets on Potash today. It just barely managed a YTD closing high, and pulled back to slightly below the January intraday high. I will be watching to see if a cup-with handle forms. Lets keep it on the radar.

In Trading Candidates on

12 March 2010 with no comments

Lately, it’s been Brazil that’s been acting almost as a proxy for the market as a whole. Take a look at ProShares double-short Brazil ETF:

I would consider buying this one (i.e. shorting Brazil) on a breakout above the trendline shown ($25), which also right now is the resting point for its 20 and 50 day moving averages.

In Links on

12 March 2010 with no comments

Five interesting trading or business links, up by 5 PM:

* Is Nelson Peltz the real burger king? Wendy’s raider sets his sights on operator of Hardee’s and Carl Jr’s.

* Lessons from a bear (Tim Knight) who didn’t cover his shorts.

* Attention underemployed entrepreneurs: mobile phone “app” makers needed!

* Taking the walk of shame? Bank of America to forbid ATM and debit card overdrafts.

* Forget airline miles or hotel stays. Credit card holders want cash!

In Trading Candidates on

11 March 2010 with 1 comment

If (when) the market finally cracks, I’m going to need some candidates for short sales. Many traders like beating on the much maligned plastic shoe maker, though come to think of it, plastic hoops and flying disks have sold well for decades. At any rate, lets take a look:

CROX has shown some surprising pop (and not too bad technicals, except for the double top) for a stock that gets bashed so much, recovering even after losing its CEO at the end of February. Bears will focus on the double top, while bulls will wonder if a cup-with-handle is in the works. The bears will be freaked if it goes much over 8, so you know it soon will be there, if only for a minute or two. I will play this one short only if it closes solidly below the 50 SMA (in other words, under 7) and have a tight stop ready to buy it back. A more conservative way to go would be to wait and see if bears can bust through 2010 support at $6.75.

In Trading Candidates on

10 March 2010 with no comments

Everybody’s favorite, Apple Computer surged to all time highs this week. Its two day RSI is currently 99.91 (!), untouchable for long purposes for the time being, but another for buy-the-dips watch list.

I’ve never really made trading AAPL my bread and butter, because it is a “newsy” issue where rumors continually fill the wire services and play havoc with technical setups that otherwise would be expected to be fruitful.

Nevertheless, I am expecting to use it both as a long and a short in the coming year, but probably not right now.

Short minded speculators will be eyeing last Friday’s gap up from the 210 level, reminding themselves of the bromide that “all gaps must fill.” How soon, of course, is the rub!