In Market preview on

22 March 2010 with no comments

The twelfth week of trading in 2010 started off with a first-hour whipsaw, with the S&P’s testing resistance-now-support around 1152, before snapping back into positive territory by 10:30AM EDT.

My open position (short oil) did just the opposite, naturally, flirting with a nice profit before giving up most of the gains.

This week finds the New York-Washington corridor buzzing about the House of Representatives vote approving the Senate version of health insurance overhaul. Much of this news appears to have been baked in to prices, but it may pay to keep your eyes close to your screens today, as the day after an important expiration date can play tricky.

I am going to be babysitting my SCO position for today, I might have time to put some links up later. Make it a good day!

In Trades on

19 March 2010 with no comments

I never expected to open trading on this swing trading blog with a position on a commodity like crude oil, but after holding off for a month with my self-imposed start date, I couldn’t resist.

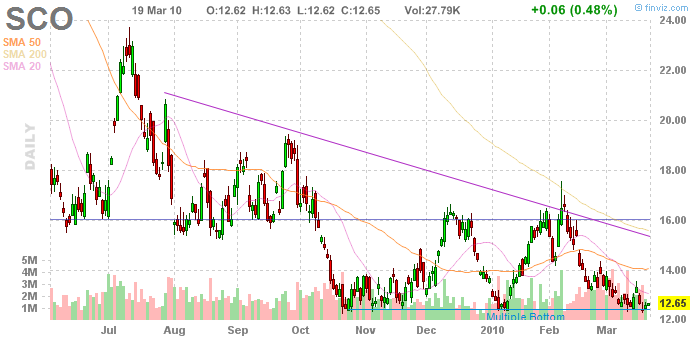

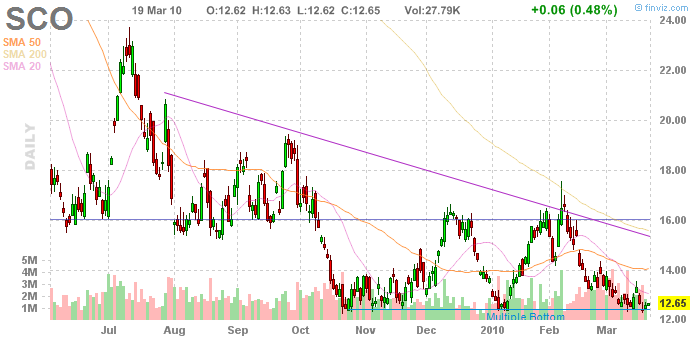

So I purchased 1000 shares of SCO — ProShare’s double bearish crude proxy — at $12.65 this morning. Here, I am looking for the triple bottom to hold, and will be out in a flash if it doesn’t. My initial stop will be placed around $12 on a closing basis.

For the potential upside, I’d love to shoot for the 50 day simple moving average close to $14, but first we want to see if we can get to Monday’s intraday high at $13.55.

Its a good feeling to get things underway!

In A start-up venture on

19 March 2010 with 4 comments

The reason that I am formally opening trading on this site on March 19th is not that I have some perverse desire to make things difficult by starting on a quad witching day, but that it is the birthday of my beloved late grandmother, Edith Carlson of Malden, Massachusetts.

She was the one who gave me the trading bug; born in the nineteenth century, she came to America in her twenties and settled just north of Boston. She worked hard every day at not very attractive jobs, but saved her money and was smitten with the stock market. She had a bit of speculator in her, and I hope a bit of it rubbed off.

Many times as a boy I would take the elevated railway trains in to Boston with her on an errand to some broker or bank. It was still the era of ticker tape, and I never forgot the visit to the old brokerage houses where she would jawbone with the brokers while I watched the numbers fly by and tried to learn. I still have one of the old tapes on my desk right now as a keepsake and remindder of those times.

Edith lived to the age of 105, independently until close to her death, and she still tooks trains to the banks in Boston well into her nineties. I loved her and she loved me, so if I have any talent for the market, it is all to her credit.

And that is why I why a fiscal year around here starts on the 19th of March. If Edith is watching I hope she enjoys. And I hope you do too.

In Trading Candidates on

18 March 2010 with 1 comment

Revisiting CROX, where last week I was looking at a possible cup and handle forming, well now it does indeed look like that has come to pass. But I have to wonder, while looking at today’s price action, if eager buyers of yesterday’s breakout are really caught in a massive fake out instead! Time will tell, but so far I’m glad I didn’t jump on board yesterday.

In Links on

18 March 2010 with no comments

Got some links out for you early today, as I’m getting ready to start live trading tomorrow:

* Angular momentum heading up on the SPY (Afraid to Trade)

* Alan Farley thinks YUM! is ready for an upside breakout (HardRightEdge)

* Extended market due for a pullback? (Alchemy of Trading)

* No more of those trips to the video store — Blockbuster considers Chapter 11 (Bankruptcy Topics)

* The balance between being a splurger or a miser (Get Rich Slowly)

In Market Recap on

17 March 2010 with no comments

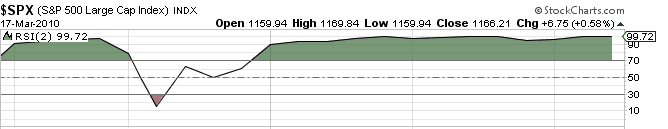

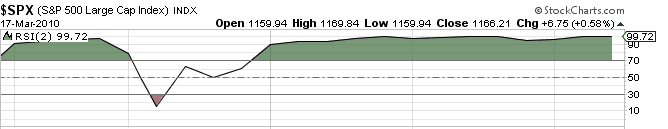

In honor of St. Patrick’s Day, a chart full of green! RSI (2) is green for March, and sits at 99.72.

One of these days, the bears must come out and play!

In Trading Candidates on

17 March 2010 with no comments

Purveyors of my favorite nasal spray, Walgreens hits the list for a potential short trade. Its sitting under most important moving averages, with a shot at the bottom of the trend channel (about $32) if the market breaks. Stop would be on close above $36 or so.

In Market Recap on

17 March 2010 with no comments

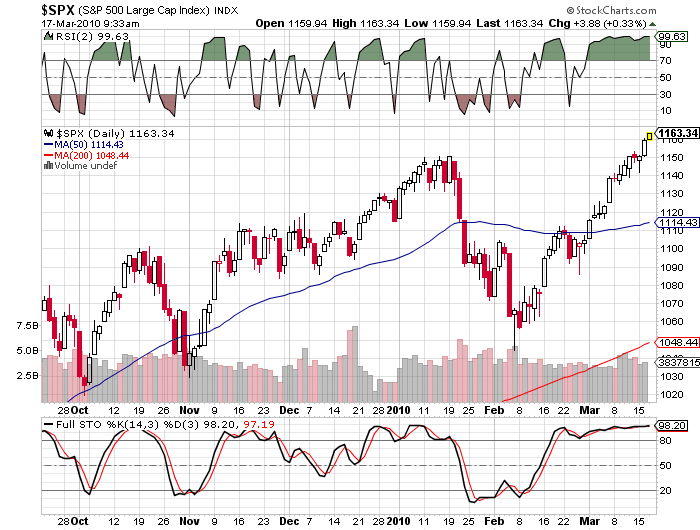

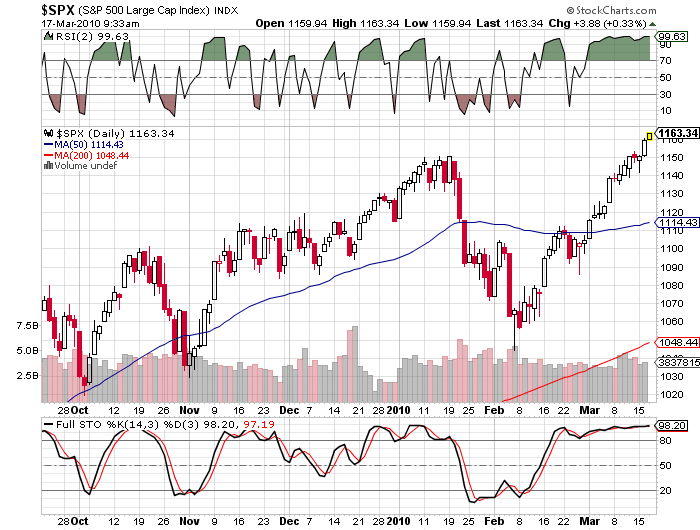

With Fed Day behind us and St. Patrick’s Day upon us, the market just keeps melting up as this blog is almost ready to go to live trading on March 19th.

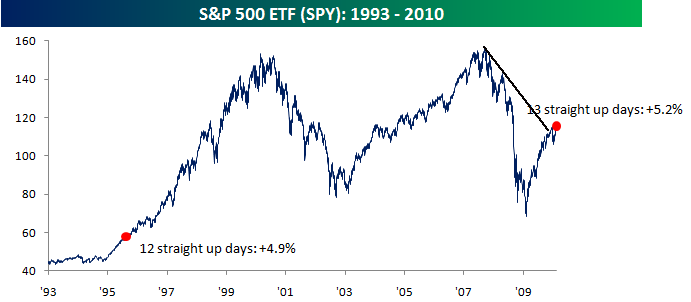

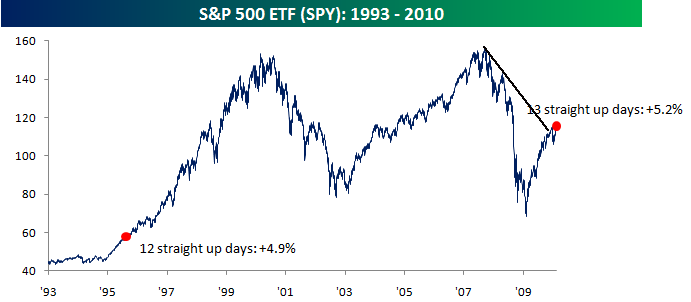

The folks at Bespoke Investment Group have unearthed the nugget that the S & P 500 tracking fund SPY hit an alltime record for consecutive up days yesterday with 13 (the actual average had a couple of miniscule downers during that run). But borrowing their chart and drawing this trend line could lead you to the conclusion that the run may be almost over:

Also note on the top chart RSI(2) being pegged over 90 for the entire month of March so far. Can’t remember that ever happening before. Consequently, it’s looking more and more like I will open trading as a bear!

Ed. note — As of March 17th, make that record fourteen days in a row! – CCD

In Market Recap on

16 March 2010 with no comments

Waiting on the fed to do nothing, with the market at resistance levels, I thought I’d take a little longer look.

If you buy into the theory, suggested by this trendline, that we broke through the downtrend last fall, how long until we test the line again, somewhere near SPX 1000?

In Links on

15 March 2010 with Comments Off on Five by Five

Five links for your enjoyment, that I didn’t get up by 5PM. Sorry!

* The three most imminent disasters, and how to survive them. Hint: pick up some water on the way home! (Trading report)

* Fib lines from the 1929 crash! And guess what — they may signal a reversal now! (Slope of Hope)

* Lack of movement equals boredom: lets call these the Dog Days of March! (Bespoke).

* 2009 saw a massive increase in personal bankruptcy filings. (Bankruptcy Topics)

* Got a credit card? Better check this out! (Detroit Free Press)