In Trading Candidates on

8 April 2010 with no comments

Here’s another long setup for the eternal optimists, as for-profit education play Grand Canyon forms a tight bull flag. Tough part here is where to place the initial stop; the 50 day SMA at $23 has too much risk attached if you are only shooting for $28 or so on the upside.

In Market Recap on

8 April 2010 with no comments

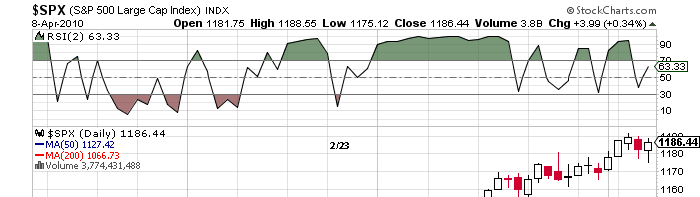

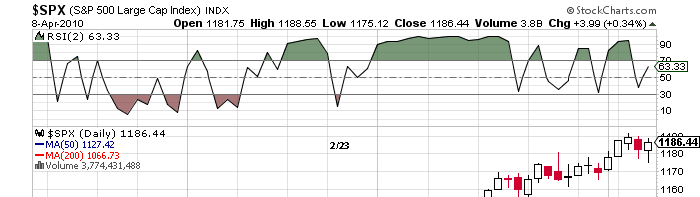

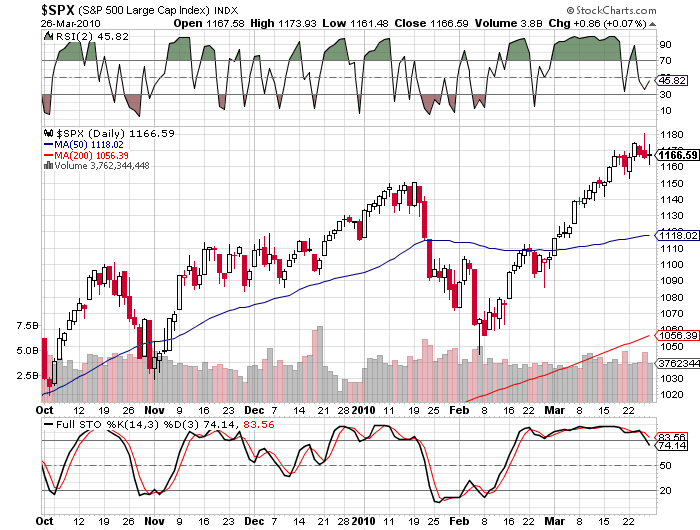

With today’s rebound (itself a miniature melt-up from first hour lows) the SPX has now spent 31 trading days, or if you prefer, 44 calendar days, without dipping below 30 on the RSI (2) indicator — a feat that is pretty much strength personified:

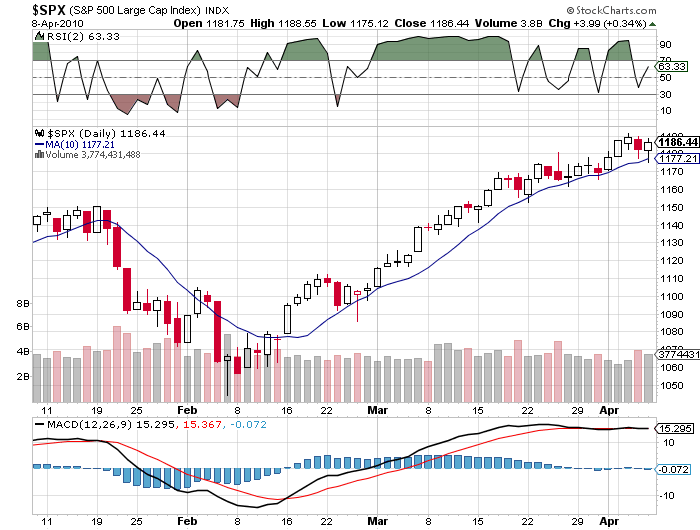

Another view that shows the amazing spring strength of 2010:

Gotta go all the way back to Lincoln’s Birthday on Feb. 12th to find a close under the 10 day moving average; surely enough ammo to bring down the strongest bear!

In Followup on

8 April 2010 with no comments

I forgot to do a followup on Super Valu yesterday; it looks like cup-with-handle buyers have yet to be rewarded, as the buyout talk of early March has apparently died down a bit. If you’re still interested in SVU as a long, the way to play this one now is to buy only on a close above Monday’s high of $17, put a stop under the 20 day SMA (now about $16.75, so the stop could go at $16.50 to give it a little room), and hope for the best. Good luck!

In Trading Candidates on

7 April 2010 with no comments

If the plastic shoes don’t float your boat, maybe a wicker chair might? Someone looking for a real aggressive swing trade in this environment might hope for a down day Thursday that would have Pier One Imports (PIR) test its 20 day SMA (pink line). If bought on a successful test, you would be looking to go back up to the recent high around $7.70 or higher. A safer version of the trade (although it might not let you in) would be to wait for retrenchment to $6.50, where PIR started April. That is still in the top half of the uptrend channel, so there is still considerable risk. The stop would be set at $6.15 on a failure to hold the 50 day SMA (yellow line). Good Luck!

In Market Recap on

7 April 2010 with 1 comment

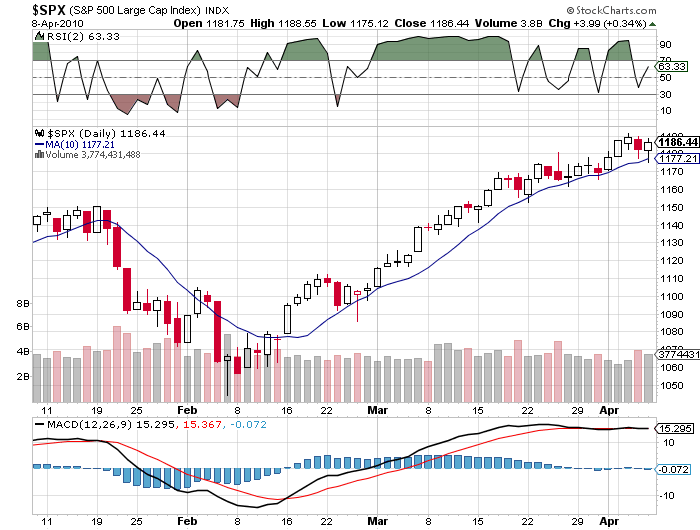

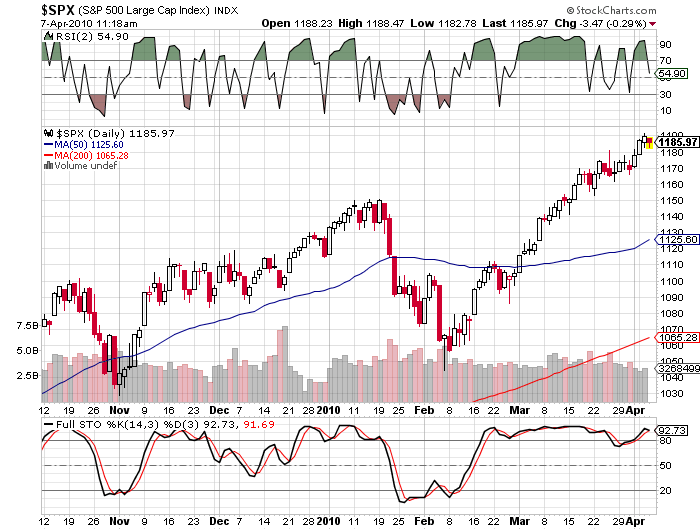

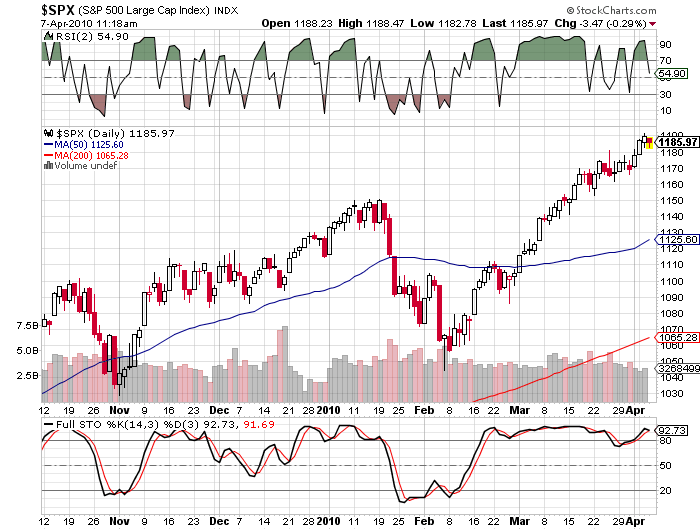

A large scale project at my job has kept me away from the trading wars for an entire week, during which time the market has done little but ascend to recovery highs:

Traders who somehow pegged February 5th as a major turning point are looking pretty good, while the sidelined, like myself (for whatever reason) are wistfully on the outside looking in.

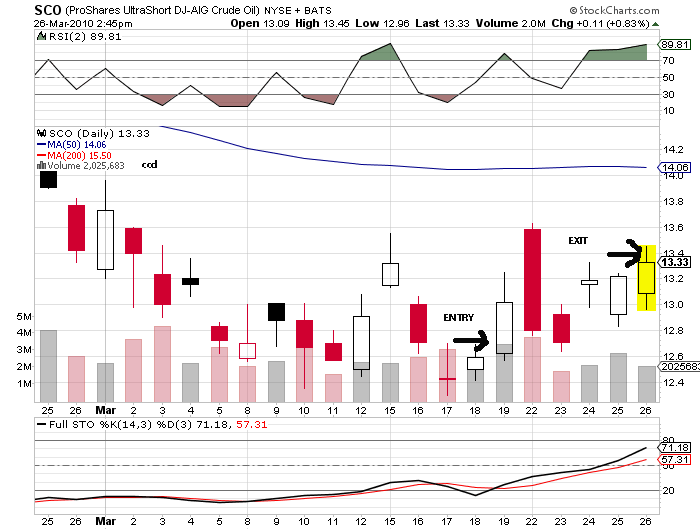

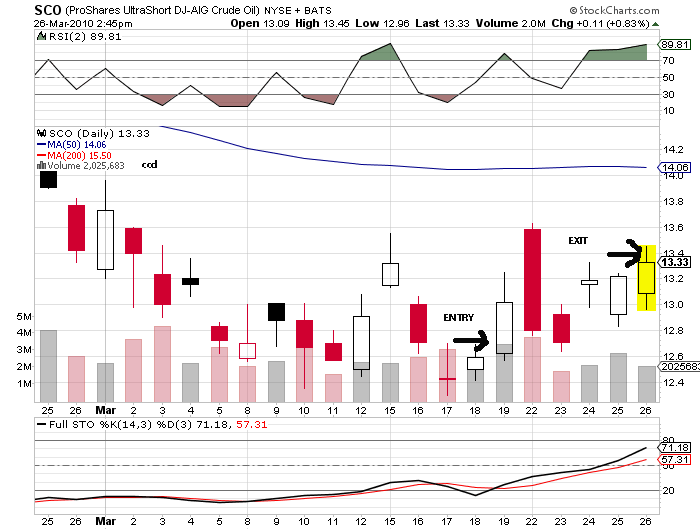

To help myself get back in the game, I find it helpful to go back and review what I was working on before. First up is that short-oil trade in SCO that put some money in the bank at the end of March:

I briefly thought about getting back into this one last week, but was just to busy to do it right. I’m glad I didn’t, as oil had a significant break-out, showing up on this chart as the violation of support for the double-short SCO. So I’ll probably be out of this trade for a while, and may even play against it on the long side if the line (representing about $82/bbl oil) gets tested.

The coffee-roaster trade in GMCR that I had pegged as a long setup looks like it has paid off, although not without getting a whisker away from being stopped out on March 31st:

If I was still in this one, I’d see if I could get $100, even despite today’s downturn, with a stop at the entry point ($95.50) for a free roll at a profit.

My continuing obsession with the plastic shoe business leads me back to CROX, which has paid off nicely after all for those who traded the cup-with-handle breakout of March 25th:

A return to the $8 level would give the plastic shoe optimists another chance to get in on a dip.

The cruise lines have been nothing but profit for the bulls lately:

Notice how Royal Carribean (RCL) has not only run up with the market, but for the most part avoided the unpleasantness of the late January correction. This is the definition of a technically strong stock, and might make a good play on days where its RSI-2 falls below 10.

Finally, Walgreens (WAG), touted as a potential short on St. Patrick’s day didn’t pan out, as it broke above its trend channel just a few days later:

I wouldn’t short this one now unless and until it gets down under that SMA 50 line.

Not much in the way of currently actionable trades in this group, and I’ll be away next Monday as well. If I see anything good, I’ll post it here, but may be reluctant to pull the trigger knowing I will be out of town of Monday.

In Trading Candidates on

29 March 2010 with no comments

Vermont is justifiably proud of its bazillions of trees and stunning foliage displays, but I’ve never seen a single one of them produce a coffee bean. Nevertheless, traders with a bullish bent for the next week or so might consider buying up some Green Mountain Coffee Roasters, which bounced a bit off its 20 day SMA this morning. Place a stop below the 20 near $92; aggressive traders can shoot for a new high near $100 at the top of the trendline, and get a 3:1 reward.

In Market preview on

29 March 2010 with no comments

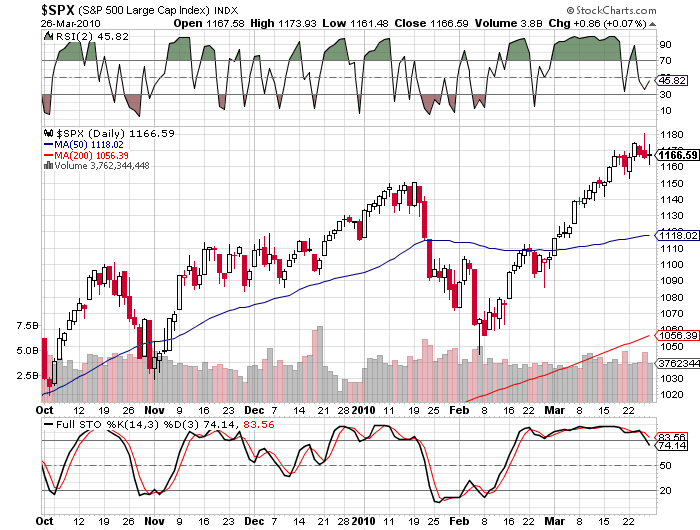

Only four trading days this week, as the markets close on Good Friday, and many international markets may not reopen until Tuesday April 6th, due to Easter Monday. The key levels I am watching this week will be 1180 on the S & P 500, which represents last Thursday’s intraday recovery high, and especially 1150 on the downside, to see is support can hold this former level of resistance.

In Links on

26 March 2010 with no comments

Five links for weekend reading: As for my plans, I plan to reward myself with a Sunday getaway to Waterville Valley for some late season skiing!

Five links for weekend reading: As for my plans, I plan to reward myself with a Sunday getaway to Waterville Valley for some late season skiing!

* Starting out as a day trader: (Trademark Academy)

* Buckets of blood in the streets . . .time to buy Thai stocks? (Research Reloaded)

* Dollar assets back in favor (Afewdollarsmore)

* The world didn’t end after all . . . (recap of past year):(Paragon)

* The fundamental case for being bearish on oil: (Stock Market Prognosticator)

In Trade deconstruction on

26 March 2010 with 1 comment

Sound too good to be true? It should sound like those ubiquitous ads — although I have never figured out how to trade in 10 minutes per day during the evening hours.

But this week it was true for me, as I closed out my starter position on this site this afternoon at $13.40 for a $750 profit. Now only $9275 to go to meet my own audacious goal of trying to double my $10,000 stake in a year!

I’m already starting to second-guess myself about this one, since I sold short of my stated $14 target. lack of patience is often my Achilles heel, and many people advise you should only get out of trades when a target or a stop loss is hit, one way or the other.

Oil fundamentals played no part in my decision to sell; I have little knowledge of them and entered this trade purely on speculation that the double bottom would hold. So why sell now?

Well, if you are going to double your stake, a good start is vitally important. The $1500 in extra buying power in my account should prove useful in the coming weeks, and the $750 profit cushion will hopefully provide the psychological confidence that will be so important to pulling this off. Also, technically, the 2 day RSI was over 90 at the time I sold, so I was reluctant to push this one any further.

One down, many to go. There is no way I can really promise 6% a week, or 6% a month, or whatever the other ads claim. All I can do is keep my eyes peeled for the next opportunity!

In Trades on

26 March 2010 with no comments

I just closed my first trading position on this site with a small profit. Sold 1000 shares of SCO (double-short crude oil) for $13.40. Details and recap will follow shortly as time allows.