In Trades on

20 April 2010 with 1 comment

Trade alert — I’m putting my money where my mouth is, and trying the Potash trade. Bought at the open this morning 100 shares POT at $108.71. I’m paying more than I would like, due to an analyst upgrade issued before the open, which itself is coming on the heels of a downgrade last week. Difference of opinion is what makes the world go ’round, I guess . . .

In Followup on

19 April 2010 with no comments

OK, manure trading junkies, take a look at the chart of Potash Corp. of Way Up North at the end of trading today:

Its setting up for a nice inverse head-and-shoulders pattern (bullish), as well as emerging from a test of the all important 200 day moving average at the same time. The bold and reckless could enter immediately, those with a little more caution,and who dislike catching knives, might want to wait for something better than seven straight down days for an entry.

I would use a stop of $103 on a closing basis (i.e. clear failure to hold the of the 200) for a short term trade in POT. Target would be reclamation of the 50 day SMA around $116. I’ll sleep on it and we’ll see if there is any trigger pulling in the AM! Good luck . . .

In Market Recap on

19 April 2010 with no comments

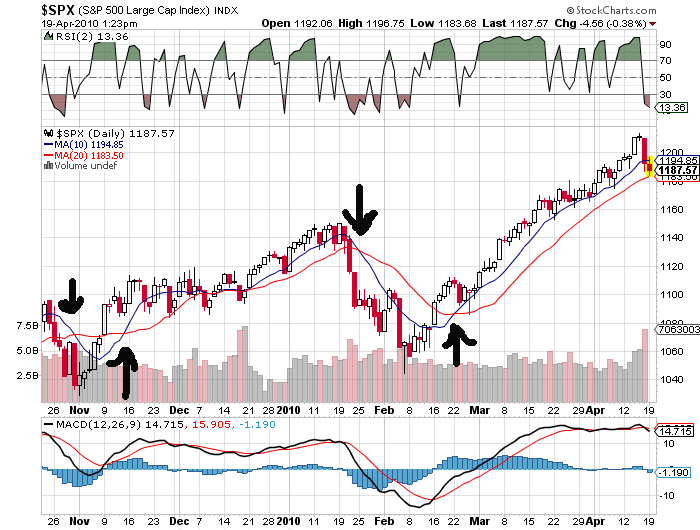

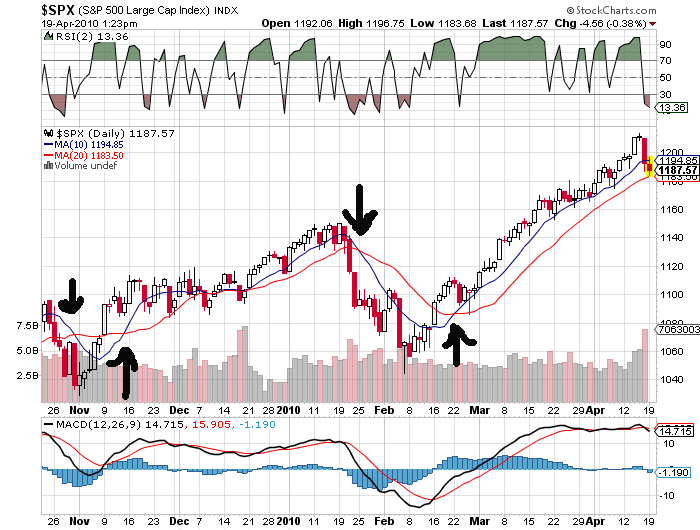

Anyone thinking we might be primed for a substantial leg down on the S&P 500 will find this chart interesting:

We’ve broken through the 10 day moving average, but holding the 20-day as this is written. In 2010, the two crossover points for these moving averages — a sell signal on January 25th and a buy signal on February 22nd — pointed to excellent trades. Not so at the end of 2009, though; the sell signal right before Halloween was an especially big fake-out, and would have led to costly trading errors.

Also of interest is the lack of many discernable gaps during that long grind upwards in March and April; you have to go down to 1125 on March 5th and then to 1080 on February 12th to find a target for filling.

It will be interesting to see if another cross forms in the coming days; in the meantime, be careful out there!

In Stock of the Day on

19 April 2010 with Comments Off on CNBC Stock of the Day — Citigroup — (C)

Taking a look at CNBC’s stock of the day, which today is Citigroup, up a little on its first quarter earnings, which were largely derived from increased trading profits.

I’m not really interested in Citi as a trading vehicle, but take a look at its twenty-year chart:

Citi could make a good choice for buy-and-hold investors who are betting on an economic comeback. Buy under $5, and hope it can make another run up to $50 some day, with dividends to boot. Good Luck!

In Market preview on

19 April 2010 with no comments

Markets are under pressure again this morning as Goldman Sachs litigation proves a more powerful pull than good numbers from Citi group.

This would be a classic place for buy-the-dippers to step and and enter. For my part, I will be waiting a bit longer for my favorite signal to emerge before going long again. Hopefully, more on that to follow!

In Performance Review on

17 April 2010 with no comments

Since starting this site on March 19th, I can’t complain about the three profitable trades I made, which together produced a first month profit of 21.3% for my modest account. Kinda leaves those “6% a month with ETFs” advertisements in the dust!

Of course I haven’t had a loser yet,and that surely will come in time. Going in to this, I expected really no more than a 50% hit rate on profitable trades; I still think that is what it eventually gravitate to by the end of a year. There’s nothing wrong with that, so long as you have a method (and the willpower) to “cut the losers and let the winners ride.”

That brings me to my biggest self-criticism so far; I have been especially eager to leave winning trades quickly. Sure there have been specific reasons for doing so on the trades I made so far (including the fact that I have been going “all-in” and using margin as well), but in the long run, it could prove dangerous to leave money on the table, especially if I develop the bad habit of hanging around in losing trades, “hoping” that they come back to break-even.

But I will try not to be too critical in the face of some early success; and I am sure the the market will have plenty of surprises for us in the second month here!

In Market Recap on

16 April 2010 with no comments

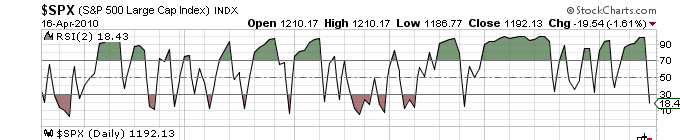

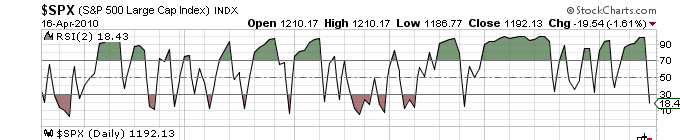

Today’s close brings to an end an amazing streak of 36 trading days that the two-period RSI has closed above 30. The last day for a close under 30 was February 23rd:

In Trades on

16 April 2010 with no comments

I covered my 180 share short position in SPY just before the close for $119.32, making a quick one day profit of $291.60. At the time of execution RSI (2) was 19.72, so it was clearly going to close below my target sell signal of 30. This trade provided just what I hoped; a quick one day pop, given the extreme overbought readings in the general market.

Have a great weekend!

In Market Recap on

16 April 2010 with no comments

One down day has spiked the VIX, and apparently shaken some of the complacency out of the markets. It’s the largest increase in the volitility guage since the end of February.

One down day has spiked the VIX, and apparently shaken some of the complacency out of the markets. It’s the largest increase in the volitility guage since the end of February.

In Links, Uncategorized on

16 April 2010 with no comments

Five links for weekend reading:

* Near and dear to my heart: the CAPE index foretells tough times: (Money Honey).

* The “predator” was watching for a trend day this morning — guess he found one! (PredatorsDen).

* Avoid the three most common day trading mistakes: (TradeMark Academy).

* People are spending money on discretionary items and not paying the mortgage: (Bankruptcy Topics).

* Talent Overload: 400 people apply for two jobs with a venture capital firm: (A VC in NYC).