In Links on

17 September 2010 with no comments

* Surprise! TARP is ineffective! (MarketWatch)

* Surprise! TARP is ineffective! (MarketWatch)

* FedEx: profits up, jobs to be cut (WSJ)

* What’s a Halo, and why would I want to buy one? (Reuters)

* Massive fee in Madoff case (Bankruptcy Topics)

* Foreclosures up 25% on the year (Yahoo)

In Pure speculation! on

16 September 2010 with no comments

Notice how now even the 200 day moving average has gravitated to the 1115 level on the S & P 500!

In Market Recap on

13 September 2010 with Comments Off on Total equilibrium!

Has the stock market, the ultimate “body in motion,” finally reached its proper resting point?

On the S & P 500, the highest intraday point reached in October 2007 was 1576.09, with the lowest recent reading in early March 2009 at 666.72:

That averages out to 1121.41, almost exactly where we are now after Moday’s gap open!

As for the calendar year 2010, we hit the peak in late April at 1219.80, and the low on July 1 at 1010.91:

That’s an average of 1115.35, also about where we are trading now, and exactly where we began the year!

In Trades on

10 September 2010 with 1 comment

Looking at a quickie trade in BZQ (double short Brazil), which didn’t work out so well last time. But I picked up 1000 shares at the open today — we are at support and there is that nice gap at $22 from September 1st that I’m shooting for.

Looking at a quickie trade in BZQ (double short Brazil), which didn’t work out so well last time. But I picked up 1000 shares at the open today — we are at support and there is that nice gap at $22 from September 1st that I’m shooting for.

Have a great weekend!

In Pure speculation! on

9 September 2010 with no comments

As of this morning’s open, the market is very close to where it started the year (S&P 1115), but also shows three promising unfilled gaps to the downside for aspiring bears to shoot for:

It may be awhile before we get down to the 1050 area and fill that September 1st gap, but the jobs report gap from Friday the 3rd at about 1090 came oh so close to being filled on Monday.

There’s 20 points sitting right out there for those who dare!

In Market Recap on

1 September 2010 with no comments

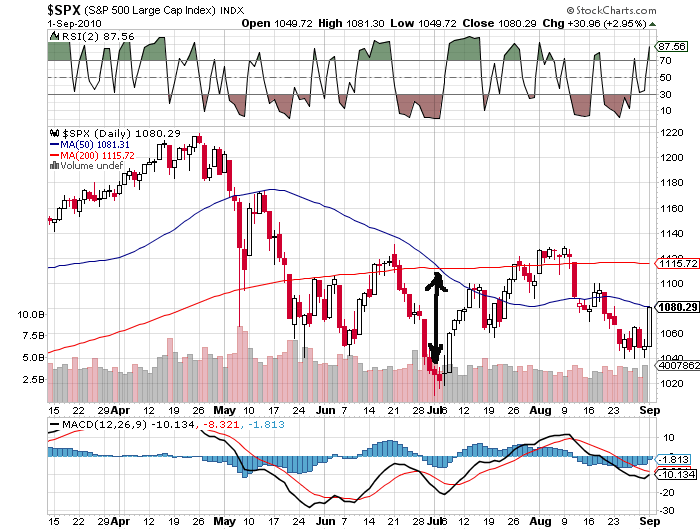

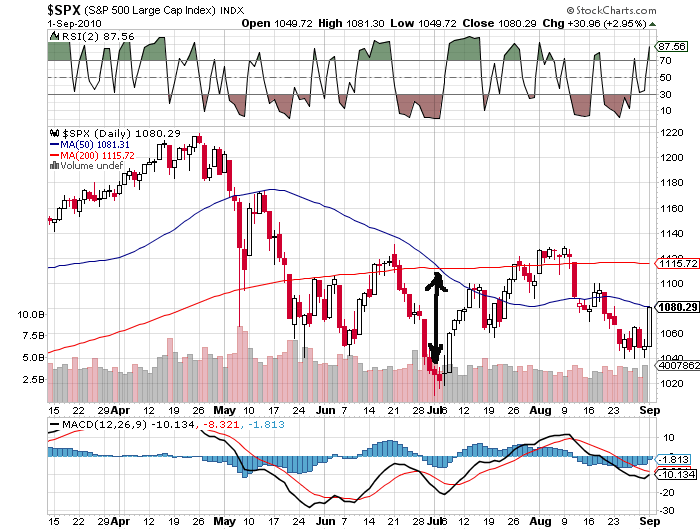

I’ve commented here before on how tough it is to apply the principles of technical analysis to the market as a whole, rather than to specific stocks or ETFs.

A great example of this is the so-called Death Cross (50 day MA dropping below the 20-day MA) that formed in early July:

Amazing how this most negative signal almost perfectly correlates with the market lows for the year (so far anyway)!

That why I prefer the gap-fill method of scoping out trades. While its not perfect either, it does have the advantage that fewer eyeballs are following the signals that I use.

In Trades on

1 September 2010 with no comments

As August went out with a whimper, September started right off with a nice fill of last weeks down gap. I sold my 150 shares of SPY for 108.18 — and a nice $486 profit:

Sharp eyed observers will note that there now remains only two unfilled gaps on the S&P yearly chart — the drop in early August from 1120, and the long-in-the tooth gap down from 1150 in mid-May. If you are still shooting for one of those, good luck!

In Trades on

30 August 2010 with no comments

Recently casino operator Las Vegas Sands has been throwing out some nice tradable down gaps, even as it’s overall performance looks comparably strong:

All the gaps on that chart have filled, and most quickly, except for the mega-drop on June 29th, which took most of July to heal. But heal it did, so will will be watching this one from now on for any potential trades.

In Trades on

25 August 2010 with no comments

I decided to liven up this blog a little and dumped my BZQ shares this morning, pretty much at a break even price.

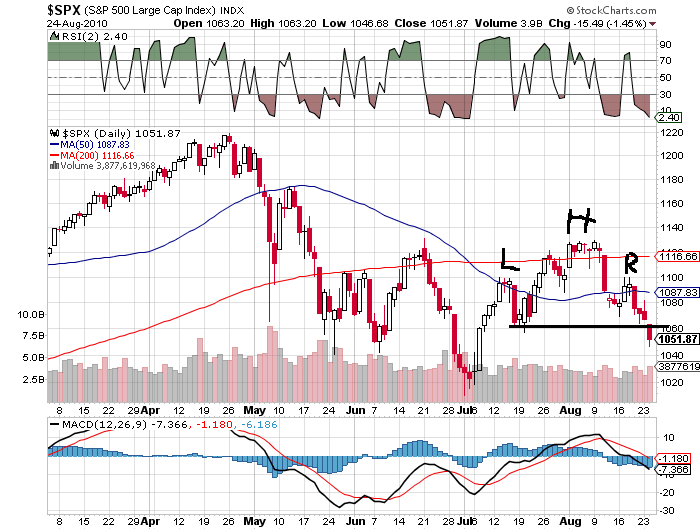

I then turned around and bought the market, playing for the S&P 1067 gap fill mentioned yesterday; 150 shares of SPY were scooped up at just under $150. Head and shoulders? Bah!

In Market preview on

24 August 2010 with 1 comment

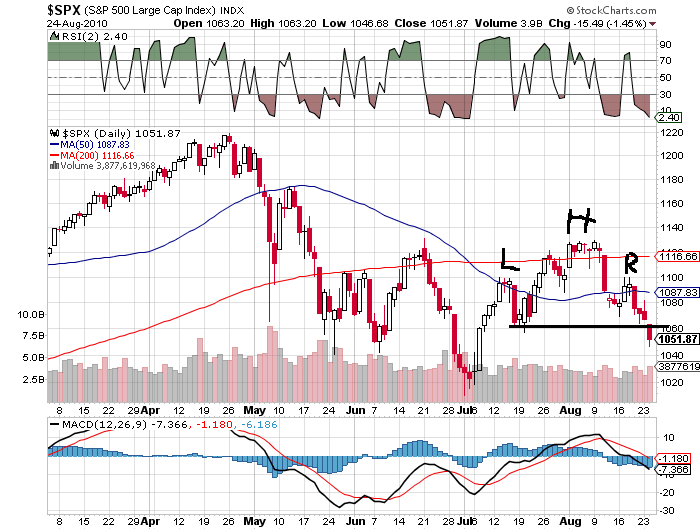

Everybody and their cousin has been watching the summer-long head and shoulders forming on the S&P and other major indexes, but remember the market often frustrates those who try to use conventional technical indicators on broad indexes:

I prefer to bet on the contrarian view, and look to see that juicy gap at 1067 fill sooner rather than later!

* Surprise! TARP is ineffective! (MarketWatch)

* Surprise! TARP is ineffective! (MarketWatch)