Summer trading: wash, rinse, and repeat, with trepedation

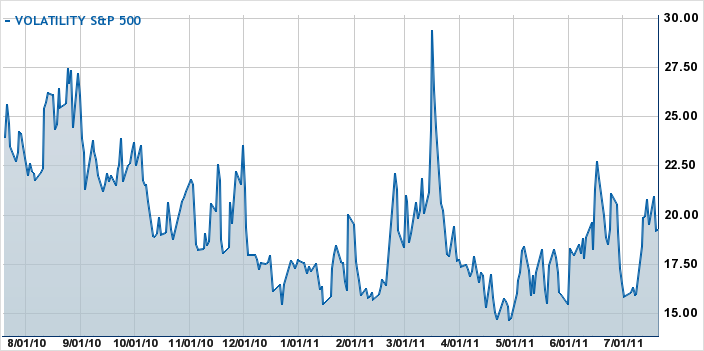

I dodged a bullet again at VIX expiration, and was able to book a nice profit on the July calls I sold last month. Then I turned around and repeated the trade, selling 12 more 25 calls, this time for August 17th, for $0.80 each. July VIX settlement was 19.10.

I dodged a bullet again at VIX expiration, and was able to book a nice profit on the July calls I sold last month. Then I turned around and repeated the trade, selling 12 more 25 calls, this time for August 17th, for $0.80 each. July VIX settlement was 19.10.

I’m a lot more nervous this time around. And being nervous about trades isn’t what summer trading is supposed to be about.

First, it’s a short month this cycle, so I’m not getting as much in premium as I would like.

Then the whole debt ceiling thing, with it’s self-imposed August 2nd deadline (right in the middle of the options cycle, natch) has got me woollied. I’ll be the first to admit I don’t have a clue how it will play out. If I had to guess, a lot of brinksmanship up to the deadline, potentially spiking the VIX, followed by more debt and no default. But that’s only a guess.

Then there’s the vacation thing; I don’t have exact dates when I’m going away, and I don’t want to manage a margin-sucking trade like this from a smart phone, because, well, that ain’t no vacation!

So what I’m doing is giving this a little rope, but not a lot. I’ll buy it back at a loss if VIX spikes to 25, and then sell some spreads to recoup, and maybe hook a little profit on the rebound. And when vacation time comes round, I may just buy it back regardless, and just go away!

No Comments Yet