In Trades on

4 August 2011 with no comments

Every trader worth his salt has at some time or other known the feeling of being trapped in a trade.

And once you’ve experienced that feeling, try to burn it in to your brain, and avoid getting trapped again! Making mistakes is unavoidable if you take a directional position in the markets. Learning from mistakes can be valuable indeed, while failure to “get the lesson” will eventually lead to a blown-out account.

Every once in a while, though, you can get lucky with a trap trade. It happened to me today, when my sell stop on BZQ (which is double-short Brazilian equities) was unexpectedly hit at the end of the session during the general market mayhem:

Bottom line — I got out where I got in ($20.21), and escaped unscathed. This was, however, overall a draining beat-down trade that took almost eleven months to play out (not bad for a swing trader, eh?), and caused enough angst that it probably prevented me from pursuing other more creative trading ideas.

But live and learn. One good thing that came out of it was it forced me to look closer at using options to define risk, and that is where the bulk of this year’s trading profits have come from.

In Links on

3 August 2011 with no comments

The trading life ain’t the normal life. At least that’s the thesis of the Rogue Traderette, an Australia-based market commentator who occaisionally dips her hands into swapping CFD’s (a type of option) and other intruments banned by the SEC in the good old United States.

The trading life ain’t the normal life. At least that’s the thesis of the Rogue Traderette, an Australia-based market commentator who occaisionally dips her hands into swapping CFD’s (a type of option) and other intruments banned by the SEC in the good old United States.

“RT” rather astutely points out that what traders would consider normal would be considered daft by most of the financially-illiterate general public. “Normal people love any kind of profit, and despise losing money. Traders recognise that losing money is acceptable – necessary, even – and that a profit realised through a lack of discipline can be worse than no profit at all,” she writes.

Successful trading more of less means forcing oneself to abandon the typical “normal” ways of thought (and especially how we desal with emotion), even if it takes an act of pure will to do it. Rogue Traderette points out that “normal people can go through life blissfully ignorant of their inner workings. Traders must be intimately acquainted with the way they think.”

Turning RT’s thesis around a bit, must one be a bit “off” to make money in the markets? I wouldn’t go that far, although a constant vigilance against the most dangerous emotions –“loving” a company, pride in a particular gain that is getting long in the tooth, and most especially, the inability to get of of a loss when it is still small — will certainly be a life time endeavor for anyone bent on staying in the game.

In Trading Candidates on

2 August 2011 with no comments

Cost Plus World Markets has taken a week-long beat down along with the general market, and has arrived at a crucial support level:

Now the tricky question is, do you think this represents a good buying opportunity (we have made some good coin on this blog trading CPWM), or is this an alarm that screams “get out?” (I’m not in, currently, but obviously someone is).

It’s a very tricky call. If I was trading CPWM now instead of VIX options, I think I would demand some good price action, and enter buy orders at $9 or thereabouts, leaving some $$$ on the table to be sure, but avoiding a ride into the abyss.

In Stock of the Day on

2 August 2011 with no comments

With Washington in what seems like pepetual turmoil, and the in what seems like . . . perpetual turmoil (although VIX has descended to 22.85 as I write this), at least Americans can take comfort in their nice comfortable shoes.

With Washington in what seems like pepetual turmoil, and the in what seems like . . . perpetual turmoil (although VIX has descended to 22.85 as I write this), at least Americans can take comfort in their nice comfortable shoes.

Earning season is in full swing, not that anyone focused on DC has noticed, and it has been especially kind to purveyors of casual footwear. Take a look at our old friend CROX:

That’s not a chart from a stagnating ecomomy, right?

A little less impressive chart, but with a big boost off Q2 numbers, comes from the good folks who bring us Uggs:

I guess no matter how bad things get generally, as long as our feet are well-pampered, things will eventually turn out OK!

In Food for thought on

1 August 2011 with no comments

With the markets hinging on every development in Washington lately, as the debt ceiling debate lingers on, “trading the news” is itself more frequently in the news.

With the markets hinging on every development in Washington lately, as the debt ceiling debate lingers on, “trading the news” is itself more frequently in the news.

But with markets as big as they are, as fast as they are, and dominated by peripatetic machine algorithms, there may be little time any more for actually reading the news.

Instead we are going to start mining it — and we already have (just take a look at this service, for one example).

The idea is to get an AI program that can digest news and financial releases, and begin trading on their content in nanoseconds. Makes Evelyn Wood speed reading courses seem decidely old hat!

If you think you are going to daytrade the markets based on particular news information, all the while competing against these programs, I think you are seriously deluding yourself.

Instead, why not try to develop a more rational, low-key, low-frequency trading approach? That’s what I’m doing, and reducing trading expenses, while at the same time reducing trading angst, and (hopefully) keeping trading profits high.

Let the news reading algorithms play against themselves!

In Market Recap on

25 July 2011 with no comments

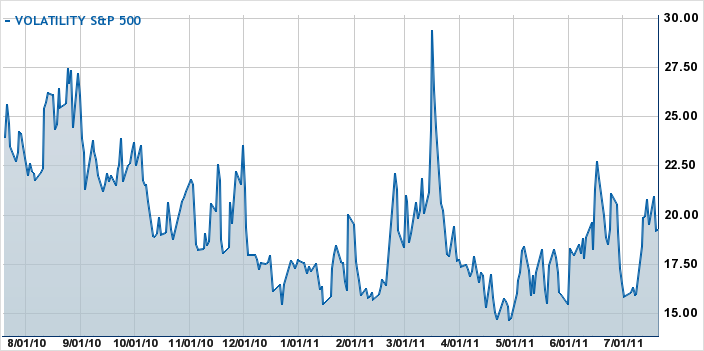

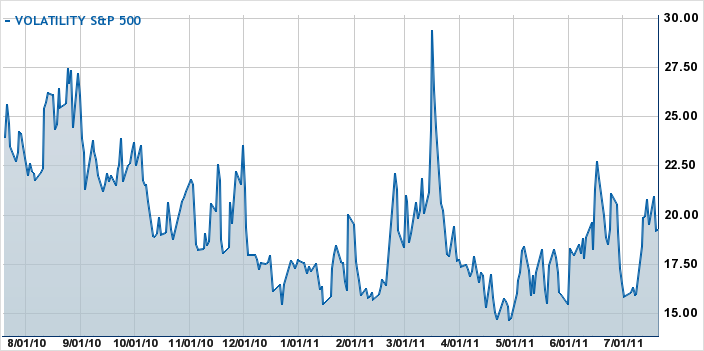

With the debt ceiling deadline looking like it will linger in the news right up to August 2nd, VIX has popped up to 19.25 and trading in the volatility index is drawing increased interest.

With the debt ceiling deadline looking like it will linger in the news right up to August 2nd, VIX has popped up to 19.25 and trading in the volatility index is drawing increased interest.

The highest open interest in August VIX calls is in the 25 strike (186K contracts), closely followed by the 30 strike (157K contracts). I sold the August 25 calls last week for premium and got $0.80 for them; today they are still hanging in there in the $0.65 range. The 30’s closed at $0.40 today. So you gotta pay a pretty good price if you want to speculate on (or hedge against) impending debt default disaster.

On the other hand, some puts are cheap. August 16’s can be had for $0.20 at this writing. Remember, VIX closed Friday 7/22 in the mid 17’s. If everything settles down, these could pay off handsomely to someone who likes such speculations.

In Trades on

20 July 2011 with no comments

I dodged a bullet again at VIX expiration, and was able to book a nice profit on the July calls I sold last month. Then I turned around and repeated the trade, selling 12 more 25 calls, this time for August 17th, for $0.80 each. July VIX settlement was 19.10.

I dodged a bullet again at VIX expiration, and was able to book a nice profit on the July calls I sold last month. Then I turned around and repeated the trade, selling 12 more 25 calls, this time for August 17th, for $0.80 each. July VIX settlement was 19.10.

I’m a lot more nervous this time around. And being nervous about trades isn’t what summer trading is supposed to be about.

First, it’s a short month this cycle, so I’m not getting as much in premium as I would like.

Then the whole debt ceiling thing, with it’s self-imposed August 2nd deadline (right in the middle of the options cycle, natch) has got me woollied. I’ll be the first to admit I don’t have a clue how it will play out. If I had to guess, a lot of brinksmanship up to the deadline, potentially spiking the VIX, followed by more debt and no default. But that’s only a guess.

Then there’s the vacation thing; I don’t have exact dates when I’m going away, and I don’t want to manage a margin-sucking trade like this from a smart phone, because, well, that ain’t no vacation!

So what I’m doing is giving this a little rope, but not a lot. I’ll buy it back at a loss if VIX spikes to 25, and then sell some spreads to recoup, and maybe hook a little profit on the rebound. And when vacation time comes round, I may just buy it back regardless, and just go away!

In Food for thought on

14 July 2011 with no comments

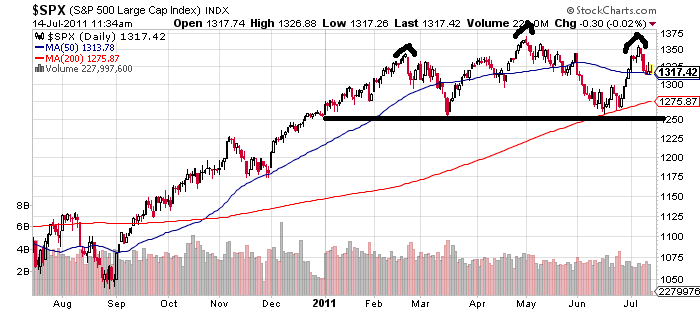

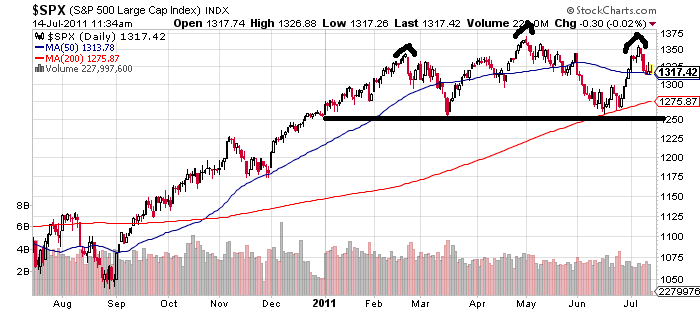

Fans of technical analysis — and especially those who appreciate giant head-and-shoulders patterns — should be salivating over the current one-year S&P 500 chart:

It’s intersting to not that both shoulders and the head have formed within this calendar year, making the remainder 2011 sort of a referendum on whether the pattern will play out. (If you’re new to chart patterns, or infrequently fool with them, H & S potentially portends a large scale drop).

I would say that the market needs to either 1) push to year highs, voiding the pattern; or 2) drop below the “neckline,” which coincidentally is around where we started the year (1258), and then plunge rapidly, or 3) consolidate somewhere within the year’s range (1258-1370) and frustrate everyone for a good long time.

I would also note that large scale, easy-to-see chart patterns on major market averages rarely play out as anticipated. So, unless you’re a riverboat gambler, the only thing we can do is wait and see!

In Stock of the Day on

13 July 2011 with no comments

They say it’s not easy to blow out a trading account if you stick to stocks and don’t use leverage. And they’re right. But it can be done! Going all-in on trendy Evergreen Solar in 2007 would have done the trick:

They say it’s not easy to blow out a trading account if you stick to stocks and don’t use leverage. And they’re right. But it can be done! Going all-in on trendy Evergreen Solar in 2007 would have done the trick:

Quite a wild ride down from $110 to $0, excuse me, $0.41, don’t you think? And there are rumors that the Massachusetts-based alternative energy play is headed for bankruptcy.

In Market Recap on

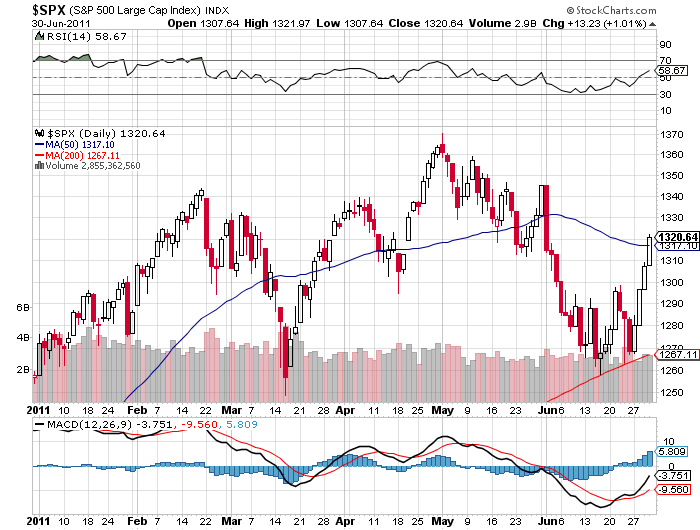

30 June 2011 with no comments

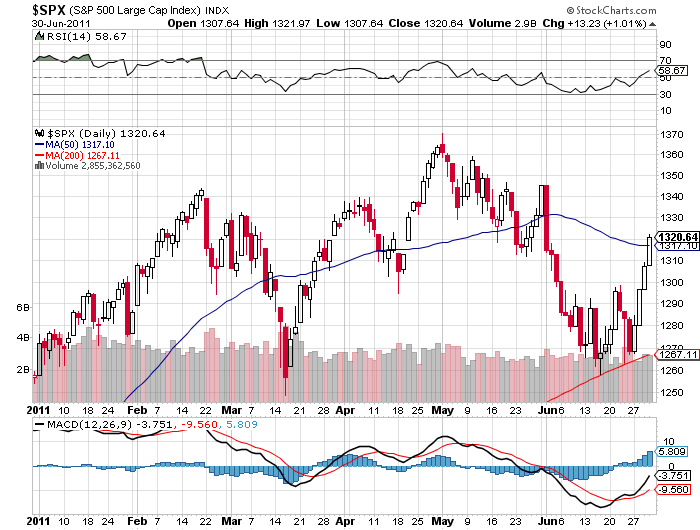

Last year, the run-in to the Independence Day weekend proved to be the low point of the year. This time it’s different, of course, with the markets making a big run over the last four days of the second quarter:

So let’s simplify things:

The S&P is now up 4.9% for the year so far (and almost all of that due to just this week’s trading).

Cape Cod Doug is up 27.3% for the year so far (trading mostly options, lately).

How are you doing in 2011? Remember, you can always improve your performance in the coming months.

Hope you have a great long Independence Day weekend!