Somebody’s got money to spend on fun — CCL

Recession? Double Dip? Don’t tell that to the folks who are spending discretionary dollars on cruises — if they keep it up, Carnival looks to break out of that seven month downtrend:

Recession? Double Dip? Don’t tell that to the folks who are spending discretionary dollars on cruises — if they keep it up, Carnival looks to break out of that seven month downtrend:

This company — which we spotted languishing on the 52 day low list last winter, ain’t down for good and just keeps popping back up:

Supervalu operates supermarket chains in many states. If it can break that downtrend marked by the purple line, look for it to eventually rally back up and test the $11 level.

Looks like I’ll be leaving for vacation tomorrow with two positions open — both negative bets on VIX options.

I’ll be spending a week decompressing in the Florida Everglades — no phones, no ‘net, no trades, so I’ll just have to see how things turn out when I return on August 30th.

Enjoy the rest of the summer, folks!

With the gap down this morning, and VIX shooting past 40, I’m making a “quickie” spur-of-the-moment trade, and buying somewhat reasonably priced September 30 VIX calls for $3.10. Hope to be out of this one by Monday, as vacation looms.

It looks like the Market Speculator, a favorite blogger whose, er, speculations are always interesting to follow is back in action this month after a season on the sidelines.

On August 5th Market Speculator posted four new long positions (which he apparently still holds). One of his new longs was the American market in general, represented by SPY:

The arrow shows the speculator’s entry point. Looks like he’s had a rough ride so far, at least on this one!

For my late summer trade, I’m going to stick with VIX options, but try a little different tack: put spreads.

For my late summer trade, I’m going to stick with VIX options, but try a little different tack: put spreads.

I’ve put on what amounts to the equivilent of two VIX September put spreads: twenty contracts on a 27.50 – 25 spread and ten more on a 25-20.

Essentially, this is a simple bet that VIX will fall to 25 before September 21st, with an added bonus if it falls to 20.

Because both buying and selling the 25’s partially cancel each other out, I put it on as three transactions instead of four to save a little on commissions, as shown in my trading log.

If rationality returns to the markets and summer goes out on a calm note on Wall Street, it will go out with a bit of a bang for me!

The dream of pain-free easy summer trading has turned out to be just that — a dream. With this being the last day to trade August VIX contracts, I closed out my open positions for a nice hefty loss of almost $2,500.00.

The dream of pain-free easy summer trading has turned out to be just that — a dream. With this being the last day to trade August VIX contracts, I closed out my open positions for a nice hefty loss of almost $2,500.00.

I’m going to chalk this up as a live-and-learn experience. And since misery loves company, I am very mindful that trading has been very painful for a lot of folks in the past month or so.

If there is at least a little positive spin to put on things, my summer trading (if you count the start of “summer” as the US Memorial Day weekend, as many do has now attained a grand net loss of $64. The S&P500 in the same time period is down -10.4%. So, by that measure at least, I am protecting my capital.

And the current enviornment may hold more opportunities before the equinox arrives on September 23. Stay tuned!

With the market plunging almost 20% in three weeks at its worst, you knew it wouldn’t be long before some short term speculators were turned into long term investors!

With the market plunging almost 20% in three weeks at its worst, you knew it wouldn’t be long before some short term speculators were turned into long term investors!

Scott Kirsner of the Boston Globe has listed some of his favorite bear market rationalizations and bromides at Boston.com:

■Venture capitalists: “We are counter-cyclical investors.’’

“Economic slumps are the best times to start a company.’’

“We can invest less and own a bigger chunk.’’

“We’re a top-decile firm. We won’t be hurt by a shakeout in the VC industry.’’

■Angel investors: “At least the VCs won’t be falling all over themselves to invest in my companies and cram me down.’’

■Entrepreneurs: “We’ll do better without so many me-too companies getting funded.’’

“My entire net worth is wrapped up in this company. What do I care about the stock market?’’

“We’re developing a product that will disrupt the established players. There are always customers for that.’’

“I don’t regret turning down that $100 million acquisition offer last week. The IPO window will open again.’’

■Employees “It’ll be nice not to be distracted by all of those calls from recruiters offering me jobs at other companies.’’

“I never wanted to sell any of my shares on SecondMarket anyway.’’

■Investment bankers: “Without so many IPOs to manage, I’ll get to spend more time at my place on Nantucket.’’

Got any favorites of your own?

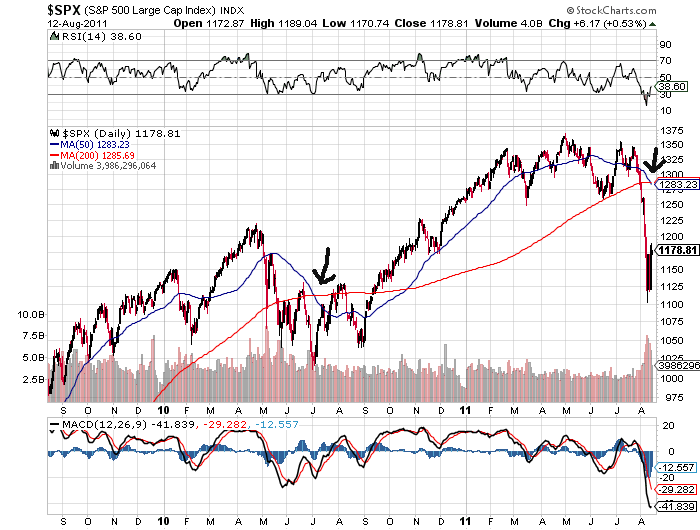

The violent trading of the past three weeks has finally triggered the infamous death cross on the SPX Friday:

Death (and golden crosses), where the 50-day moving average cross over each other, are by definition trailing indicators. But how badly trailing are they?

Simon Maierhofer has done some nice research on this at Yahoo Finance. Looking at all instances of death (sell signal) and golden (buy signal) crosses on the S&P since 2000, he estimates that as a trading signal these crosses are still useful, though lagging, and typically have a risk / reward ratio of 3:1 in favor of the trader.

Ambitious longs looking to play a bounce when and if one arrives might take a look at Wendy’s, a stock we check on periodically here:

The fast food chain, which recently shed itself of its Arby’s stores, has certainly dived along with the rest of the equities markets, but closed Monday not to far under critical support at $4.50. If it reclaims that on the open, a small position with a stop around $4.40 might make a low-risk swing trade.

© 2010; Counting with Doug:. Powered by WordPress using the DePo Skinny Theme.