In a day of stock market turmoil, a bet on calmer waters ahead

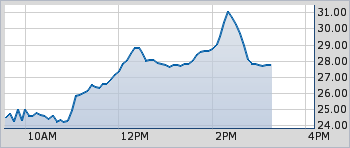

The VIX spiked up to 31 at one point today:

The VIX spiked up to 31 at one point today:

as the stock markets gave up the remainder of their calendar year 2011 gains:

I used this period of turmoil — much of it seemingly rooted in Japan’s nuclear problems following Friday’s earthquake — as the time to switch course yet again, and bet on calmer times ahead, and a drop in the VIX with a put spread.

Specifically, I bought 10 VIX April 25 puts for $3.20 each, and sold 10 VIX April 22.50 puts for $1.65 each. My total cost was $1550, and this bet will pay off best when and if the VIX drops to 22 1/2 before mid-April.

At the time I put the spread on, VIX was 28.62.

No Comments Yet