Defending 1300

With the S & P 500 descending to 1300 this morning (a level right above its 50 day moving average), and then battling to stay there:

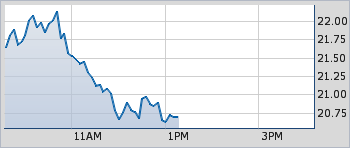

and the VIX temporarily spiking up near 22:

I got what I was looking for and I took the opportunity to close out my open positions in VIX options.

As detailed on the trading log, I sold the April calls for $1.75 and a profit of $170.00, and also sold my May VIX calls for $2.53 and a $215 profit.

Then I switched around and made a bet AGAINST further volitilty: I “went naked” and sold 10 March $25 VIX calls for $0.50 each. If the VIX stays under 25 until March 18th, this should provide another $500 to the balance sheet. Wish me luck with that!

No Comments Yet