The pitfalls of using technical analysis on major market averages

I’ve commented here before on how tough it is to apply the principles of technical analysis to the market as a whole, rather than to specific stocks or ETFs.

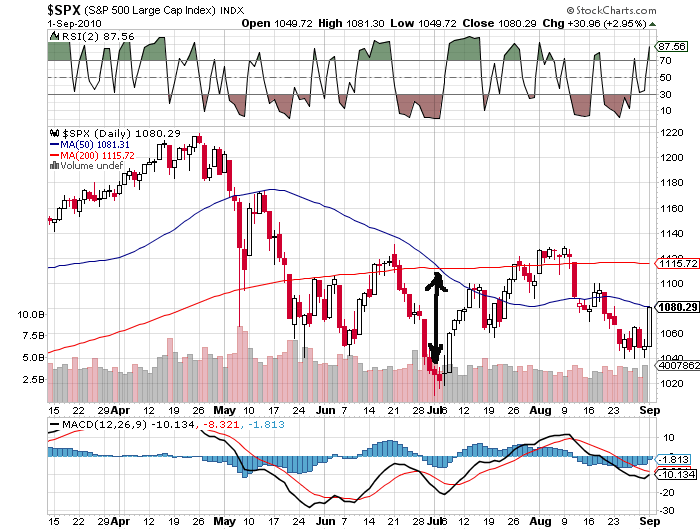

A great example of this is the so-called Death Cross (50 day MA dropping below the 20-day MA) that formed in early July:

Amazing how this most negative signal almost perfectly correlates with the market lows for the year (so far anyway)!

That why I prefer the gap-fill method of scoping out trades. While its not perfect either, it does have the advantage that fewer eyeballs are following the signals that I use.

No Comments Yet